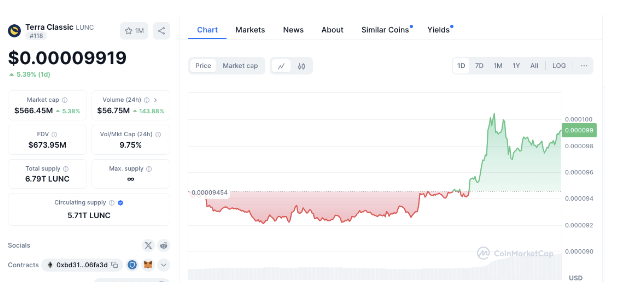

- LUNC’s trading volume surge signals heightened market participation and volatility.

- Key support at $0.000094 for LUNC may bolster price if volume momentum slows.

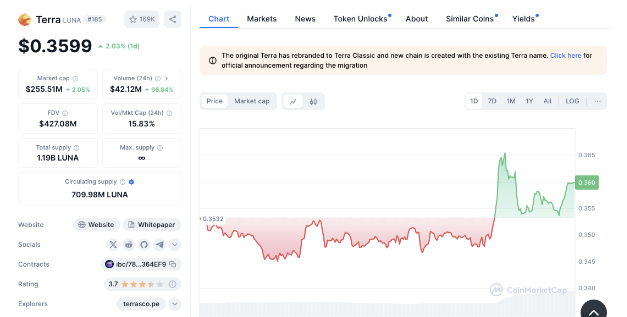

- LUNA’s resistance at $0.360 could break if trading volume remains robust.

Terra Labs faces an intense legal battle with the U.S. SEC, sparking significant interest in Terra Classic (LUNC) and Terra (LUNA) prices. Investors are watching price movements and recent trends closely given the renewed legal scrutiny.

Besides regulatory concerns, both LUNC and LUNA have shown notable shifts in trading activity, suggesting heightened market interest. Price trends, key support and resistance levels, and technical indicators offer insights into potential future moves for both assets.

LUNC Price Momentum and Trading Volume Surge

LUNC has recently shown an upward trajectory, rising 4.43% over the past day to 0.0000919. This increase comes after a period of consolidation, suggesting that investor interest is growing again.

The trading volume has surged 140.46%, indicating stronger market participation. These increases in trading volume often signal a boost in buying or selling pressure, which can increase volatility.

Key levels for LUNC include support at $0.000094, which held steady during recent consolidations. Additionally, $0.000092 acted as a safety net in previous downward trends, preventing sharper declines.

On the resistance side, $0.000098 is a critical barrier that LUNC is working to breach. If successful, the next psychological resistance is at $0.00010, a threshold that often sees increased market activity.

If the trading volume stays high, LUNC may attempt to break the $0.00010 resistance. However, if the volume falls, a retest of support levels could follow. High trading volume relative to market cap, which is 9.75% for LUNC, highlights the asset’s volatile nature, showing strong buyer or seller confidence.

LUNA Price Action and Potential Resistance

Over the last 24 hours, Terra (LUNA) saw a price increase of 1.78%, with the value currently around $0.3596. This follows a consolidation phase, hinting at renewed momentum.

Trading volume for LUNA has also risen sharply, up by 93.03%, which could signal intensified trading interest. Such volume spikes typically indicate a potential trend shift, as rising volume can often precede upward or downward price swings.

Key support for LUNA includes $0.3532, which helped stabilize prices during recent declines. A more substantial support level at $0.345 has historically prevented further downward movement.

Conversely, $0.360 currently acts as a resistance point. A breakthrough here could open the path to $0.365, a level marking the recent high. If trading volume remains robust, LUNA may challenge this upper resistance. However, a volume drop could see prices revert toward the support at $0.3532.

Technical Indicators and Implications for LUNC and LUNA

LUNC’s current trading volume-to-market cap ratio of 9.75% indicates strong activity, often a sign of conviction in the market. Likewise, LUNA’s volume-to-market cap ratio of 15.83% points to sustained interest.

For both tokens, continued growth in trading volume could lead to prices breaking through the immediate resistance levels. However, if volume momentum weakens, both LUNC and LUNA may fall back to test their respective support zones.

Related: Terra’s $4.5 Billion Fine: A Warning Shot to Crypto Fraudsters

Related: Terra’s Collapse: The Fallout Reaches a Prime Minister’s Office

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.