Solana price today is trading at $209, holding near the upper boundary of its ascending channel after a strong summer rally. Buyers are testing the $210–$220 zone, which coincides with Fibonacci retracement levels and EMA clusters, leaving traders to weigh the impact of bullish fundamentals against seasonal headwinds.

Solana Price Holds Channel Support

The daily chart shows SOL advancing within a rising parallel channel since April. Support rests near $197–$200, where the 20-day EMA aligns with mid-channel demand. Resistance remains concentrated around $220, where price has stalled multiple times.

Related: XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout As ETF Speculation Heats Up

Momentum indicators lean neutral but constructive. The RSI sits near 58, showing room for further gains without being overbought. Meanwhile, the alignment of the 50- and 100-day EMAs below spot continues to provide structural support. A clean breakout above $220 could open the path toward $236 and the key Fibonacci level at $252.

Alpenglow Upgrade Secures Overwhelming Approval

Fundamental sentiment turned sharply positive this week after Solana stakers voted overwhelmingly to approve the long-awaited Alpenglow upgrade. More than 98% of participants backed the proposal, which introduces Votor and Rotor, two components designed to replace Proof-of-History and TowerBFT.

The overhaul is set to slash transaction finality times from 12 seconds to around 150 milliseconds, a milestone for user experience. Rotor’s later rollout will optimize validator communications, targeting performance improvements for high-demand DeFi and gaming applications. With 52% of staked SOL involved in the vote, the outcome demonstrates strong community alignment and reinforces confidence in Solana’s scalability roadmap.

Related: World Liberty Financial (WLFI) Price Prediction 2025–2030

Seasonal Trends And Elliott Wave Outlook

Analysts caution that September has historically been a weak month for Solana. Seasonality charts from Seasonax show repeated dips or sideways trading during this period, often followed by a strong recovery in October.

Elliott Wave analysis echoes this view. Charts suggest SOL is consolidating in a corrective phase, with the broader structure pointing toward a resumption of the uptrend. According to More Crypto Online, patience may be required through September, but the bias favors higher levels into Q4 if current supports hold.

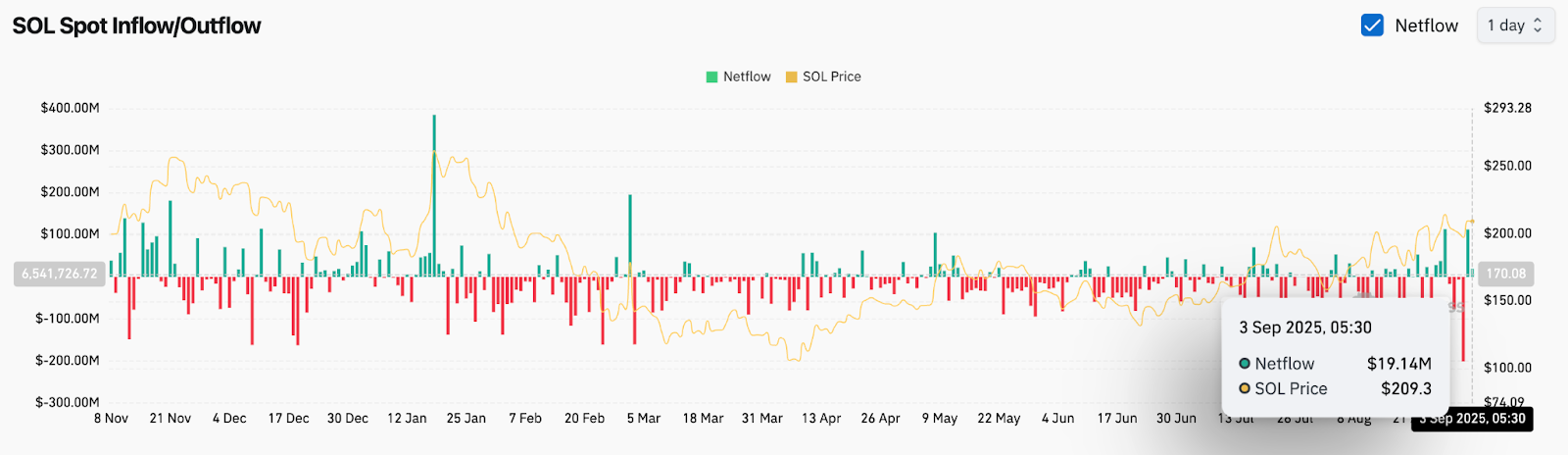

On-Chain Flows Signal Cautious Accumulation

On-chain data offers a mixed but improving picture. Spot netflow data from Coinglass shows $19.14 million in positive inflows on September 3, reflecting cautious accumulation around the $209 level.

While inflows have been inconsistent in recent months, the latest pickup suggests traders are positioning for a potential breakout. Conviction would require sustained inflows above $50 million, but the trend is consistent with broader optimism about the Alpenglow upgrade.

Technical Outlook For Solana Price

Immediate support rests at $197–$200, with deeper downside risks toward $186 and $171 if selling pressure emerges. On the upside, reclaiming $220 with volume would strengthen the case for a rally toward $236 and $252, the latter marking the 0.786 Fibonacci retracement of the prior downtrend.

A failure to clear $220 in September could extend the consolidation, consistent with historical seasonality, before a renewed attempt higher later in the year.

Related: Dogecoin (DOGE) Price Prediction for September 3

Outlook: Will Solana Go Up?

Solana’s near-term trajectory hinges on whether bulls can absorb seasonal weakness and capitalize on the momentum from the Alpenglow upgrade. As long as SOL holds above $197, the broader structure remains bullish, with $236–$252 as key upside targets.

Analysts remain cautiously optimistic. The combination of strong community backing for the upgrade, positive netflows, and a constructive Elliott Wave setup suggests Solana could be primed for another leg higher into Q4, even if September brings short-term pauses.

Solana Price Forecast Table

| Level | Support | Resistance | Indicator Bias |

| Near-term | $197–$200 | $220 | Neutral to bullish |

| Short-term | $186 | $236 | RSI supportive |

| Medium-term | $171 | $252 | Channel + Fibonacci bullish |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.