- Sui (SUI) is trading in a descending triangle, a classic pattern that signals a major breakout is near

- The key support level to watch is $3.15–$3.20; a hold here could lead to a rally toward $5.00 and $10.00

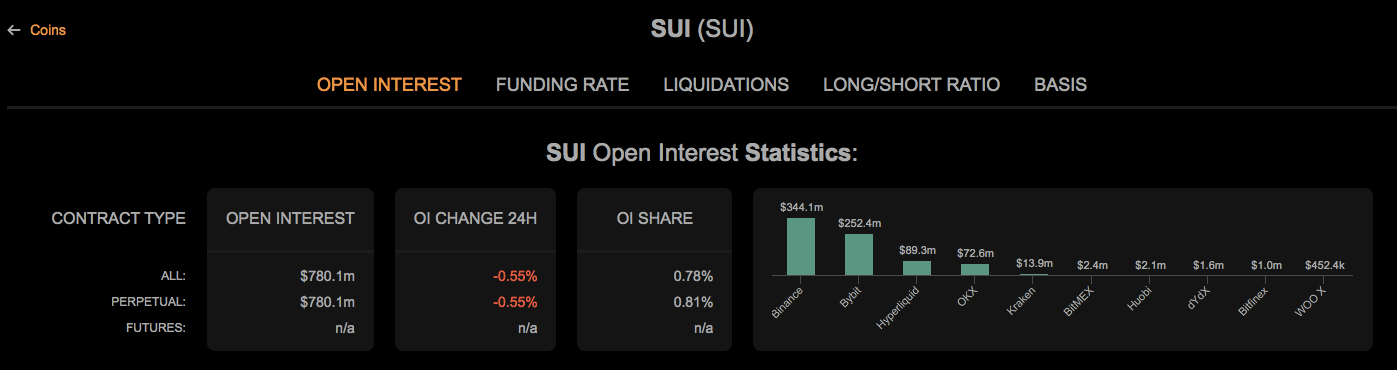

- Over $780 million in open interest is positioned on exchanges, ready for the next major move

Sui (SUI) is trading in a tight consolidation pattern that is getting ready to resolve, and analysts say the next move could be explosive.

The token is repeatedly testing a critical support floor around $3.15–$3.20. A successful defense of this level could set the stage for a nearly 3x rally toward a $10 price target. To refresh, the token currently trades near $3.30, reflecting a slight 24-hour drop of 0.57% and a sharper 7-day loss of 6.66%.

Even with these setbacks, the project still commands a market capitalization of nearly $11.8 billion, supported by a circulating supply of 3.6 billion tokens. Analysts argue that this consolidation phase could set the stage for the “next leg” upward, provided key technical levels hold firm.

The Technical Setup: A Descending Triangle Nears Its Apex

The entire story for SUI right now can be seen in one chart pattern: a descending triangle that has been forming for weeks. This is a classic setup for a major volatility event.

What is the key support level to watch?

According to analyst Altcoin Gordon, the make-or-break level for SUI is the support zone between $3.15 and $3.20. The price has tested this floor multiple times, suggesting strong accumulation from buyers. A failure to defend this level on the next test, however, would open the door to a much deeper correction.

What are the breakout price targets?

If bulls can hold the support and break out above the descending trendline, the first interim target is $5.00. A sustained rally could push the price toward the much larger, longer-term goal of $10.00.

Related: Sui Price Prediction: SUI Holds $3.30 as Traders Debate Channel Breakdown or Reversal

What Are the Indicators and Open Interest Saying?

The momentum indicators are showing a market in perfect balance, waiting for a catalyst to force a move.

Do the indicators confirm a direction?

The MACD line sits just below the signal line, showing mild bearish pressure. However, the histogram remains close to neutral, indicating no strong selling wave.

The RSI reading near 43 also reflects a neutral-to-bearish stance, but it is not yet oversold. This leaves room for a potential bounce if buyers regain control. Hence, the market seems to be at a balance point where the next move could shift sentiment quickly.

Where is the money being bet?

The derivatives market shows healthy participation. Total open interest in SUI stands at $780 million, dominated by positions on Binance ($344M) and Bybit ($252M).

Other notable contributions include Hyperliquid at $89.3 million and OKX at $72.6 million. The relatively broad distribution suggests healthy participation, although open interest has dipped by 0.55% over the last day.

This indicates that a large number of speculative traders are positioned to capitalize on the next major move, whichever way it breaks. The recent news of Sui launching an AI Coding Assistant with Alibaba Cloud could be the kind of fundamental catalyst the bulls are looking for.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.