- 21Shares TOXR experienced $47.25 million in outflows on January 7, 2026.

- XRP experienced a coincident 7% price drop with the ETF outflow.

- Analysts believe the latest XRP pullback is temporary and predict higher price targets.

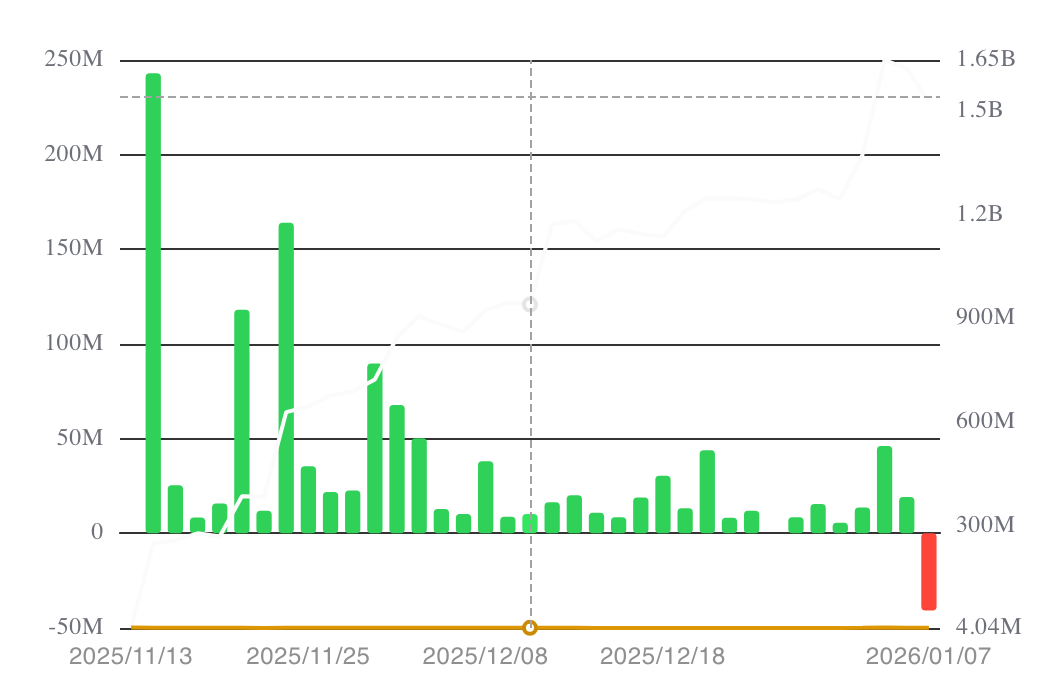

The XRP ETF experienced a $40.8 million net outflow on Wednesday, January 7, 2026, marking the first outflow of any product within the ecosystem since its launch. According to data from SoSoValue, the outflow occurred from the 21Shares TOXR, which saw $47.25 million leave its coffers. Hence, despite inflows from other XRP ETF products, the overall volume for the day remained significantly negative.

XRP Daily Inflows on SosoValue

How XRP ETFs Performed on the Initial Outflow Day

Besides 21Shares’ TOXR, which experienced a significant outflow, Canary Capital’s XEPC saw a $2.32 million inflow on January 7, Bitwise’s XRP attracted $2.44 million in volume, while investors injected $1.69 million into Grayscale’s GXRP on the same day.

In the meantime, the liquidity flows within the XRP ETF ecosystem reflect a dynamic market for the digital asset category. According to SoSoValue’s data, spot XRP ETFs have experienced a total net inflow of $1.2 billion since their launch, with a total traded value of $33.74 million, amid total net assets worth $1.53 billion.

Related Article: Why Wall Street Is Paying Attention to XRP? A Brief On Market Sentiments

Analysts Remain Bullish Despite XRP’s 7% Drop in One Day

It is worth noting that Wednesday’s XRP ETF outflow coincided with a notable selloff in the cryptocurrency, with TradingView’s data reflecting a 7% pullback in XRP’s price. The cryptocurrency broke below the 0.382 Fibonacci level on the daily chart, dropping from a daily high of $2.319 to $2.149. The pullback continued on Thursday morning, with XRP trading for $2.103 at the time of writing.

XRPUSD Daily Chart on TradingView

Despite the recent drop in XRP’s value, many crypto analysts believe in the cryptocurrency’s bullish outlook, with most predicting higher targets in the current phase of the XRP price development.

For instance, one analyst using pattern recognition from the Elliott Wave Theory and market psychology expects the cryptocurrency to reach at least $5 during the current cycle. According to him, XRP has the potential to achieve a much higher target of $20 under sustained bullish momentum in the cryptocurrency market.

Related Article: XRP Price Prediction: Buyers Defend $2.2 As Derivatives Reset After Sharp Bounce

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.