- ERC-20 stablecoin inflows topped $640M on a 7-day MA, with Binance taking $566M, its third-largest intake.

- Ethereum spot demand followed, with 5,355 ETH leaving Binance over Nov. 5 to 7, a classic accumulation signature.

- Bitcoin open interest slipped from $11B to $10.8B, showing traders are rotating from leveraged trades to spot flows.

Fresh data from CryptoQuant showed ERC-20 stablecoin net inflows to exchanges climbed above $640 million on a seven-day moving average.

Binance absorbed about $566 million of that total, nearly 90% of the liquidity, marking the exchange’s third-largest stablecoin intake on record. The move came after October’s choppy deposit pattern, when net inflows swung from roughly $300 million to near zero. By early November, deposits pushed back over $600 million, signalling that “dry powder” was returning to the market and landing mostly on one venue.

Related: Crypto Traders Flood Exchanges with $1 Billion in Stablecoins

Ethereum Spot Demand Picks Up

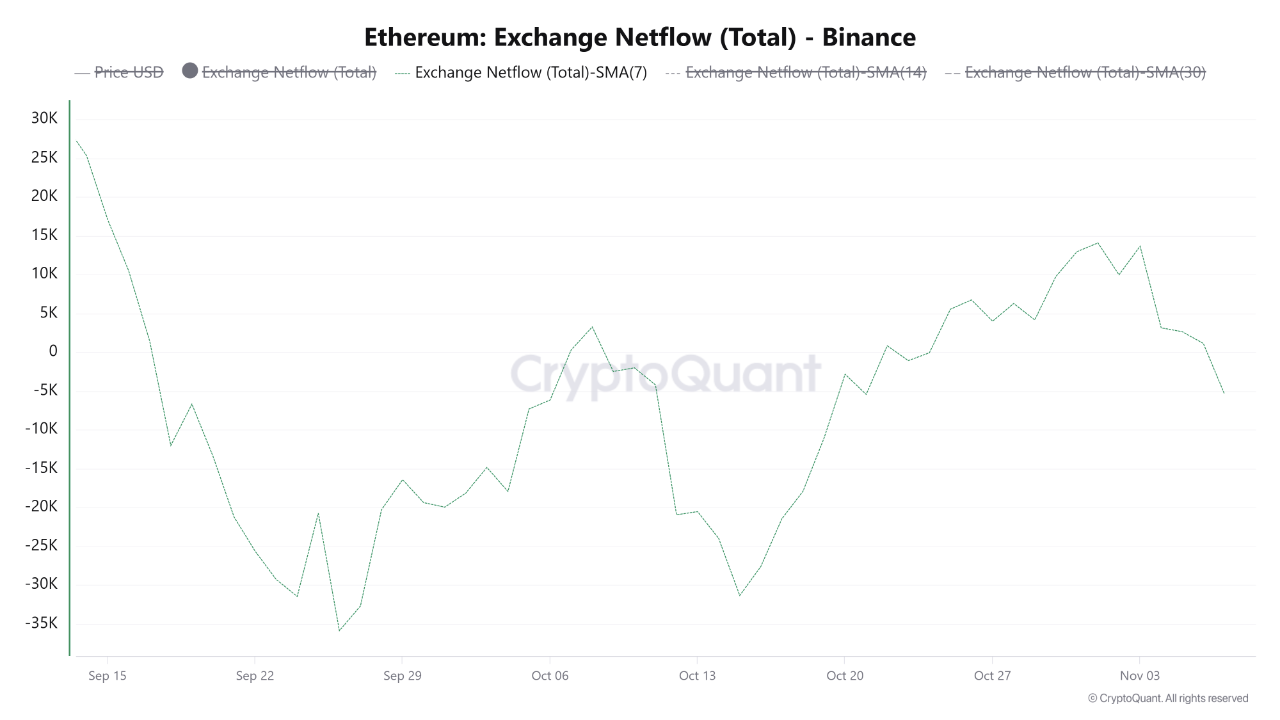

The inflow surge corresponded with increased Ethereum buying on Binance. Between November 5 and November 7, the exchange recorded a seven-day average outflow of 5,355 ETH, a trend commonly viewed as a sign of spot purchases followed by withdrawals to self-custody. This pattern coincided with earlier inflows of stablecoins, suggesting that much of the liquidity entering Binance was deployed toward accumulating Ethereum rather than trading derivatives.

On the broader series, Binance’s ETH netflows peaked above 25,000 ETH in mid-September, flipped negative below 35,000 ETH by month-end, then turned positive again in October before easing in early November. The pattern suggests traders used returning stablecoins to top up ETH holdings, not to chase derivatives.

Bitcoin Derivatives Lose Momentum

While Ethereum was seeing spot-led withdrawals, Bitcoin activity was quieter. BTC net inflows to Binance topped out near 2,760 BTC on November 4 but later fell in step with a decline in derivatives open interest, which slipped from about $11 billion to $10.8 billion. The drop shows traders were trimming leverage even as new capital arrived, an unusual but healthy profile for exchanges when markets are resetting.

Market Leans Back To Spot-Led Structure

Taken together, the early-November spike in stablecoin deposits, the specific use of that liquidity for ETH accumulation and the cooling in Bitcoin open interest point to a short phase where spot orders set direction again.

If stablecoin inflows continue to concentrate on Binance, the exchange will stay in control of near-term flows into large-cap assets, with Ethereum the first beneficiary.

Related: Binance Regains 2024-Level Stablecoin Liquidity With $7.3B Inflows

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.