- Solana price today trades near $209, testing the 50-day EMA as $200 emerges as critical psychological support.

- On-chain flows show $33M in net outflows on September 24, highlighting growing caution among traders.

- Solana ecosystem leads globally in prediction market platforms, reinforcing long-term strength despite pullback.

Solana price today is trading near $209, extending its pullback after failing to hold the $224–$230 support cluster. The breakdown has pushed SOL back into the mid-range of its rising channel, with immediate downside risks tied to the $200 psychological level.

Solana Price Retests Channel Support

The daily chart highlights SOL’s rejection near $250 earlier this month, triggering a sharp reversal. The token now trades near the 50-day EMA at $209, with the 20-day EMA at $224 acting as overhead resistance.

Momentum indicators reflect fading strength. The RSI has cooled to 42, showing that bullish energy has dissipated without yet reaching oversold territory. If $209 fails, the next cushion emerges at the 100-day EMA around $193, followed by deeper trend support at $181. A close above $224 would be needed to restore bullish momentum.

On-Chain Flows Turn Negative

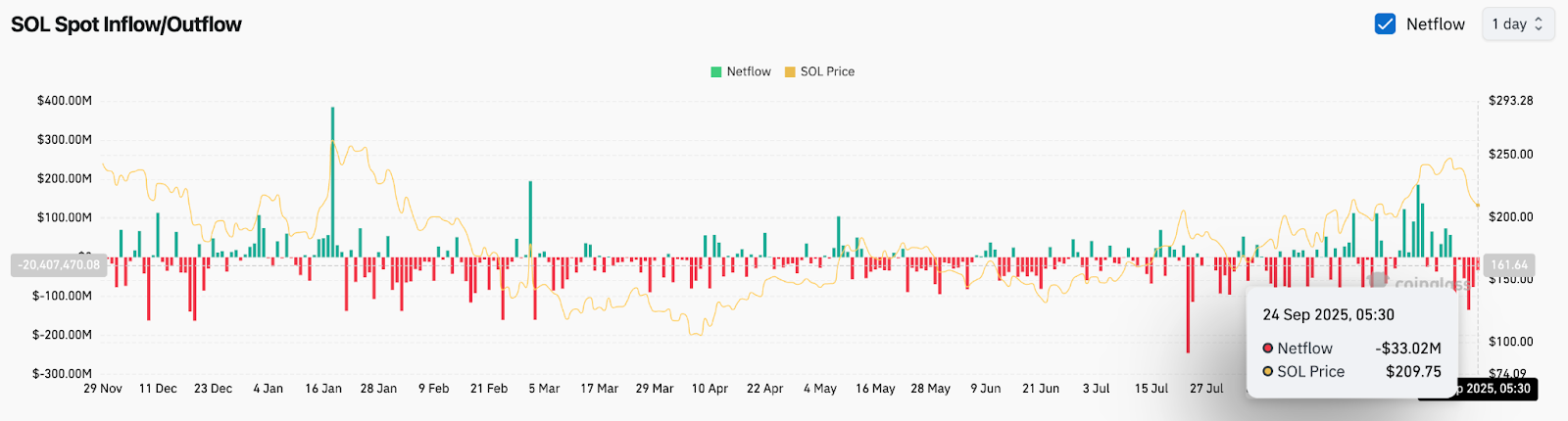

Spot flows reveal a wave of selling pressure. Data from September 24 shows $33 million in net outflows, signaling heightened distribution by holders. This marks one of the larger single-day outflows in recent weeks, aligning with the price slide below $210.

While SOL has experienced consistent inflows throughout much of Q3, the reversal highlights growing caution among traders. Sustained outflows at current levels could weaken structural support, leaving the $200 floor vulnerable.

Ecosystem Strength Counters Technical Weakness

Despite near-term selling, Solana’s ecosystem continues to show dominance. According to Messari, Solana leads globally in the number of prediction market platforms, surpassing Base and Polygon by a wide margin. With over 20 active projects, the chain’s expanding utility reinforces its long-term position as a leader in decentralized applications.

This fundamental strength provides a buffer against short-term technical corrections. Analysts note that ecosystem growth often attracts liquidity back into the network once selling pressure stabilizes, creating a base for recovery.

Technical Outlook For Solana Price

Solana price prediction for the short term rests on the following levels:

- Upside levels: $224, $235, and $250 as recovery checkpoints.

- Downside levels: $209, $193, and $181 as critical defenses.

- Channel context: SOL remains within a rising channel, but its lower boundary is now under test.

Outlook: Will Solana Go Up?

Solana finds itself at a pivotal juncture. The sharp correction from $250 has dragged it into a key support zone, with on-chain outflows signaling caution. Yet, the network’s leadership in prediction markets and expanding utility provide a strong narrative for long-term resilience.

If SOL can defend the $200–$209 range, a rebound toward $224 and $235 remains achievable. Failure to hold this zone would shift focus to $193 and potentially $181. For now, Solana’s path depends on whether community and institutional confidence can absorb the recent spike in selling pressure and reignite momentum within its broader uptrend channel.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.