- Solana price today trades near $196, holding above $192–$196 support after rejection from $246 channel resistance.

- On-chain flows remain mixed, with $21.8M net inflows failing to confirm strong accumulation trends.

- Futures open interest slips 7.4% to $13.4B, showing reduced leverage appetite as traders cut risk exposure.

Solana price today is trading near $196, recovering modestly after sliding from last week’s $246 peak. The sharp reversal has placed SOL just above key trendline support, while buyers are attempting to defend the $192–$196 zone. The main question is whether Solana can stabilize above this level or if deeper downside toward $172 will unfold.

Solana Price Loses Momentum At Channel Resistance

The daily chart shows that Solana rejected the $246 resistance, which aligned with the upper boundary of its rising channel. Price has since fallen back to the $192–$196 zone, a region supported by both Fibonacci levels and the mid-range trendline.

Immediate resistance now sits near $218, with stronger barriers at $246 and $252. On the downside, losing $192 could expose the $171 support level, while a deeper flush could test the $142 region. Momentum indicators suggest cooling conditions, with RSI retreating from overbought levels and MACD signaling early bearish crossover pressure.

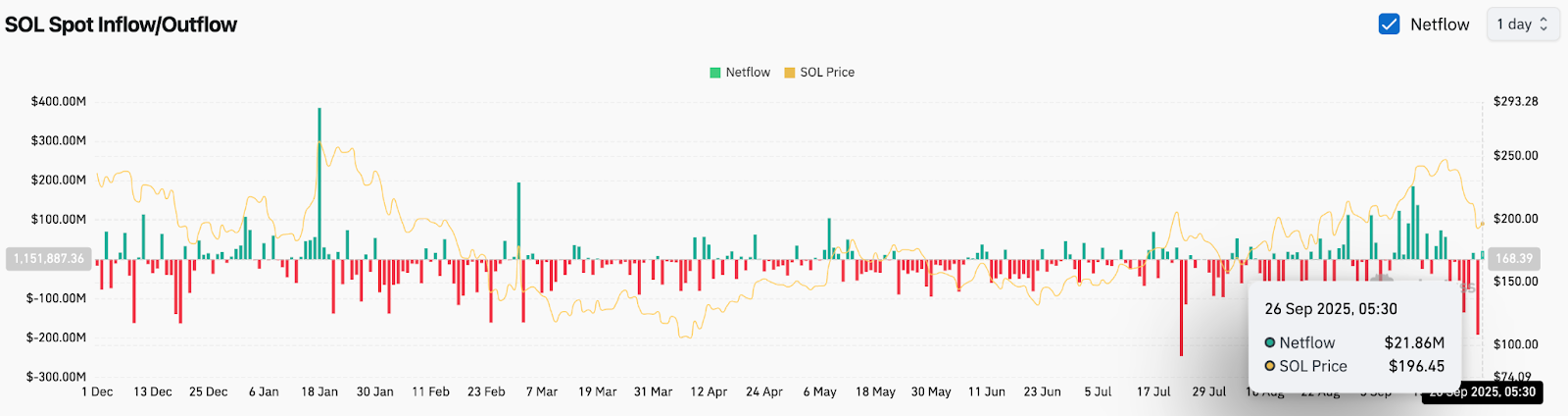

On-Chain Flows Signal Fragile Positioning

Exchange spot data shows Solana recorded a net inflow of around $21.8 million on September 26, even as price dipped to $196. While inflows often reflect renewed accumulation, the broader trend highlights inconsistent demand, with alternating bursts of inflows and outflows dominating recent months.

This choppy participation raises questions over conviction among buyers. Sustained positive flows would be needed to support a durable rebound, otherwise sellers may continue to pressure price action around the $190–$200 pivot.

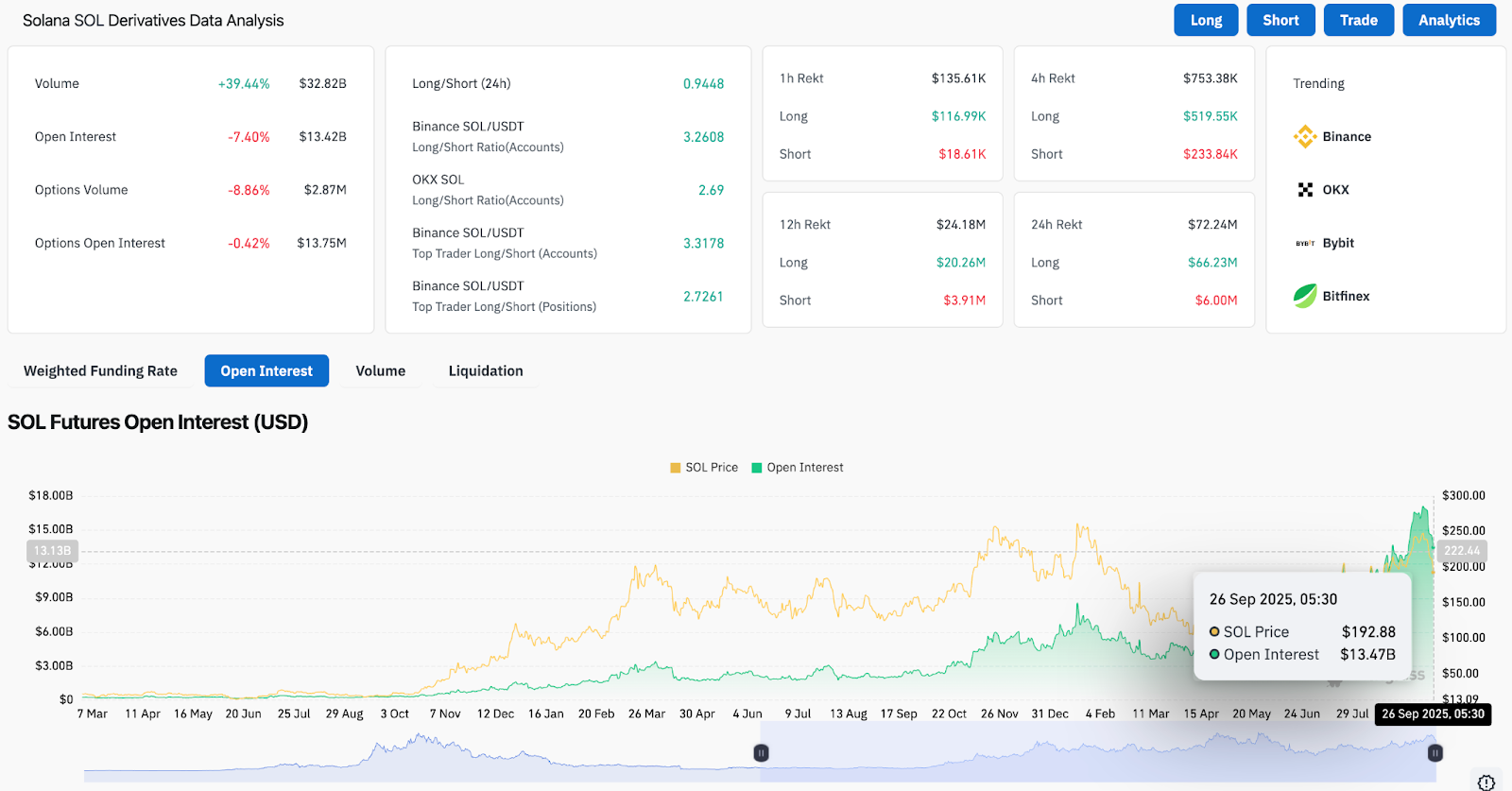

Derivatives Market Reflects Bearish Caution

Futures open interest for Solana has slipped 7.4% over the past day, dropping to $13.4 billion. This contraction underscores a cooling appetite for leveraged exposure following the recent rejection at $246.

Despite strong trading volume above $32 billion, the decline in options activity and shrinking OI shows that traders are reducing risk rather than building bullish positions. Long/short ratios remain slightly tilted toward longs on major exchanges, but without sustained capital inflows, the imbalance risks being unwound in favor of sellers.

Technical Outlook For Solana Price

- Upside targets: Regaining $218 would ease pressure, with $246 and $252 as the next breakout levels.

- Downside risks: Losing $192 exposes $171, with $142 as the next liquidity pocket.

- Trend support: The 200-day EMA near $177 remains the long-term defense line.

Outlook: Will Solana Go Up?

The path for Solana hinges on whether buyers can stabilize price above $192 while flows improve. On-chain data remains mixed, showing fragmented demand, while futures traders continue to cut back exposure.

If Solana price today holds $192 and reclaims $218, the door opens for another attempt at $246. Failure to hold this zone, however, risks pulling SOL back toward $171. For now, the market leans cautious, with momentum and flows signaling a consolidation phase rather than immediate recovery.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.