- SUI Group amasses 101M tokens worth $344M, fueling speculation of institutional demand.

- Key support at $3.27 and resistance at $3.41 define SUI’s short-term trading outlook.

- Mixed indicators show mild bearish momentum but RSI hints at potential rebound zone.

Nasdaq-listed SUI Group Holdings is making bold moves in the digital asset space, and investors are closely watching. The firm, formerly Mill City Ventures, has transitioned from a small-scale lender into a major player in blockchain.

With a growing stake in Sui (SUI) tokens, the company now holds more than 101 million SUI worth roughly $344 million. This aggressive accumulation raises questions about whether its strategy could ignite the next rally in SUI’s price.

Strategic Token Acquisitions

The SUI Group secured an agreement with the Sui Foundation that allows it to purchase locked tokens at a discount. This arrangement provides the firm with a competitive advantage compared to retail investors.

Besides its existing holdings, the company still has approximately $58 million in cash reserved for future acquisitions. Such liquidity suggests its buying campaign is far from over.

Related: Sui Price Prediction: SUI Holds $3.30 as Traders Debate Channel Breakdown or Reversal

The firm also cemented its position as the official SUI treasury following a $450 million private placement. This move signals a long-term commitment to building influence within the Sui ecosystem. Consequently, the company’s aggressive approach has fueled speculation that institutional demand might strengthen SUI’s market position.

Price Levels to Watch

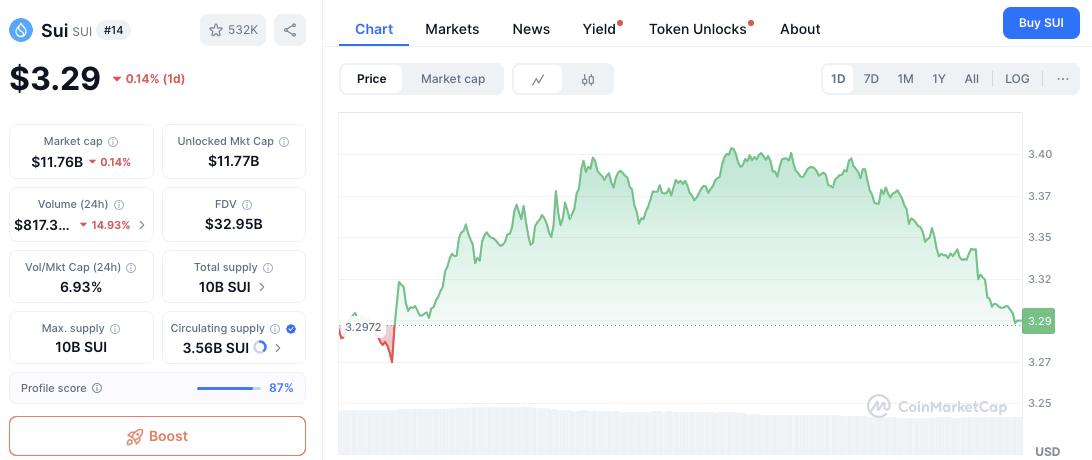

At the time of writing, SUI trades around $3.29, showing a slight daily decline of 0.03%. The token has established short-term support at $3.27, which remains critical to hold.

If this level breaks, the next downside target stands at $3.20. On the upside, immediate resistance lies at $3.35, while $3.41 forms the stronger ceiling to overcome.

The trading session saw a failed attempt to sustain momentum beyond $3.41, resulting in a lower high formation. This pattern points toward consolidation as volume fell by more than 15%. Hence, SUI could remain range-bound until fresh catalysts emerge.

Market Indicators Signal Uncertainty

Technical indicators highlight mixed signals. The MACD is slightly negative, suggesting mild bearish momentum. However, the RSI near 43 hints that SUI is approaching oversold conditions. This could leave room for a short-term rebound if buyers defend key support levels.

Related: SUI Tests Its Make-or-Break $3.15 Support; Breakout Being Next

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.