- Bullish Solar (SXP) price prediction ranges from $0.1947 to $4.1667.

- Analysis suggests that the SXP price might reach above $4.

- The SXP bearish market price prediction for 2023 is $0.2242.

Table of contents

- What is Solar (SXP)?

- SXP Current Market Status

- Solar (SXP) Price Analysis 2023

- Solar (SXP) Price Prediction 2023-2030 Overview

- Solar (SXP) Price Prediction 2023

- Solar (SXP) Price Prediction 2024

- Solar (SXP) Price Prediction 2025

- Solar (SXP) Price Prediction 2026

- Solar (SXP) Price Prediction 2027

- Solar (SXP) Price Prediction 2028

- Solar (SXP) Price Prediction 2029

- Solar (SXP) Price Prediction 2030

- Solar (SXP) Price Prediction 2040

- Solar (SXP) Price Prediction 2050

- FAQ

What is Solar (SXP)?

Built on the Solar Core, a Layer-1 Blockchain Framework, Solar is a decentralized blockchain using a Delegated Proof of Stake consensus model which is secured by 53 elected block producers that produce blocks, validate transactions and optionally pay commission to voters.

The Solar blockchain ecosystem powered by open-source developers and community participation aims to create a transparent governance ecosystem. Developers constructing Decentralized Applications (DApps) on the Solar platform have access to a variety of features, such as smart contracts, and decentralized storage, as well as numerous tools and resources, all of which are provided by Solar Core.

Joselito Lizarondo and Nayiem Willems founded Solar Network in 2018. Lizarondo and Willems, who previously launched Swipechain, built Solar to serve a similar purpose in mind: to provide sustainable, clean energy solutions to remote areas by leveraging blockchain technology.

SXP Current Market Status

Solar (SXP) has a circulating supply of 563,032,322 SXP coins, while its maximum supply is unavailable, according to CoinMarketCap. At the time of writing, SXP is trading at $0.5545 representing 24 hours decrease of 3.99%. The trading volume of SXP in the past 24 hours is $51,418,302 which represents a 110.55% increase.

Some top cryptocurrency exchanges for trading Solar (SXP) are Binance, KuCoin, Bithumb, Bitstamp, Bittrex, Huobi, ProBit Global, and Gate.io.

Now that you know Solar and its current market status, we shall discuss the price analysis of Solar (SXP) for 2023.

Solar (SXP) Price Analysis 2023

Will the SXP blockchain’s most recent improvements, additions, and modifications help its price rise? Moreover, will the changes in the payment and crypto industry affect SXP’s sentiment over time? Read more to find out about SXP’s 2023 price analysis.

Solar (SXP) Price Analysis – Bollinger Bands

The Bollinger bands are a type of price envelope developed by John Bollinger. It gives a range with an upper and lower limit for the price to fluctuate. The Bollinger bands work on the principle of standard deviation and period (time).

The upper band as shown in the chart is calculated by adding two times the standard deviation to the Simple Moving Average while the lower band is calculated by subtracting two times the standard deviation from the Simple Moving Average.

When this setup is used in a cryptocurrency chart, we could expect the price of the cryptocurrency to reside within the upper and lower bounds of the Bollinger bands 95% of the time.

The above thesis is derived from an Empirical law also known as the three-sigma rule or the 68-95-99.7 which states that almost all observed data for a normal distribution (normal scattering of data) will fall within three standard deviations.

As such, for a data set that follows a normal distribution, 68% of data will fall within 1 standard deviation of the mean, while 95% of data for the normal distribution will fall within 2 standard deviations of the mean and 99.7% of data will fall within 3 standard deviations of the mean.

Hence, as the Bollinger bands are calculated using two standard deviations, we could expect SXP to abide within the Bollinger bands 95% of the time. (i.e. whenever the cryptocurrency touched the upper band, the chances of it coming down are 95%.). This concept applies vice-versa as well.

Moreover, the sections highlighted by red rectangles show how the bands expand and contract. When the bands widen, we could expect more volatility, and when the bands contract, it denotes less volatility. As the bands are widening currently, we could see a drastic change in prices.

Currently, SXP is fluctuating in the second half of the Bollinger bands between the lower band and SMA. Although SXP tested the SMA on a few occasions it wasn’t able to break it. Hence, we could expect SXP to test the SMA once again. In the event that SXP is strong enough to break the SMA and reach the Upper band, then there could be a price action of 16%, which investors would want to cash in on.

However, that does not necessarily remove the probability of SXP touching the lower band once again from the equation.

As such, traders should be vigilant about entering the market using the Bollinger bands. If by any chance SXP tests the lower band once again, it may present an excellent entry point.

Notably, the Bollinger Band behaves very closely with the Keltner channel. For instance, if you were to use both the Bollinger bands and Keltner channel indicators for a cryptocurrency, you would see that almost most of the time both indicators overlap.

However, the only difference between with Bollinger band and the Keltner channel is that the Bollinger bands use Standard Deviation while the Keltner channel uses Average True Range for calculating its bands which are the top and bottom limits.

Solar (SXP) Price Analysis – Relative Strength Index

The Relative Strength Index is an indicator that is used to find out whether the price of a security is overvalued or undervalued. As per its name, RSI indicators help determine how the security is doing at present, relative to its previous price.

Moreover, it has a signal line which is a Simple Moving Average (SMA) that acts as a yardstick or reference to the RSI line. Hence, whenever the RSI line is above the SMA it is considered bullish and if it’s below the SMA then it is bearish.

When considering the first green rectangle from the left of the chart below we can see that the RSI line (purple) is above the Signal line (yellow). As such, SXP is bullish or gaining value. Therefore it is reaching higher highs as shown in the chart.

The second green rectangle shows that the RSI is below the signal. Hence, SXP is bearish as it is making lower lows.

Currently, the RSI of SXP at 51.05 has just crossed the Signal. The question that arises is, will SXP be able to keep rising above the Signal or will this be just another failed attempt, like the highlighted red ellipticals?

To properly adjudicate this scenario, it is better for the investors to wait for the market to saturate, before making any vital moves.

To deduce whether a cryptocurrency is bearish or bullish, the RSI compares the gains of the securities against the losses it made in the past. This ratio of gains against the losses is then deducted from the 100.

If the answer is equal to or less than 30, then we call that the price of the security is in the oversold region.

This means that many are selling the security in the market, and as such the security is undervalued. Moreover, as per the Supply-demand curve theory, the price is supposed to drop when there is an increase in supply.

If the answer is equal to or greater than 70 then the security is overbought as many are buying. Since many want to buy the security the demand increases which intuitively increases the prices.

Additionally, the RSI could be used to determine how strong a trend is. For instance, when a cryptocurrency is bullish or reaching higher highs, then the RSI line also should be making higher highs in unison.

For instance, if the RSI is making lower highs when the cryptocurrency is making higher highs, then we may say that although the token/coin is on a bullish trend it is losing value. As such, there could be a trend reversal in the future.

However, the RSI could also give false alarms for breakouts. Although we may expect, the prices to retrace if it goes to the oversold or overbought region, the prices also can stay in the oversold or overbought region for an extended period. As such, traders should be wary of it and let the market saturate before making vital decisions.

Solar (SXP) Price Analysis – Moving Average

The Exponential Moving averages are quite similar to the simple moving averages (SMA). However, the SMA equally distributes down all values whereas the Exponential Moving Average gives more weightage to the current prices. Since SMA undermines the weightage of the present price, the EMA is used in price movements.

The 200-day MA is considered to be the long-term moving average while the 50-day MA is considered the short-term moving average in trading. Based on how these two lines behave, the strength of the cryptocurrency or the trend can be determined on average.

In particular, when the short-term moving average (50-day MA) approaches the long-term moving average (200-day MA) from below and crosses it, we call it a Golden Cross.

Contrastingly, when the short-term moving average crosses the long-term moving average from above then, a death cross occurs.

Usually, when a Golden Cross occurs, the prices of the cryptocurrency will shoot up drastically, but when there’s a Death Cross, the prices will crash.

Whenever the price of cryptocurrency is above the 50-day or 200-day MA, or above both we may say that the coin is bullish (red rectangle). Contrastingly, if the token is below the 50-day or 200-day, or below both, then we could call it bearish (Green triangle section).

We could see that SXP tested the 50-day MA on numerous occasions but wasn’t able to break above it. Had investors taken the false buy signal hoping for SXP to break out and exited the market before 2023 they would have made a loss. However, those holding SXP after 2023 would have made profits.

Moreover, the Golden Cross gave more momentum to SXP as it surged after tanking just below the 200-day MA. Currently, SXP has a bullish engulfing, hence, it may keep on rising,

However, Solar is just above the 50-day MA, and in the event that the bears take over the market in the future, SXP may seek assistance from the 50-day MA. If the 50-day MA does not support it, then it would seek assistance from the 200-day MA.

Solar (SXP) Price Analysis – Rate of Change

The Rate of Change Indicator is a momentum oscillator, that measures the change of the current price against the past price a few number of periods ago, in percentage. As long as the price is rising ROC will be positive. But, the ROC indicator will reach the negative zone when the prices reduce. Increasing values in either direction, positive or negative, indicate increasing momentum and moving back toward zero indicates diminishing momentum.

Moreover, the equation for ROC is as follows: ROC = [(Today’s Closing Price – Closing Price n periods ago) / Closing Price n periods ago] x 100.

Unlike the RSI, ROC has no set overbought or oversold regions, it rather depends on a trader’s discretion. Traders often tend to find the areas in the positive and negative zones where the trend changes have happened in regularity. Based on this they could mark their bounds for overbought and oversold regions.

ROC could also be used as a divergence indicator that signals a possible upcoming trend change. Divergence occurs when the price of a stock or asset moves in one direction while its ROC moves in the opposite direction.

For example, if a stock’s price is rising over a period of time and registering higher highs while the ROC is progressively moving lower, or making lower highs, then the ROC is indicating bearish divergence from price, which signals a possible trend change to the downside. The same concept applies if the price is moving down and ROC is moving higher.

Additionally, the zero line crossover could be used to signal trend changes. However, depending on the number used for n (periods) in the indicator the signals may come in early or late.

When considering the chart we could see that SXP was making lower highs and lower lows in unison with the ROC. Hence, there seems to be no divergence.

Moreover, Solar’s extremely overbought regions are marked as Overbought Region 1 at 39.26, Overbought Region 2 at 81.35, Overbought Region 3 at 133.75, and Overbought Region 4 at 183.11. SXP’s trend reversed many times after it reached the overbought region 1. Furthermore, we could see higher the overbought region lesser the number of times SXP tested those levels.

Similarly, Solar reached the Oversold Region 1 at -28.16 many times as compared to the Oversold Region 2 at -65.39

Currently, after residing in the depths of the negative zone SXP is making a move into the positive region. Although as of press time SXP is at -0.31, it has the potential to move into the positive region. This could signal a bullish market for Solar. Moreover, since SXP is approaching the zero line, this could present an excellent entry point for traders.

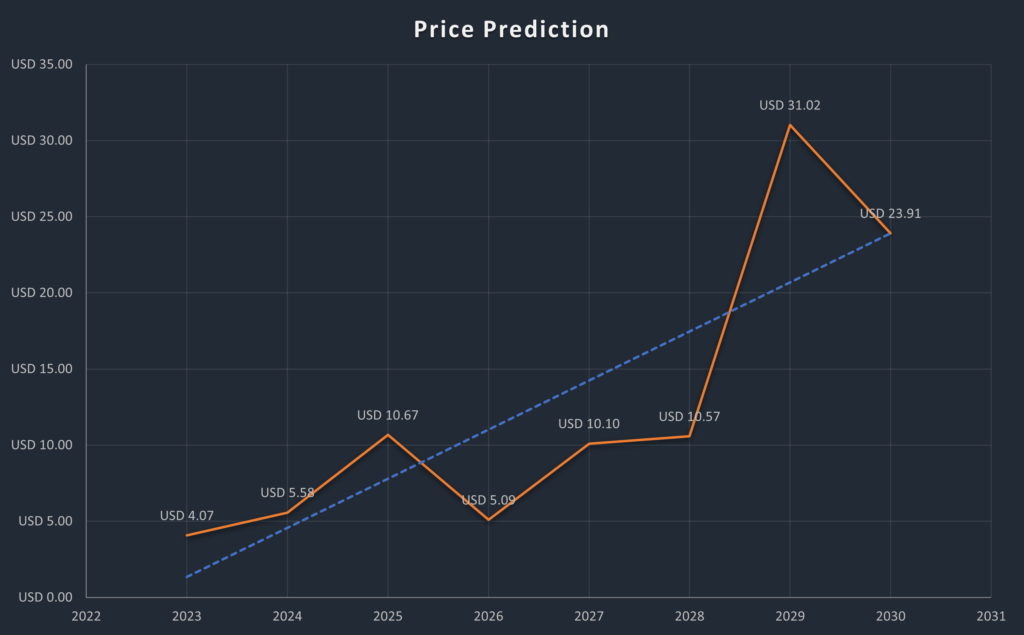

Solar (SXP) Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $2.15 | $4.07 | $4.97 |

| 2024 | $5.21 | $5.58 | $7.81 |

| 2025 | $9.97 | $10.66 | $11.9 |

| 2026 | $4.78 | $5.09 | $6.59 |

| 2027 | 9.48 | $10.10 | 11.11 |

| 2028 | $9.52 | $10.57 | $11.21 |

| 2029 | $28.55 | $31.02 | $33.21 |

| 2030 | $22.18 | $23.91 | $24.19 |

| 2040 | $55.21 | $56.15 | $57.18 |

| 2050 | $87.79 | $88.39 | $90.31 |

Solar (SXP) Price Prediction 2023

When looking at the chart above, we can see that during March-April 2022, SXP took a deep fall. During this fall, Solar lost more than 80% of its value. And since its fall, there have been very few vertical movements until recently. Solar has been relying on Support 1 at $0.2242 heavily.

But we can see that the end of March brought about a spike of hope for Solar as its gained some momentum and gained value. However, the bears didn’t let the bulls off the hook, as such, Solar could not march on.

Although there seems to be a bullish engulfing, if the bears are strong enough, Solar may keep on reducing. Moreover, this thesis can be supported as the bears were able to keep the pressure despite Solar being encompassed by a bullish engulfing on a previous occasion.

Hence, if the bears keep their stranglehold on Solar, then SXP would seek assistance from Support 1 at $0.2242. Moreover, as the Bollinger bands are squeezing, we could expect Solar to move sideways, if it reaches Support 1 again.

Contrastingly, if the bulls dominate the market there is a possibility that Solar could rise exponentially breaking Resistance 1 and 2 and rise to Resistance 3 at $4.0702, as it rose in early 2021.

However, on its way up if Solar experiences resistance near Resistance 2 at $ 2.9326, then it may consolidate at Resistance 2. Similarly, if Solar encounters resistance at Resistance 1 then it may consolidate near Resistance 1 at $2.1743.

Solar (SXP) Price Prediction – Resistance and Support Levels

When looking at the chart above, we could see how SXP tried to climb up after experiencing a fall just after the 2021 exponential rise. When closely scrutinizing the behavior of SXP, although it tried to consolidate and rise up after falling the bears didn’t allow solar to do so. As such, we could see that Solar was making lower highs as shown in the chart.

Notably, SXP rose exponentially when it was residing quite close to where it is residing now. Hence, this makes us question whether there is another exponential rise for Solar on the horizon. However, the contracting Bollinger bands negates this thesis. But, what if there’s going to be more volatility and the bands widen? Therefore traders should keep a close eye on Solar.

Solar (SXP) Price Prediction 2024

There will be Bitcoin halving in 2024, and hence we should expect a positive trend in the market due to user sentiments and the quest by investors to accumulate more of the coin. Since the Bitcoin trend affects the direction of trade of other cryptocurrencies, we could expect SXP to trade at a price not below $5.5783 by the end of 2024.

Solar (SXP) Price Prediction 2025

SXP may still experience the after-effects of the Bitcoin halving and is expected to trade above its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, SXP will continue to rise in 2025 forming new resistance levels. It is expected that SXP would trade beyond the $10.6663 level.

Solar (SXP) Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, SXP could tumble into its support regions. During this period of price correction, SXP could lose momentum and be a little below its 2025 price. As such it could be trading at $5.0894 by 2026.

Solar (SXP) Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. Moreover, the build-up to the next Bitcoin halving in 2028 could evoke excitement in traders. As such we could expect SXP to trade at around $10.1000 by the end of 2027.

Solar (SXP) Price Prediction 2028

As the crypto community’s hope will be re-ignited looking forward to Bitcoin halving like many altcoins, SXP will continue to form new higher highs and is expected to move in an upward trajectory. Hence, SXP would be trading at $10.5700 after experiencing a massive surge by the end of 2028.

Solar (SXP) Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market would gradually become stable by this year. In tandem with the stable market sentiment and the slight price surge expected after the aftermath, SXP could be trading at $31.0200 by the end of 2029.

Solar (SXP) Price Prediction 2030

After witnessing a bullish run in the market, SXP and many altcoins would show signs of consolidation and might trade sideways and move downwards for some time while experiencing minor spikes. Therefore, by the end of 2030, SXp could be trading at $23.9100.

Solar (SXP) Price Prediction 2040

The long-term forecast for SXP indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point.

However, SXP may face a slight fall before starting its upward journey once again. It is expected that the average price of SXP could reach $56.1500 by 2040.

Solar (SXP) Price Prediction 2050

The community believes that there will be widespread adoption of cryptocurrencies, which could maintain gradual bullish gains. By the end of 2050, if the bullish momentum is maintained, SXP could hit $88.3904

FAQ

Built on the Solar Core, a Layer-1 Blockchain Framework, Solar is a decentralized blockchain using a Delegated Proof of Stake consensus model.

SXP can be traded on many exchanges like Binance, KuCoin, Bithumb, Bitstamp, Bittrex, Huobi, ProBit Global, Gate.io, and more.

SXP has a possibility of surpassing its present all-time high (ATH) price of $5.8562 in 2021.

SXP is one of the few cryptocurrencies that has retained its bullish momentum in the past seven days. If this momentum is maintained, SXP might reach $4 soon after its breaks Resistance 1 and 2 levels.

SXP has been one of the most suitable investments in the crypto space. It has been rising exponentially, hence, traders may be allured to invest in SXP.

SXP has a present all-time low price of $0.161.

Joselito Lizarondo and Nayiem Willems founded Solar Network.

SXP maximum supply is unavailable.

SXP was launched in 2018.

SXP can be stored in a cold wallet, hot wallet, or exchange wallet.

SXP is expected to reach $ 5.5783 by 2024.

SXP is expected to reach $10.6663 by 2025.

SXP is expected to reach $5.0894 by 2026.

SXP is expected to reach $10.100 by 2027.

SXP is expected to reach $10.5700 by 2028.

SXP is expected to reach $31.0200 by 2029.

SXP is expected to reach $23.9100 by 2030.

SXP is expected to reach $56.1500 by 2040.

SXP is expected to reach $88.39 by 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.