- Solana price today trades near $223, testing wedge support after rejection at $252 and break below $236–$240.

- On-chain data shows $126.8M in net outflows on September 22, signaling whale selling pressure after strong YTD gains.

- Solana open interest dropped 10% to $15.19B as derivatives reset, while ETF optimism and upgrades provide long-term support.

Solana price today is trading near $223, down over 5% after failing to hold above the $236–$240 zone. The decline has put SOL back inside its rising wedge structure, raising questions about whether institutional optimism and ETF narratives can outweigh growing signs of weakening momentum.

Solana Price Tests Rising Wedge Support

The daily chart highlights SOL’s sharp rejection from $252, a level that aligns with the wedge resistance and the 61.8% Fibonacci retracement. Price has since slipped back to $223, testing support at the 20-day EMA of $227. Below this, $209 and $193 are critical defense zones, with the 200-day EMA at $180 marking the last major floor.

Related: Dogecoin (DOGE) Price Prediction For September 23

Momentum indicators reinforce the caution. RSI has rolled over from near 70 toward 62, showing cooling strength, while Parabolic SAR dots flipped bearish at $253. As long as SOL remains below $240, the path of least resistance appears tilted toward a deeper retest of $209.

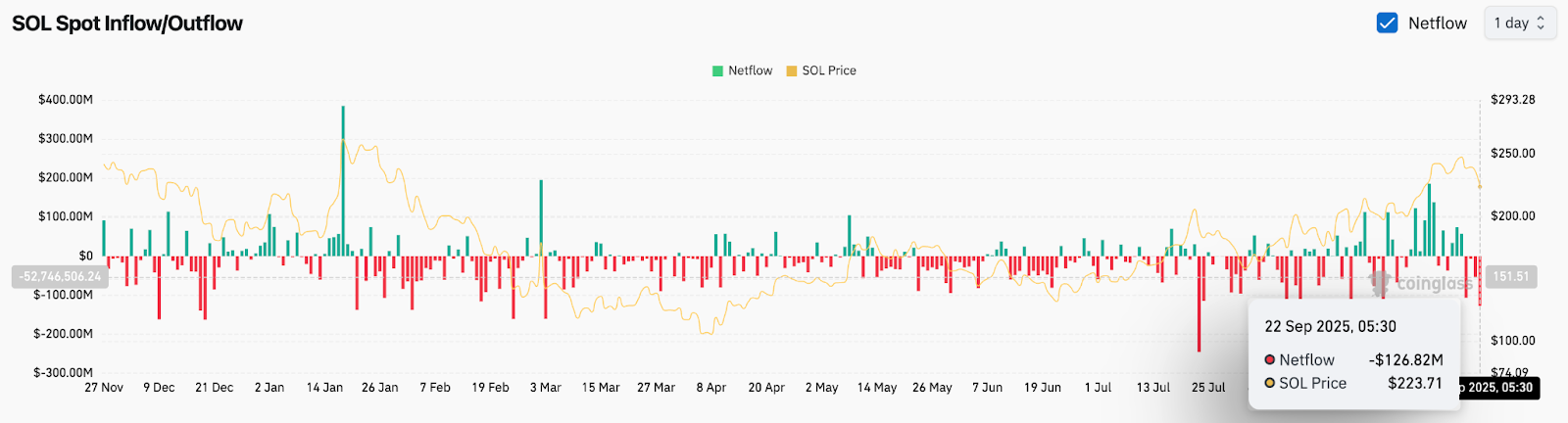

Spot Flows Show Heavy Selling

On-chain data confirms pressure from the spot market. Coinglass reported net outflows of $126.8 million on September 22, one of the largest single-day withdrawals in recent weeks. Persistent selling aligns with the price rejection at $252, suggesting that whales and large holders may be reducing exposure after the strong 150% year-to-date rally.

Without a reversal in flows, Solana price volatility is likely to remain elevated, with downside liquidity clusters near $209 and $193 becoming potential magnets for price action.

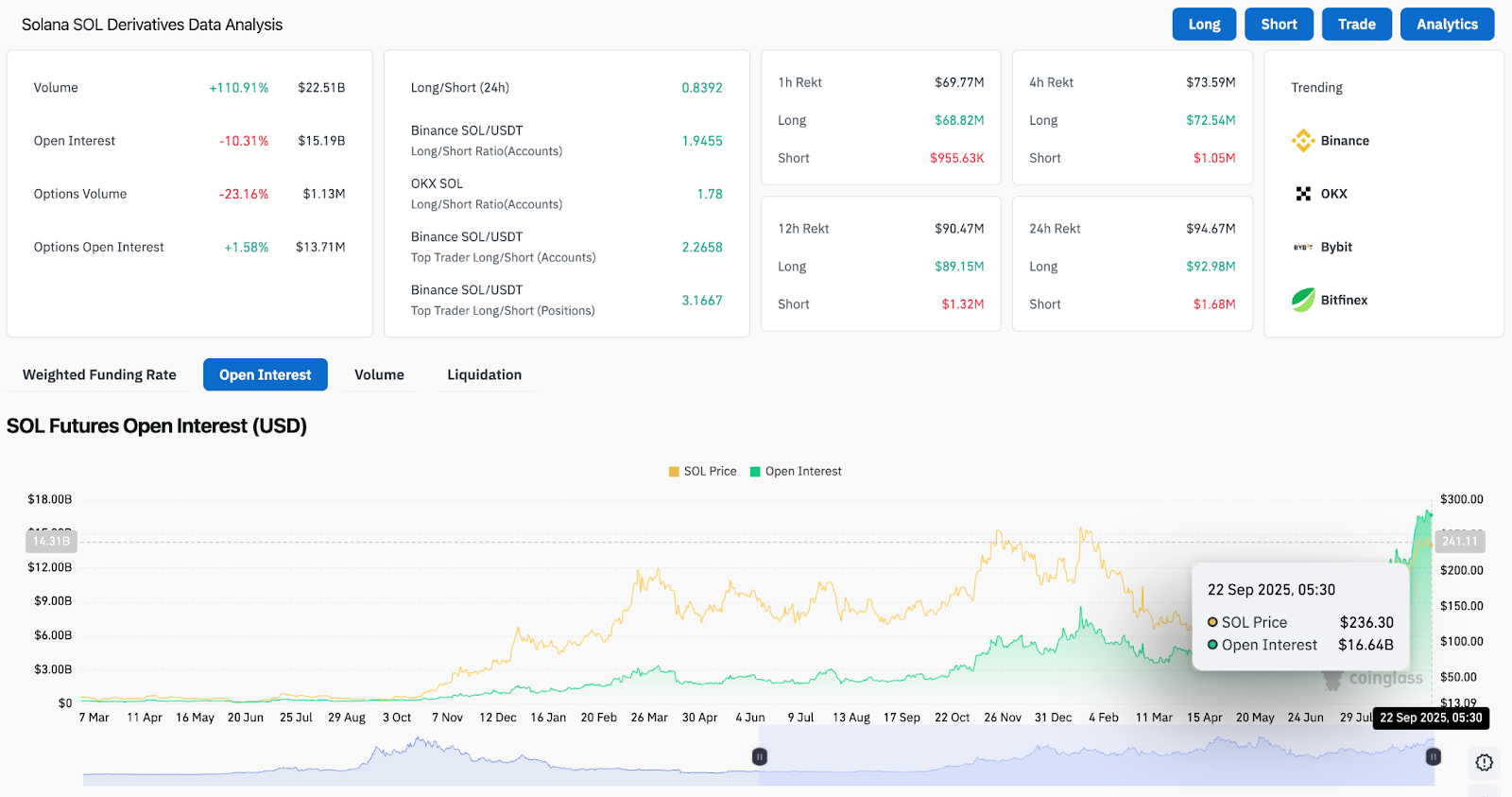

Derivatives Market Resets As Open Interest Falls

Derivatives data shows a clear cooling of speculative positioning. Solana’s open interest dropped more than 10% to $15.19 billion, signaling that traders are unwinding leveraged bets after the failed breakout. Options volume fell sharply by 23%, reinforcing the idea of waning conviction.

Related: Avantis Price Prediction: Can AVNT Sustain Momentum After $10M Spot Inflows?

Despite this, futures volume surged 111% to $22.5 billion, pointing to active repositioning rather than a collapse in interest. Funding rates remain stable, and top trader long/short ratios on Binance still show bias toward longs, though leverage has eased.

This reset could serve as a healthy shakeout, clearing weak hands before a potential attempt to reclaim higher levels.

Broader Narrative Remains Supportive

Fundamentally, optimism continues to surround Solana. The Alpenglow upgrade, expected to enhance throughput and efficiency, has been cited by analysts as a key bullish driver. ETF optimism also adds long-term demand prospects, with Solana increasingly being viewed as an institutional-grade blockchain alongside Ethereum.

As one strategist noted, SOL sits at a “pivotal crossroads” where structural adoption trends clash with short-term technical weakness. Treasury accumulation and ecosystem growth remain strong tailwinds if price can hold key supports.

Technical Outlook For Solana Price

Solana price prediction for the near term rests on whether $223–$227 support holds:

- Upside levels: $236, $252, and $270 remain the resistance cluster. A breakout above $252 would validate bullish continuation.

- Downside levels: $209, $193, and $180 as critical demand zones. Losing $180 risks unwinding gains toward $171.

- Trend support: Rising wedge support currently sits near $209, with the long-term floor at $180.

Outlook: Will Solana Go Up?

Solana’s outlook remains finely balanced. Spot outflows and a sharp drop in open interest show traders pulling back, while ETF optimism and network upgrades provide a structural cushion. For now, Solana price today remains under wedge support pressure, and traders will watch $223–$227 closely.

If SOL holds this region and reclaims $236, momentum could quickly return to target $252 and higher. A failure, however, would expose $209 and $193, with $180 as the final line of defense. In short, Solana sits at a turning point where both bulls and bears have strong arguments.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.