- ECB warns stablecoin growth could threaten financial stability if expansion continues unchecked.

- USDT and USDC dominate the market; euro-denominated stablecoins remain marginal.

- Links to traditional finance and regulatory gaps raise risks for banks and global markets.

A new European Central Bank (ECB) analysis warns that stablecoins remain relatively small in the euro area. However, their rapid global expansion and deepening links with traditional finance could create meaningful spillover risks if growth continues unchecked.

Stablecoin Market Hits Record Levels

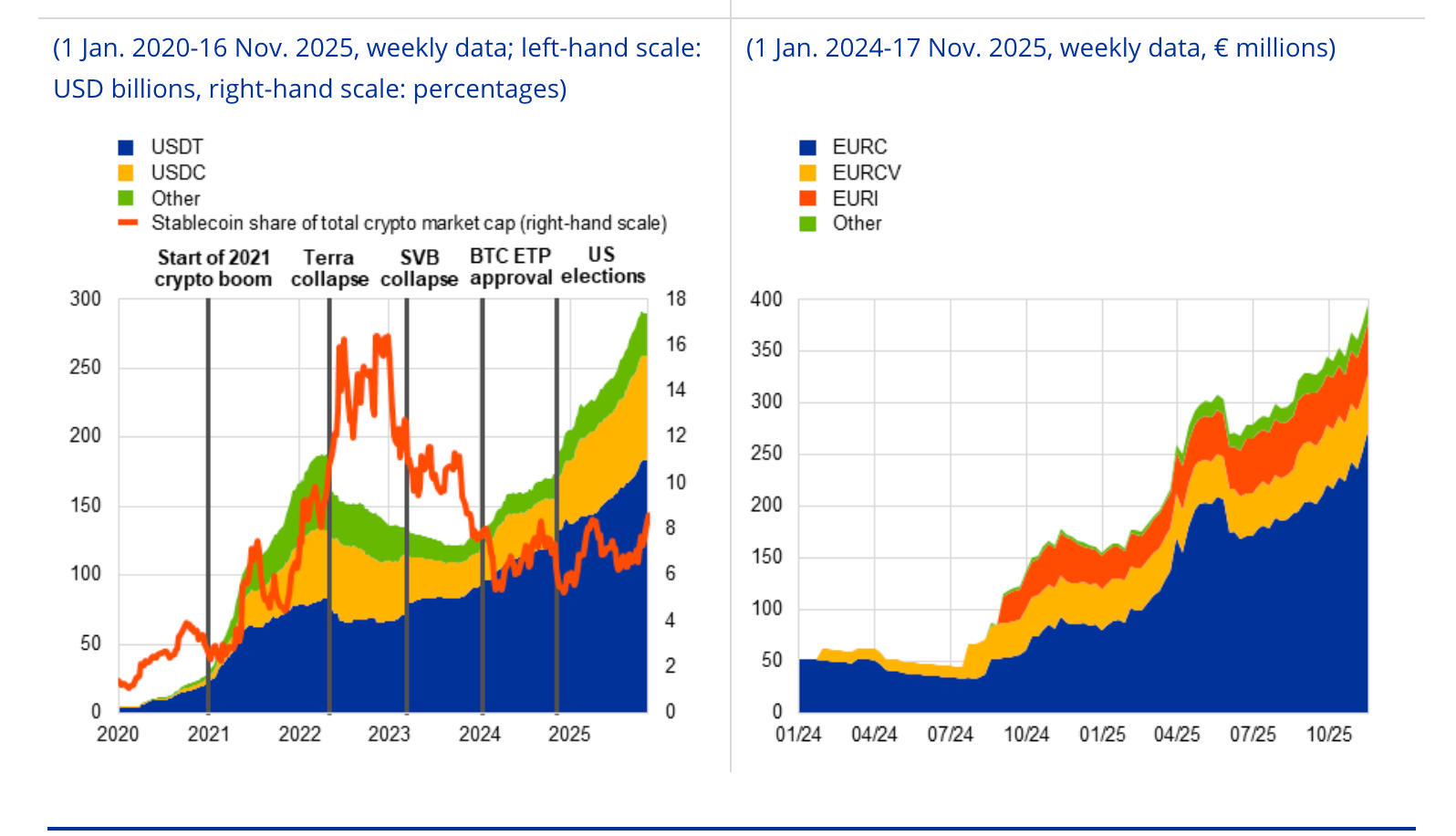

According to the ECB, the total stablecoin market has surged past $280 billion, reaching a fresh all-time high and now representing roughly 8% of the entire crypto market. Two US-dollar stablecoins, Tether (USDT) and USD Coin (USDC), overwhelmingly dominate the space, accounting for nearly 90% of supply.

Euro-denominated stablecoins remain marginal, with just €395 million in circulation, despite the EU’s full rollout of the MiCA (MiCAR) regulatory framework.

The ECB suggests that clearer global regulations including the US GENIUS Act and new rules from regions like Hong Kong have contributed to the recent acceleration in stablecoin demand.

Crypto Trading Still the Core Use Case

The ECB observes that stablecoins are still primarily used within the crypto ecosystem rather than in mainstream payments. Around 80% of all trades on centralised exchanges involve stablecoins.

More than 70% of stablecoin flows cross regions, but there is little evidence that they are widely used for remittances. Less than 1% of stablecoin activity appears to come from retail-level transfers. The ECB concludes that stablecoins remain “internal plumbing” for crypto trading rather than broad financial tools.

Growing Links to Traditional Finance Raise Risk Concerns

Furthermore, the central bank highlights the increasing overlap between stablecoins and traditional markets, especially US Treasuries, as a potential channel for spillovers.

USDT and USDC issuers are now among the largest holders of short-term US Treasury bills, comparable in size to large money market funds. The ECB notes that a sudden run on a major stablecoin could trigger rapid asset sales, straining Treasury market liquidity.

With projections suggesting stablecoins could reach $2 trillion by 2028, concentration risk is a major concern as just two issuers currently control about 90% of the market.

Impact on Bank Deposits

Although EU rules (MiCA) prevent stablecoin issuers from paying interest, making them less attractive, banks could still face pressure if many depositors switch. The ECB warns that stablecoin-related funding is more unpredictable, and a sudden rush to withdraw could strain bank liquidity.

Regulatory Loopholes Are the Main Concern

Even with strict EU rules, the ECB sees cross-border loopholes as the biggest risk. Differences in rules worldwide, like reserve requirements or redemption processes, could let issuers operate in ways that weaken investor protections.

Ultimately, stablecoins are not yet widely used in euro transactions, and their link to euro markets is small. But if they grow quickly, risks could rise. The ECB highlights the need for coordinated global regulation and support for the G20 crypto roadmap to prevent loopholes and limit risks from less-regulated regions.

Related: ECB Stablecoin Warning Raises Risk Of Sudden Eurozone Interest Rate Shift

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.