- Analyst Lark Davis says Solana outperforms Ethereum in speed, activity, and growth.

- Ethereum’s upgrades continue, but scalability and usability issues still slow progress.

- Solana ETFs attract nearly $200 million, showing strong institutional buying demand.

The battle between Solana (SOL) and Ethereum (ETH) is shaping up to define the next phase of the crypto market. According to crypto analyst Lark Davis, the data now tilts in Solana’s favor, even as Ethereum continues to upgrade and expand its ecosystem.

Ethereum’s Progress Isn’t Enough Yet

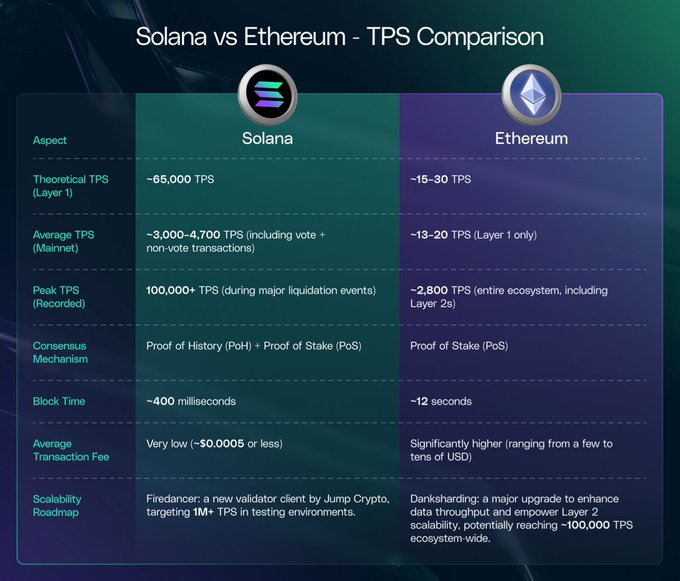

Ethereum has made steady improvements with lower fees and scaling updates, but Davis says it still faces structural challenges. Despite upcoming upgrades aimed at boosting on-chain scalability tenfold, Ethereum continues to struggle with performance and user experience.

Davis, who has held a mixed view of ETH for most of the year, recently turned slightly more positive, citing interest from institutional figures like Tom Lee. Even so, he considers his Ethereum position more of a short-term trade rather than a conviction hold.

Solana’s Growth Is Hard to Ignore

When comparing both blockchains directly, Solana appears to be leading in speed, activity, and network growth. Ethereum’s strength lies in its Layer 2 ecosystem, but Solana’s single-chain efficiency has made it a favorite among developers and new projects. Lark Davis notes,

“If you look at Ethereum’s main chain versus Solana, Solana is winning. Only when you count all the Layer 2s together does the ETH ecosystem take the lead,”

Davis considers it undervalued compared to Ethereum given its market cap and developer traction. If forced to pick only one network today, he would choose Solana, describing it as a stronger short-term bet based on current fundamentals.

Still, he warns that this isn’t a winner-takes-all market. “We’ll probably have four to five major chains capturing 90% of users, developers, and transactions,” he said. Ethereum and Solana are both part of that group, along with Binance Smart Chain and emerging contenders like Avalanche and Sui.

Solana Price Prediction

Spot Solana exchange-traded funds made their debut on U.S. exchanges with a strong start, pulling in nearly $200 million in net inflows during their first week. Solana ETFs have now crossed $500 million.

Despite the strong inflows, Solana’s price remains flat. SOL is holding near support between $178 and $184, but there’s no confirmed breakout yet. A move above $196 could open the door to a short-term rally toward $195–$200, while failure to hold current levels may keep the token range-bound for now.

Related: Is Solana Changing Its Strategy? New Debate on Decentralization Heats Up

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.