- Binance and its CEO and co-founder Changpeng Zhao approached the court on Thursday to dismiss the SEC lawsuit against them.

- The two parties accused the Wall Street regulator of retroactively enforcing laws.

- BinanceUS also filed a similar petition against the SEC, asking the court to dismiss the SEC’s actions against it.

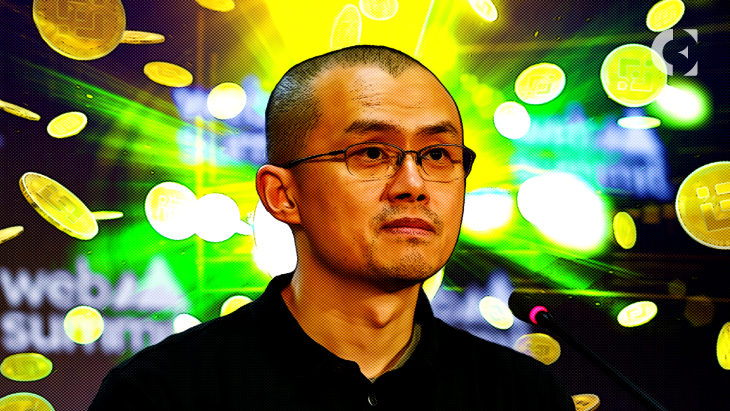

Crypto exchange Binance Holdings Limited and CEO and co-founder Changpeng Zhao approached the court on Thursday to dismiss the U.S Securities and Exchange Commission (SEC) lawsuit against them, a Bloomberg report reveals.

The 60-page petition filed by Binance and Zhao accused the SEC of acting beyond its authority against the two. Likewise, the filing also detailed other recent actions of the SEC, which they now ask the court to dismiss.

Furthermore, the filing accused the regulator of retroactively enforcing its rules against the two parties. As claimed by Binance and Changpeng, the SEC is imposing penalties on actions it didn’t provide public guidance in the past.

Lawyers to Binance and Zhao also accused the SEC of intentionally blurring the texts of the securities law. They claim the Wall Street regulator did this to claim power over the crypto industry.

Furthermore, Binance.US, separately filed a petition against the SEC, which also made similar allegations. Like Binance Holdings and Zhao, the company is also asking the court to dismiss the SEC lawsuit against it.

This recent move comes on the heels of an ongoing regulatory onslaught against Binance.US, Binance Holdings, and Zhao. Since the start of the year, the crypto exchange and its key executive have seen several allegations leveled against it by regulators.

In particular, the SEC has accused the exchange of mishandling customer funds, misleading investors and investors, and offering unregistered securities. However, the company and Zhao have denied all accusations.

Recently, the SEC saw its request for an inspection order dismissed by the court. Before that, the regulator had accused BinanceUS of being uncooperative in the ongoing investigation.

Amidst plummeting market performance, the crypto exchange giant has seen its market share take a significant hit. Likewise, there is also a widespread FUD against the company, further worsened by recent layoffs and key executives’ exits.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.