- SPX6900 faces persistent resistance as sellers cap rebounds near key Fibonacci zones.

- Weakening support and negative flows heighten risk of deeper decline toward demand areas.

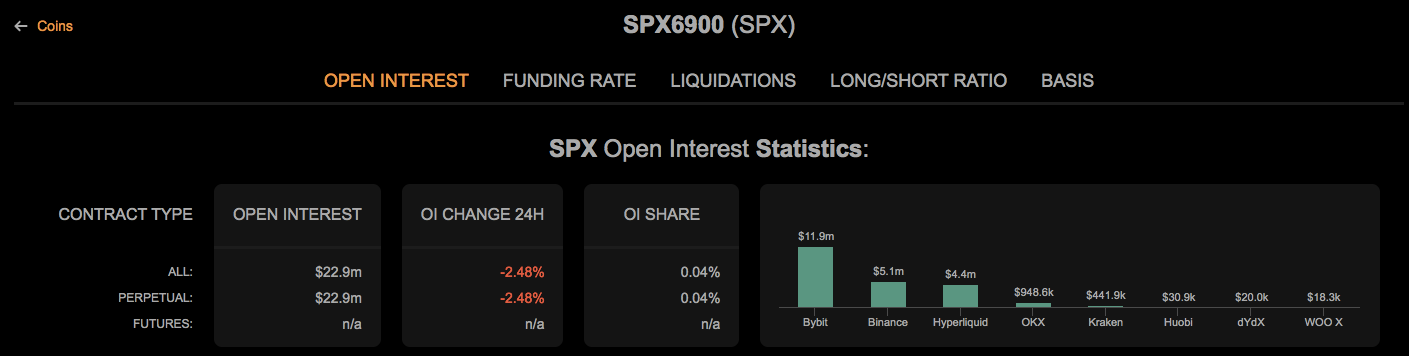

- Falling open interest shows traders reducing exposure while waiting for clearer direction.

SPX6900 continues to face pressure as sellers maintain control across the short- and mid-term structure. Recent trading shows a strong rejection near key Fibonacci levels, which limits upside attempts. Price action still respects a clear pattern of lower highs and lower lows.

Resistance Zones Continue to Cap Recovery Attempts

SPX6900 trades below major retracement zones, which restricts any sustainable rebound attempt. The region between $0.70 and $0.724 remains the first major ceiling.

The Supertrend also flashed a fresh sell signal near that area, which reinforces the resistance. A decisive move above $0.724 would signal structure improvement. However, price still struggles to secure traction near the 0.382 retracement.

Additionally, the 0.5 level at $0.8149 marks a mid-range barrier. Bulls would need a clean push above that point to shift momentum. The 0.618 level at $0.9041 marks the broader trend threshold. A break above that zone would confirm a stronger recovery phase. Until then, upside remains limited and vulnerable to renewed rejection.

Support Levels Face Pressure as Momentum Weakens

SPX6900 now hovers around local support near $0.618. The level aligns with short-term structure and the EMA zone. Losing that area could open a path toward the 0.236 retracement around $0.552. Consequently, sellers could target the wider demand region near $0.4367 if pressure increases.

Moreover, the token failed to hold above the mid-range Donchian and Keltner baselines. That failure increases the risk of a deeper pullback. The recent rally also faded below the upper volatility bands, which shows hesitation from buyers. The Chaikin Money Flow remains negative at –0.25 and confirms ongoing outflows. Hence, buyers need stronger volume to regain control.

Open Interest Declines as Traders Reduce Exposure

Market data shows SPX6900 open interest at $22.9 million, drawn entirely from perpetual markets. Bybit holds the largest share at $11.9 million. Binance follows with $5.1 million and Hyperliquid with $4.4 million. Other venues hold smaller amounts, which keeps overall leverage participation low.

Open interest also dropped 2.48% in the past day. The decline suggests reduced confidence during the recent slowdown. Significantly, the OI share across platforms remains near 0.04%, which reflects cautious positioning as traders wait for direction.

Related: SPX6900 Leads Meme Coin Slump as Sector Market Cap Falls to $54.8 Billion

Technical Outlook for SPX6900 Price

Key levels for SPX6900 remain clear as traders enter a decisive period in the current market cycle.

Upside levels cluster between $0.70, $0.724, and $0.8149, forming the immediate hurdles. A breakout above these zones could extend toward $0.9041, where the 0.618 Fibonacci band creates a major inflection point.

Downside levels include the local $0.618 structure, followed by $0.552 at the 0.236 retracement, and finally the broader $0.4367 demand zone, which anchors the cycle low.

The technical picture shows SPX6900 compressing inside a broader descending structure, with price stuck below the mid-range volatility bands. This compression often precedes sharp expansion in either direction. Traders now watch the $0.724 level, which aligns with the 0.382 Fibonacci line, as the first meaningful signal of structural change.

Related: SPX6900 (SPX) Price Prediction 2025-2030: Will SPX Price Hit $5 Soon?

Will SPX6900 Break Out Soon?

The next directional move depends on whether buyers can defend the $0.618 support cluster long enough to build upward pressure. Holding this region would keep SPX positioned to challenge the $0.70–$0.724 resistance window, the most important short-term test. A close above that band improves the probability of reaching $0.8149 and eventually $0.9041, where a medium-term trend shift becomes possible.

However, weakening momentum and persistent sell signals warn that downside risks still matter. Losing $0.618 exposes the price to $0.552, and a heavier breakdown increases the likelihood of retesting $0.4367, the key accumulation base. That zone remains crucial for long-term stability.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.