- A new Sygnum Bank report finds 61% of institutional investors plan to increase their crypto holdings by the end of 2025.

- This demand is driven by regulatory clarity, with 80% of respondents agreeing the climate has improved in the last year.

- This institutional interest is diversifying beyond Bitcoin and Ethereum, with 69% of investors willing to invest in Layer-1 altcoins.

Institutional investors are preparing to deploy significant capital into crypto assets through the end of 2025, according to a new report from Sygnum Bank. The report, which surveyed over 1,000 professional investors across 43 countries, found that 61% plan to increase their crypto holdings.

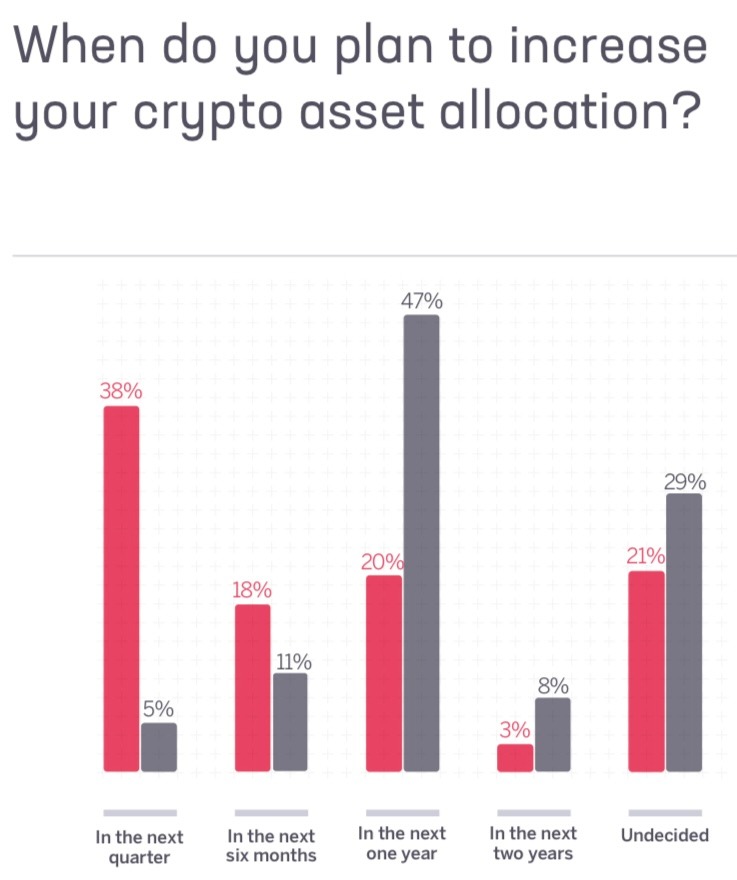

This demand is imminent. The Sygnum report noted that 38% of respondents aim to add crypto assets to their portfolios by the end of this quarter. This builds on an already high participation rate, with 89% of respondents stating they already hold crypto.

This institutional shift is driven by a strong conviction in the asset class. The report revealed 91% of high-net-worth investors now see crypto as important for wealth preservation, with the overall risk appetite of respondents increasing from 64% to 71% year-to-date.

Why Are Institutional Investors Seeking Crypto Assets?

Regulatory Clarity and Diversification Drive New Demand

The mainstream adoption of digital assets by institutional investors is heavily influenced by the clear regulatory frameworks in major jurisdictions. Notably, the United States has led in the implementation of clear crypto regulations through its GENIUS Act and soon the Clarity Act.

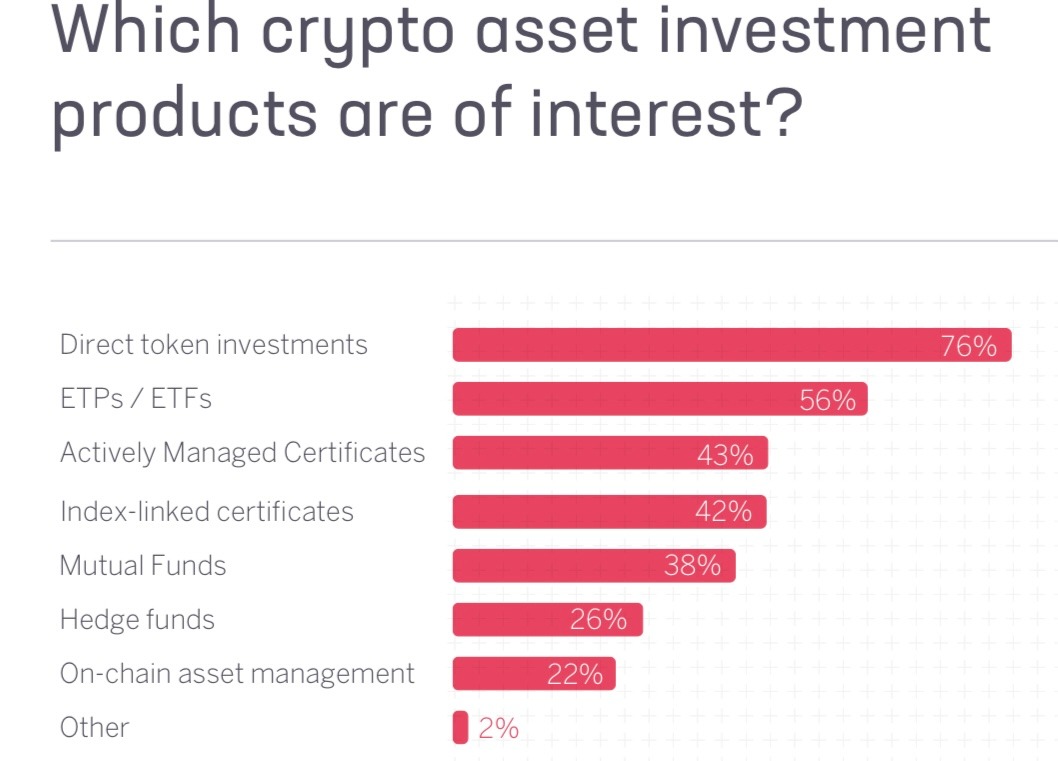

Moreover, 80% of the respondents believe that regulatory clarity has improved over the past year. As such, around 76% of the respondents are seeking direct investment into crypto assets, whereby 56% of the respondents are seeking to purchase crypto exchange-traded funds (ETFs).

Related: Will Donald Trump’s Tariff Policies Impact Global Cryptocurrency Market Sentiment?

Interest Beyond Bitcoin and Ethereum: Crypto Investors have benefited from more diversification

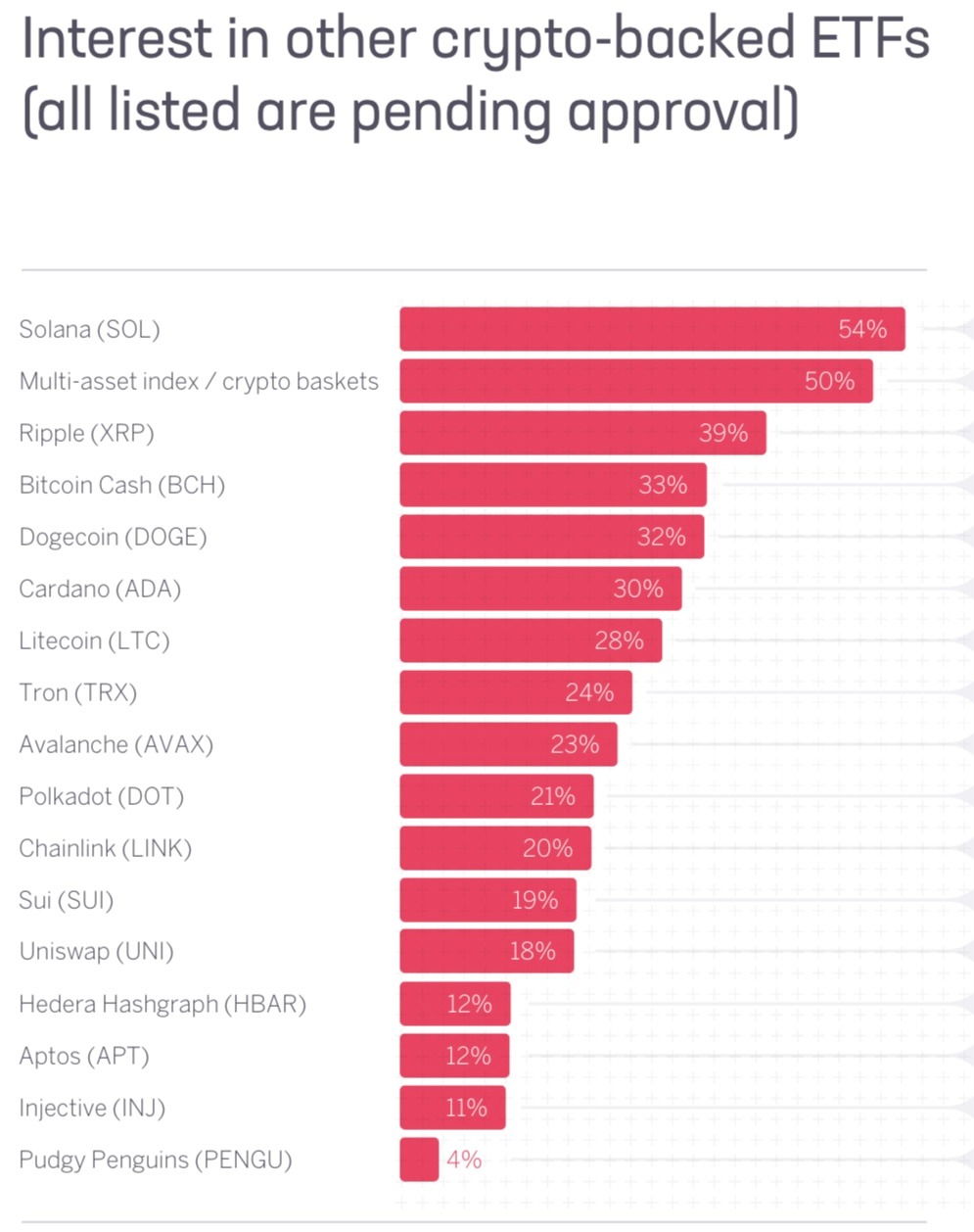

According to the Sygnum bank, 81% of the respondents are open to investing in other crypto assets apart from Bitcoin (BTC) and Ethereum (ETH). Around 69% of the respondents are willing to invest in layer one (L1) crypto assets such as Solana (SOL), Cardano (ADA), and Avalanche (AVAX).

Other notable sectors that institutional investors are willing to pay attention to include Layer Two (L2), AI-tokens, DeFi tokens, and Web3 infrastructure. The interest in other crypto assets is heavily influenced by the ongoing listings of spot altcoin exchange-traded funds (ETFs)

What’s the Expected Market Impact?

The wider crypto market has suffered low capital inflow in the past few weeks. The impact of the longest U.S. government shutdown was a notable liquidity crunch, which will likely be solved by the renewed interest from institutional investors.

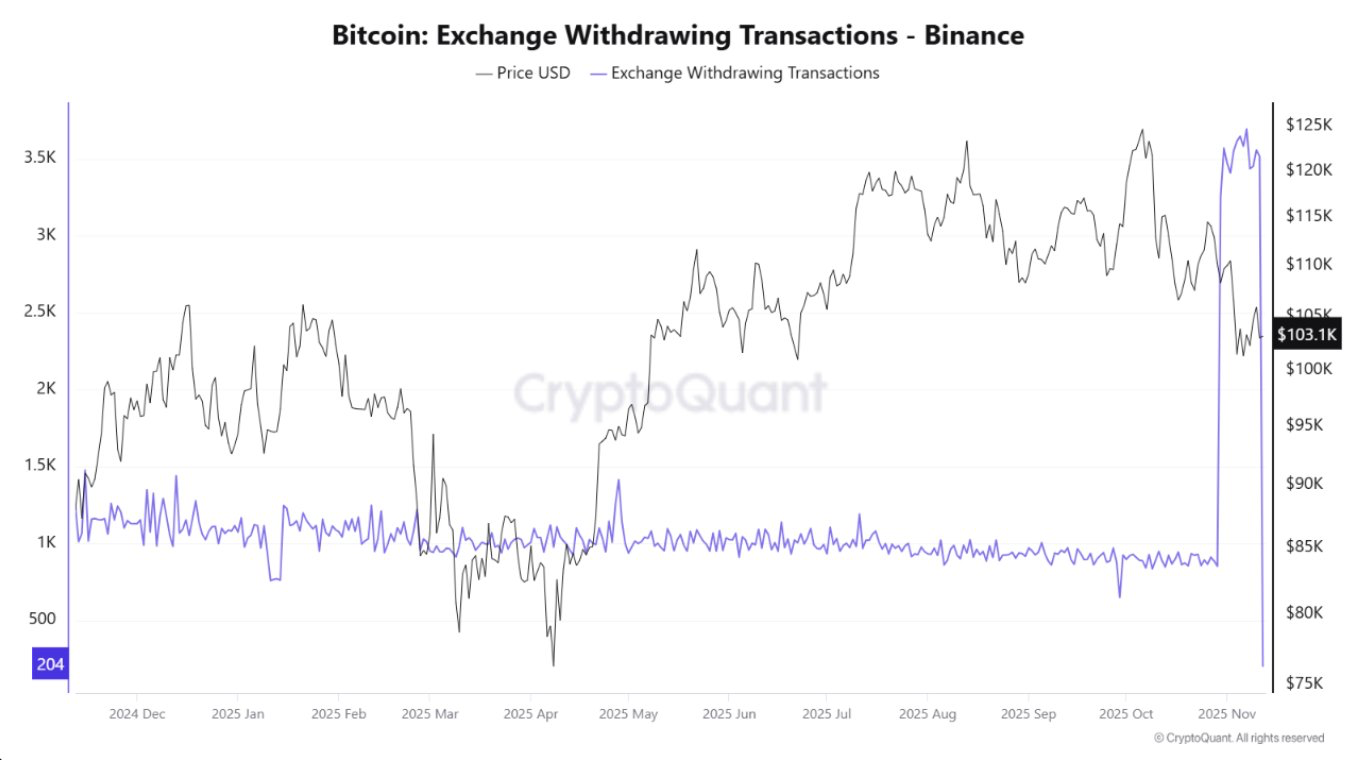

Already, on-chain data analysis from CryptoQuant shows that the number of transactions withdrawing assets from Binance has experienced a sharp uptick. The rising demand for crypto assets will likely trigger a bullish outlook in the coming weeks.

Moreover, the global liquidity is about to surge heavily influenced by the onset of the Federal Reserve’s Quantitative Easing (QE) early next month.

Related: Institutional Investors Claim 3.2% of Ethereum’s Total Supply in Two Months

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.