- Solana price today trades near $203 after bouncing from $180–$185 support.

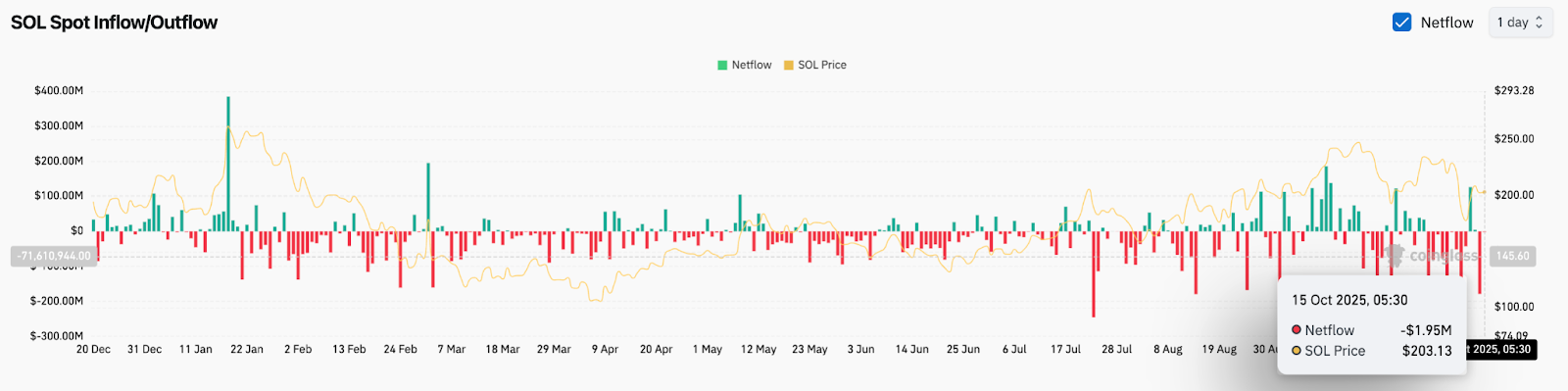

- On-chain flows show weak accumulation with just $1.95M net outflow on October 15.

- Solana’s $136.9B 30-day DEX volume outpaces Ethereum and BNB Chain.

Solana price today trades near $203, stabilizing after a volatile week that saw buyers step in around the $180–$185 support area. The recovery comes as SOL defends its long-term ascending trendline and reclaims the $200 psychological level, even as on-chain flows show lighter activity compared to earlier in the month.

Solana Price Defends Rising Trendline Support

The daily chart shows Solana holding above its ascending trendline from April, which continues to define the broader uptrend. Buyers reacted strongly near $180, aligning with the previous support zone from July and the base of the wedge structure. The Supertrend indicator flipped bearish at $230, and the Parabolic SAR at $227 marks the first resistance cluster alongside the descending triangle’s upper boundary near $214–$230.

Momentum remains fragile but constructive. The price is now consolidating between the 20-day EMA at $210 and the lower support around $185, forming a compression zone that could precede the next breakout. As long as Solana price stays above the $180 trendline, the medium-term bullish structure remains intact.

Related: XRP Price Prediction: XRP Consolidates as Traders Anticipate Breakout

On-Chain Flows Indicate Weak Accumulation

Exchange data from Coinglass shows a net outflow of $1.95 million on October 15, signaling subdued buying compared to the heavy inflows seen earlier this quarter. Over the past month, inflows and outflows have alternated sharply, indicating an uncertain market rather than strong accumulation.

This decline in activity aligns with SOL’s price recovery from $185 to $203, suggesting that the rebound is driven more by technical positioning than aggressive spot demand. Analysts note that sustained outflows above $25–$30 million would be required to confirm fresh accumulation. For now, the current muted flows suggest traders are waiting for confirmation before re-entering positions.

Solana Tops Ethereum In DEX Volumes

Solana’s ecosystem strength remains a key narrative driver. According to data shared by the official Solana account on X, the network recorded $5.84 billion in 24-hour DEX trading volume, surpassing Ethereum’s $5.75 billion. Over a 30-day window, Solana’s DEX volume reached $136.9 billion, ahead of Ethereum’s $128.5 billion and Binance Smart Chain’s $118.7 billion.

Related: Shiba Inu Price Prediction: SHIB’s Recovery Stalls As Momentum Weakens

This dominance highlights Solana’s growing appeal for decentralized trading and liquidity activity, especially in the wake of recent memecoin and NFT launches. Analysts believe this ecosystem traction provides fundamental support for Solana price, reinforcing its long-term strength despite near-term volatility.

Technical Outlook For Solana Price

Solana price prediction for October 16 suggests a balanced tone between support and resistance zones:

- Upside levels: $214, $230, and $245 if price breaks above trendline resistance.

- Downside levels: $185, $180, and $167 as key support levels to watch.

- Supertrend resistance: $230 remains the key threshold for bulls.

Outlook: Will Solana Go Up?

The outlook for Solana depends on whether buyers can defend the $200 zone and build momentum toward $230. On-chain data shows limited inflows, but DEX dominance and steady ecosystem activity continue to reinforce investor confidence.

If SOL manages to clear the $214–$230 resistance cluster, momentum could accelerate toward the $245 region. Conversely, failure to hold above $185 would weaken the bullish setup and risk a deeper pullback toward $167. For now, Solana price today remains in a consolidation phase within a larger uptrend, with technical and ecosystem support still favoring a cautious bullish bias.

Related: Ethereum Price Prediction: ETH Attempts Recovery as Open Interest Hits $46.8B

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.