- Gabor Gurbacs tweeted that the foreign central banks are selling U.S. Treasuries.

- The advisor added that the Tether is the largest buyer of U.S. Treasuries.

- Gurbacs commented that if Tether was a country, it would have been the top 30 holders of the Treasuries.

Gabor Gurbacs, the Strategy Advisor at the global investment firm VanEck Associates Corporation, shared on Twitter that while foreign central banks are selling U.S. Treasuries, the asset-backed stablecoin Tether is the biggest buyer.

Notably, Gurbacs added, “If Tether was a country, it’d be among the top 30 holders of U.S. treasuries.”

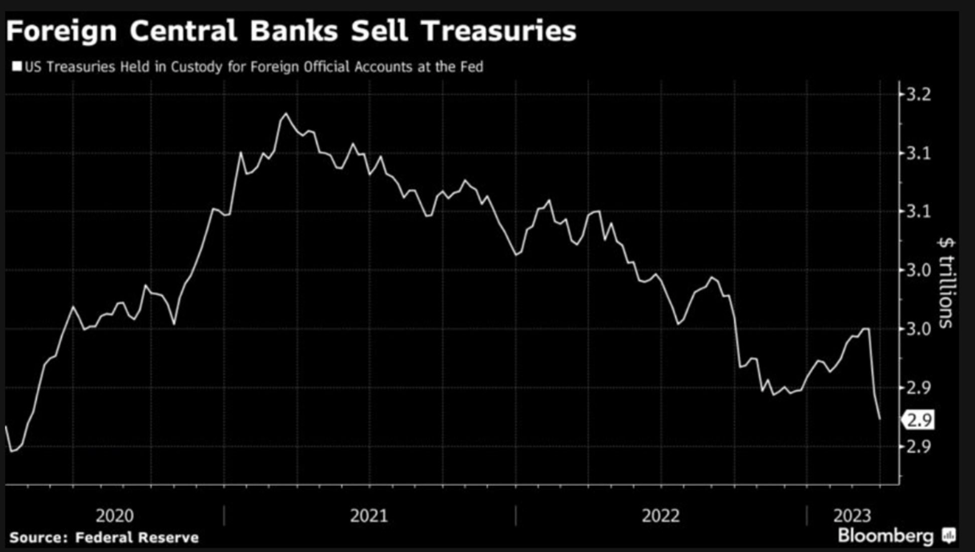

According to the recent report of the television media Bloomberg, the foreign central banks have been liquidating Treasury holdings, facilitating cash from the Federal Reserve to mitigate the banking turmoil.

Reportedly, the foreign holdings of Treasury securities have fallen by $76 billion in the week through March 22 to $2.86 trillion, creating the largest weekly decline since 2014.

Significantly, Joseph Abate, the Managing Director of the British multinational universal bank, Barclays commented that the “borrowing was precautionary,” adding:

The central bank wanted to build a war chest of available dollars in case the banking crisis deteriorated but did not want to fire sell its Treasuries.

Gurbacs asserted that Tether has bought the largest share of U.S. Treasuries, noting, “U.S. leadership should appreciate Tether for buying and holding U.S. treasuries.” He included a graph of the U.S. Treasuries sold by foreign central banks, which the popular investor Willem Middelkoop shared some hours before.

Middelkoop commented that the foreign banks have been selling Treasuries; Russia almost sold everything while China continues to sell. He suggested “FED will need to be a buyer again soon,” adding that “debt monetization is the nuclear option.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.