- Solana’s price tests key resistance at $196.89, determining short-term movement.

- SOL outperforms Bitcoin and Ethereum in recent price growth and volatility.

- Successful breakout above $198 could push SOL toward $205-$210 resistance.

Solana (SOL) has emerged as a strong contender in the cryptocurrency market, building traction due to its high-speed transactions and growing ecosystem. As staking and decentralized finance (DeFi) adoption expand, investors are watching whether these factors will push SOL’s price higher.

Recent price movements suggest an ongoing recovery, but resistance levels could determine the next trend. Meanwhile, Solana’s performance compared to Bitcoin (BTC) and Ethereum (ETH) raises questions about its long-term competitiveness.

SOL Price Recovers – Key Resistance Zones in Focus

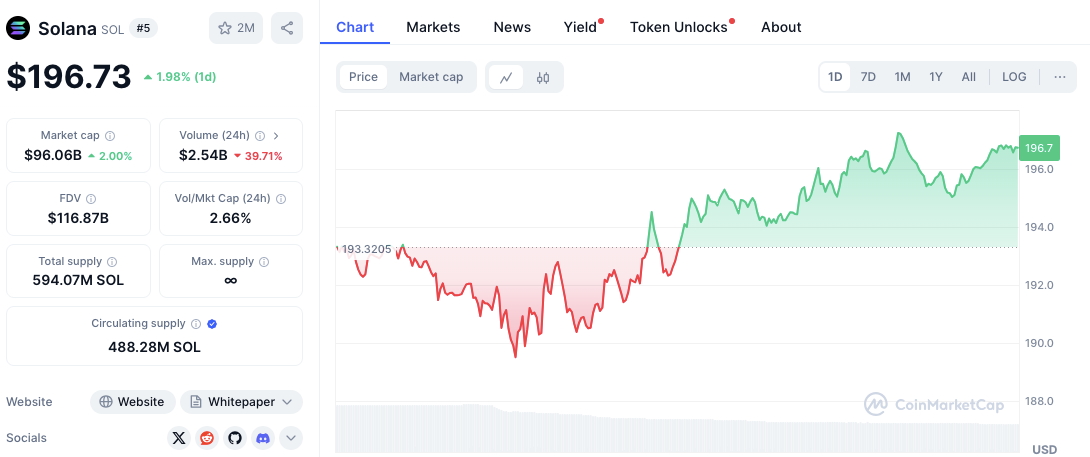

Solana’s price recently dipped to the $188-$190 range before reversing into an upward trajectory. The rebound led the price past $194, signaling renewed buying interest. Currently, SOL is testing a resistance level around $196.89, a zone that could influence short-term movement.

The broader market conditions and investor sentiment will be key in determining if SOL sustains its gains. A successful breakout above $198-$200 could fuel further upward momentum, potentially targeting $205-$210. On the other hand, if the price faces rejection at the resistance zone, a pullback toward $192-$193 may occur before another rally attempt.

Critical Support and Resistance – Price Points for Traders

SOL’s recent price movement highlights crucial support and resistance zones. The $188-$190 range represents a significant support level where the price previously rebounded. Additionally, the $192-$193 area acts as minor support, offering stability before the latest uptrend.

On the resistance side, SOL is testing the $196-$198 range. A breakout above this level could open the door for a push toward $200, a psychological resistance zone where selling pressure may increase. If SOL clears this hurdle, further gains toward $205-$210 become more likely.

Solana vs. Bitcoin – Performance Metrics Compared

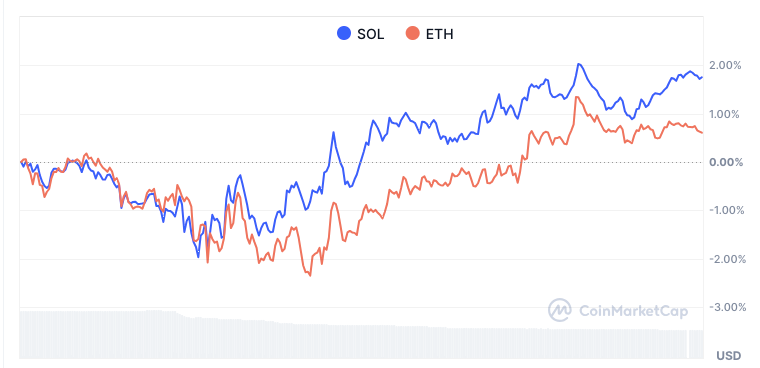

Solana’s volatility remains higher than BTC, yet it has outperformed the leading cryptocurrency in percentage gains. While BTC maintains a steadier increase, SOL’s price swings contribute to stronger overall growth. Over a specific period, SOL surged close to 2.00%, while BTC remained near 1.00%.

Solana vs. Ethereum – Performance Metrics Compared

Comparisons with Ethereum show that SOL has demonstrated stronger upward momentum. Both assets started with similar fluctuations, but SOL eventually outpaced ETH in percentage gains. While ETH maintained a positive trend, its growth lagged behind SOL’s rapid ascent. In this comparison, Solana’s superior performance is evident.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.