- SUI price today trades near $1.78, struggling after repeated rejections from the descending trendline and key EMAs.

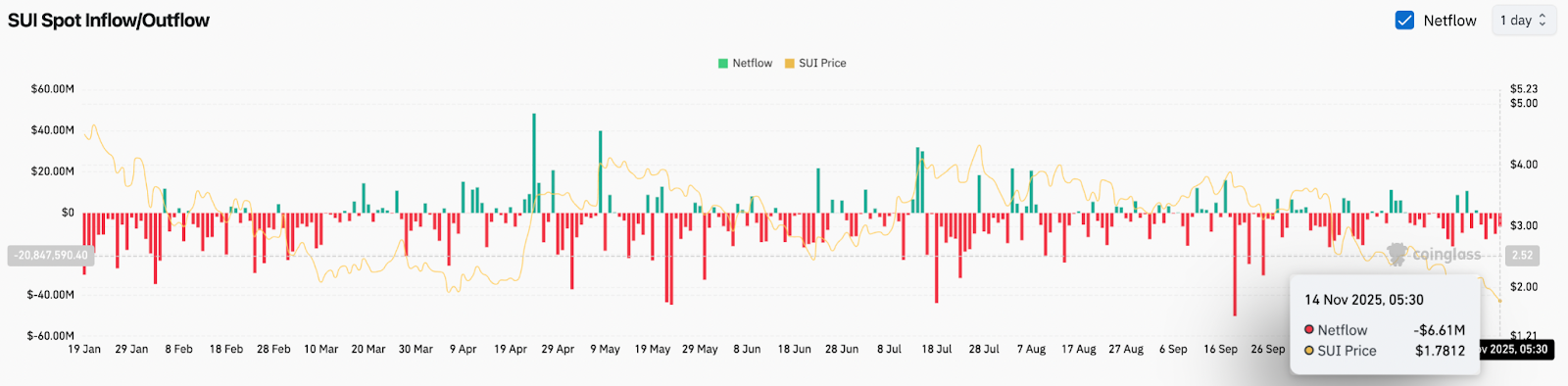

- Coinglass data shows $6.61M in outflows, extending months of distribution as traders continue reducing exposure.

- Losing $1.65 support could open the path toward $1.50, while a recovery above $2.00 is needed to confirm stabilization.

SUI price today trades near $1.78, sitting at its lowest level in weeks after a sharp drop through intraday support. The decline follows persistent negative spot flows and another rejection from the descending trendline on the daily chart.

Spot Outflows Spike As Liquidity Leaves The Market

Coinglass data shows $6.61 million in net outflows on November 14, extending a long run of negative sessions. Outflows have dominated since late September, and the scale of recent withdrawals reflects decisive risk reduction from traders.

SUI has not recorded sustained positive flow pressure in months. The repeated red prints show that market participants are sending tokens to exchanges rather than accumulating.

Daily Chart Shows Deepening Downtrend

The daily structure continues to deteriorate after SUI broke below the rising support zone from earlier this year. The token now trades under all major EMAs:

- 20 EMA at $2.17

- 50 EMA at $2.55

- 100 EMA at $2.87

- 200 EMA at $3.04

This alignment forms a powerful resistance wall. Every bounce over the past two weeks has been rejected at the 20 or 50 EMA, showing that sellers are defending the downtrend with consistency.

The descending trendline from April remains intact. SUI attempted to test it earlier this month but was pushed lower before reaching the upper boundary. The Supertrend indicator turned bearish several sessions ago and has not flipped since, confirming the directional pressure.

Price is now testing the strong demand zone between $1.75 and $1.65, a region that held twice earlier in the year. A close below this band would be significant and expose deeper levels toward $1.50.

Short Term Charts Highlight Heavy Pressure

The 30 minute chart shows an uninterrupted decline from the $2.05 rejection area. Price has moved below the VWAP band, and each attempt to retest the mid line around $1.82 to $1.85 has failed. This signals ongoing control from sellers in the intraday timeframe.

The Parabolic SAR remains above price, reinforcing the downward momentum. Until the SAR flips and SUI closes above the VWAP mid line, traders will continue to treat every bounce as corrective.

The next intraday pivot is $1.85. A break above this level would mark the first hint of stabilization, but it would not shift the broader trend unless followed by a close above $2.00.

Outlook: Will SUI Go Up?

For now, SUI remains under broad selling pressure as outflows increase and price sits under a full EMA ceiling. Bulls need to reclaim control of short term structure before attempting a larger reversal.

- Bullish case: A move above $1.85 followed by a close above $2.00 would show stabilization. Strong confirmation arrives only if SUI breaks through the 20 and 50 EMAs between $2.17 and $2.55, opening the door to $2.80.

- Bearish case: A close below $1.65 would signal a deeper breakdown and expose the next support near $1.50, with extended downside toward $1.32 if flows remain negative.

Until price reclaims $2.00, sellers retain control and the downtrend stays intact.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.