- Solana falls below $100 amid broad crypto market weakness and bearish derivatives signals.

- Network usage hits record levels, with daily transactions reaching nearly 150 million.

- Tokenized equities on Solana climbed to a new high of about $230 million.

Solana fell below $100 on Wednesday amid broad cryptocurrency market losses. The decline came despite record transaction activity and growing use of tokenized equities on the network. Traders focused on weakening demand, derivatives outflows, and bearish technical signals.

Price Decline Mirrors Broader Crypto Sell-Off

Solana trades at $97 at press time, down more than 6% over the previous 24 hours. The move followed a sharp downturn across digital assets, as investors reduced risk exposure amid rising volatility.

SOL has now declined about 23% over the past week and more than 50% on a yearly basis. Market sentiment remains fragile, with the crypto Fear and Greed Index reading 14 on Wednesday, a level that reflects intense risk aversion.

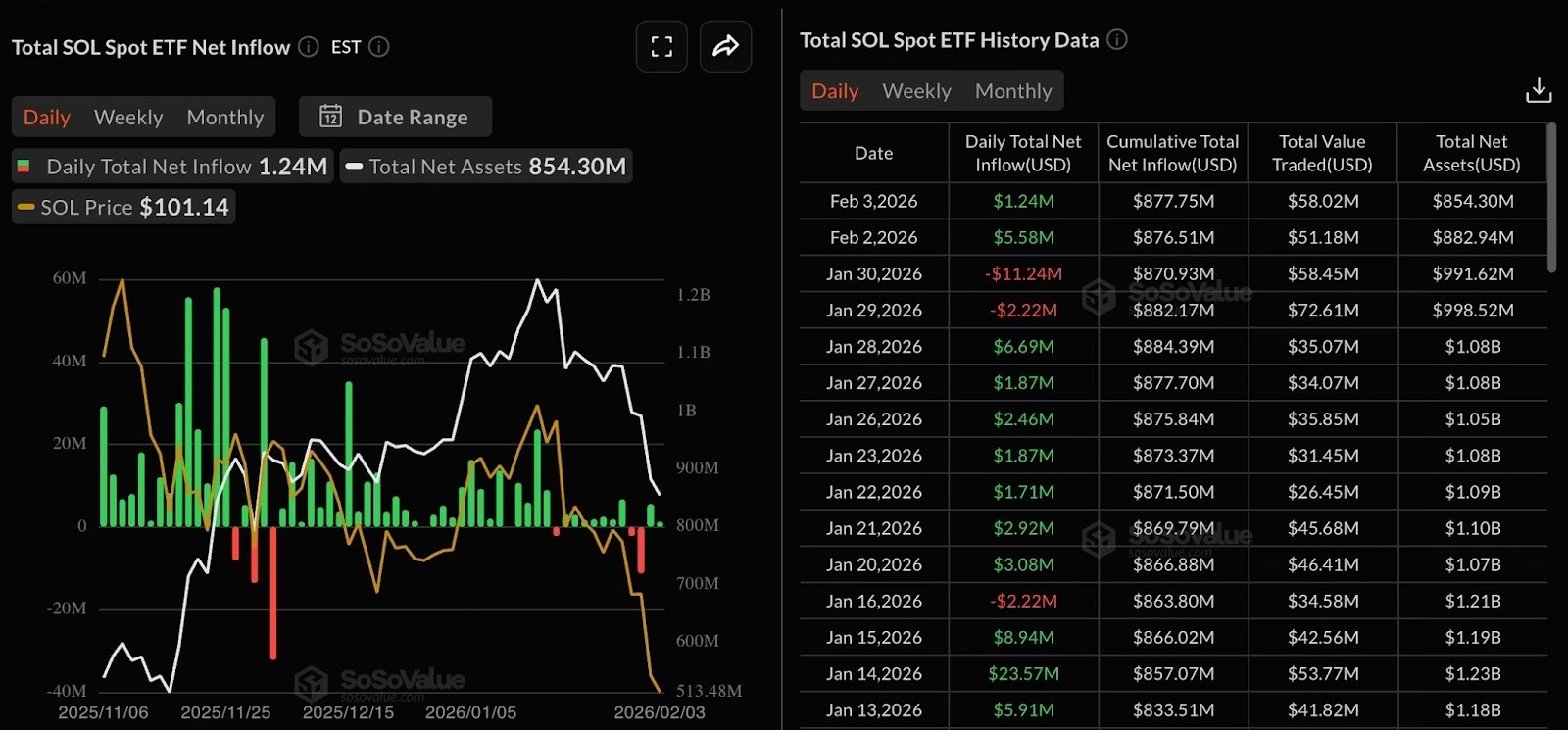

Institutional Demand Remains Subdued

Flows into Solana-linked investment products have stayed limited in recent weeks. Data shows institutional inflows have not exceeded $9 million per day for the last two weeks, with a few sessions even recording net outflows.

The Solana-focused exchange-traded funds posted a $1.24 million inflow on Tuesday, adding to a $5.58 million inflow on Monday. While positive, the figures remain modest relative to Solana’s market size and earlier periods of stronger demand.

Derivatives Data Signals Bearish Positioning

Futures market activity points to fading confidence among leveraged traders. Solana’s open interest declined 1.24% in 24 hours to $6.37 billion, indicating capital withdrawal through position closures or reduced leverage.

Liquidation data shows a clear imbalance. Long liquidations totaled $22.31 million during the same period, compared with $4.39 million in short liquidations. The OI-weighted funding rate also turned more negative, signaling that traders are paying to maintain short exposure. These indicators suggest bearish sentiment continues to dominate short-term positioning.

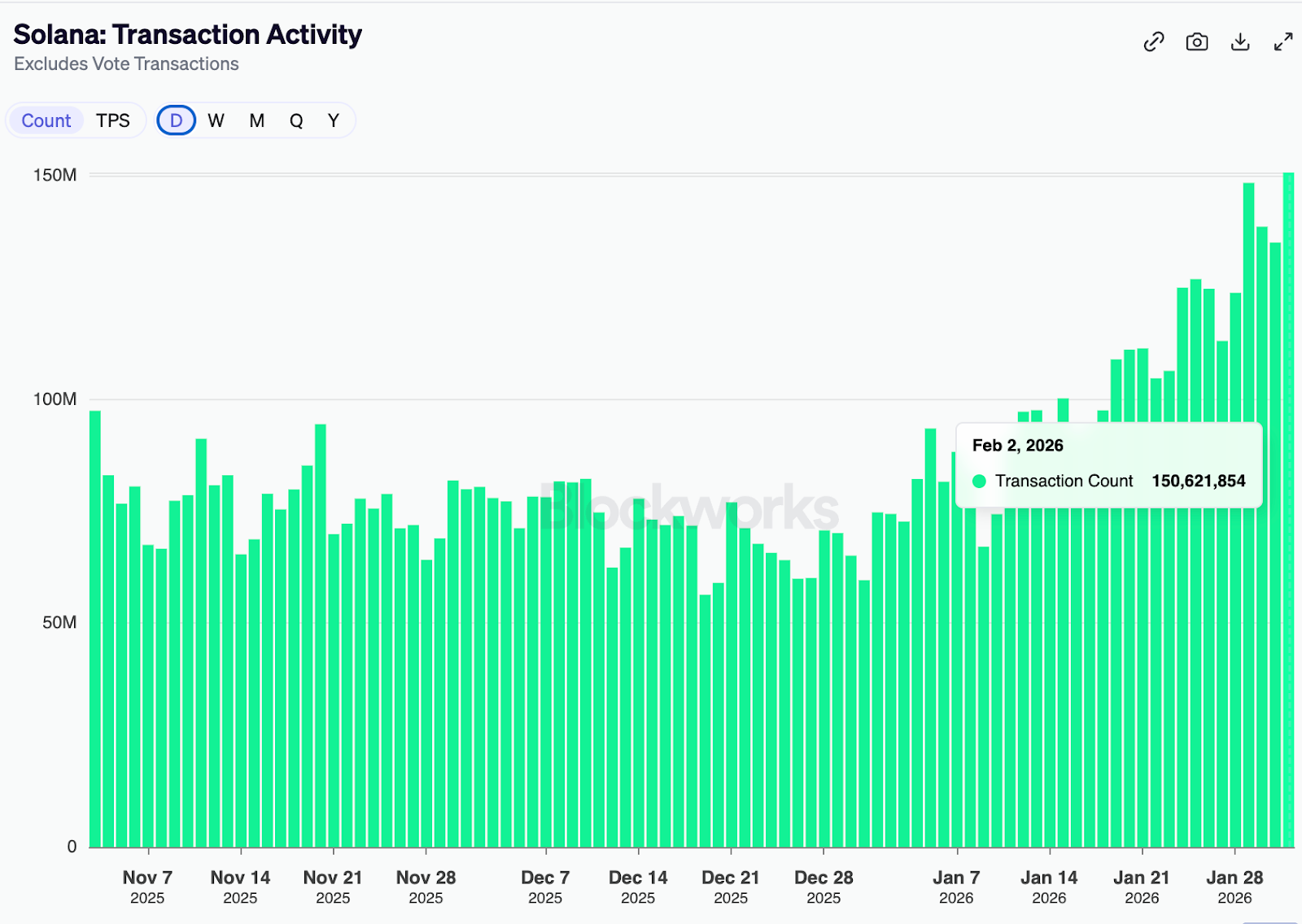

On-Chain Activity Reaches New Highs

In contrast to price action, Solana’s network usage continues to expand. Blockworks data shows the blockchain processed around 150 million transactions on Tuesday, the highest daily total on record. Average throughput reached about 1,743 transactions per second.

Earlier in the week, daily transactions surpassed 109 million, marking a two-year high. The data indicates that user activity on the network remains strong, even as market prices decline.

DeFi Growth Strengthens Network Fundamentals

Decentralized finance activity on Solana has also increased. The network’s total value locked rose to a record 73.4 million SOL, valued near $7.5 billion at current prices. That represents an 18% weekly increase and exceeds the previous peak recorded in mid-2022.

Decentralized exchange activity followed a similar trend. Weekly trading volume reached a 12-month high, while daily volumes climbed to levels not seen in eight months. Analysts often view sustained DeFi usage as a sign of continued network engagement.

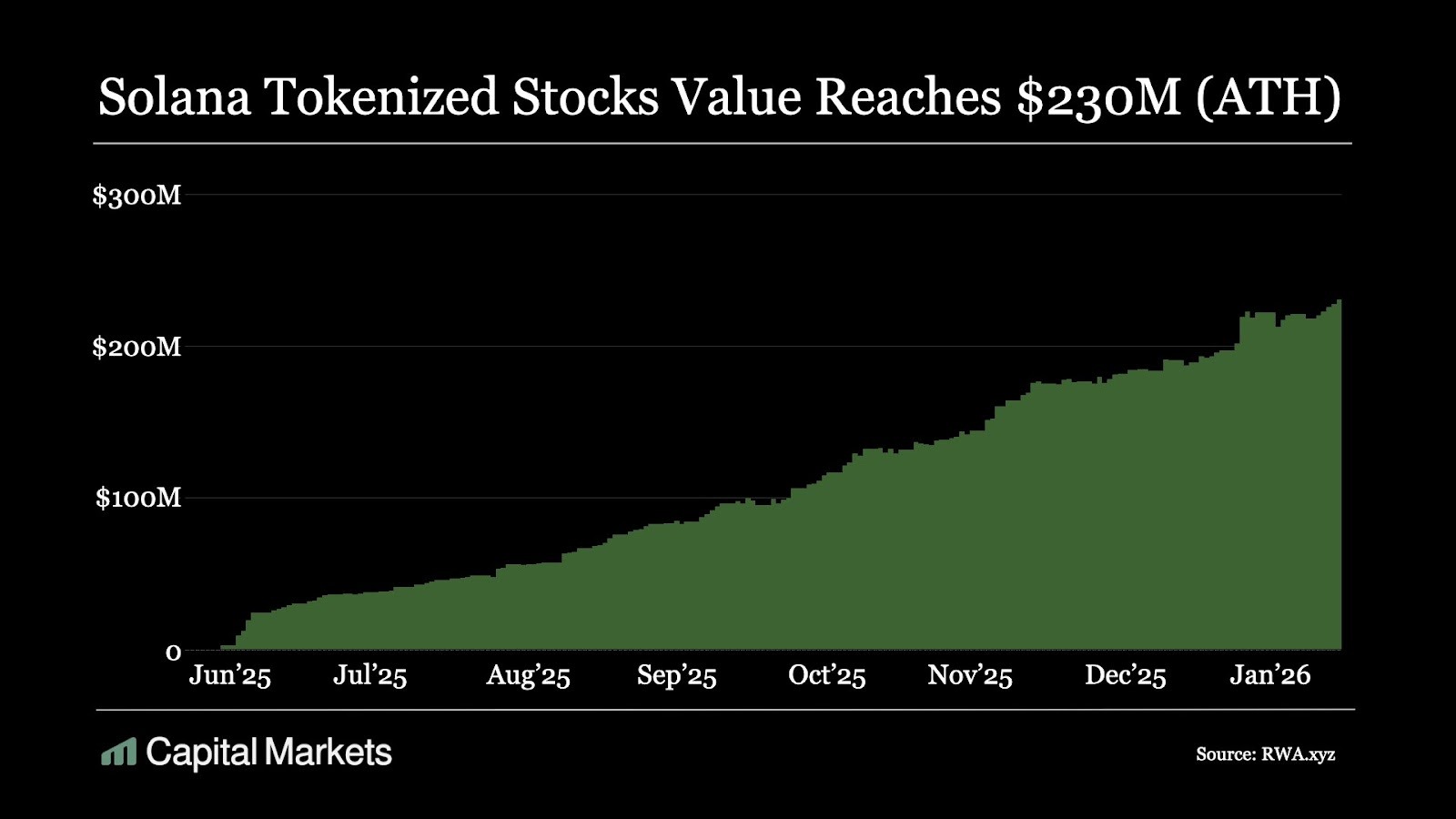

Tokenized Equities Gain Traction on Solana

Beyond DeFi, Solana is expanding its role in tokenized traditional assets. Data from Capital Markets shows tokenized equities on Solana reached an all-time high value of about $230 million.

The growth has been steady since mid-2025 and accelerated toward the end of the year. Platforms such as Ondo Finance, xStocks, Superstate, and Remora Markets have contributed to the expansion, supported by Solana’s low fees and continuous trading access.

Technical Outlook Remains Cautious

Solana (SOL) is trading below its main moving averages: the 50-day at $127, the 100-day at $139, and the 200-day at $153. Short-term averages are trending down, while long-term averages are still much higher, showing the overall downtrend remains intact.

Momentum is weak. The daily RSI is around 28, meaning SOL is oversold, and the MACD is below its signal line, signaling continued bearish pressure. Oversold conditions might slow selling, but don’t guarantee a rebound.

Key levels to watch: a drop below $95 could lead toward $85, while moving above $100 would reduce short-term pressure. Resistance comes at $113–$115, and the 50-day EMA at $127; SOL needs to clear these to turn bullish.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.