- First US XRP ETF (Teucrium XXRP) launched today April 8th, offering 2X long exposure

- XRP price rallies 12 percent to $1.90 coinciding with ETF launch, signaling positive reaction

- Launch seen as bullish catalyst linked to SEC/Ripple progress; spot ETFs also pending

XRP showed renewed strength Tuesday, jumping 12 percent with Teucrium Investment launching the Teucrium 2X XRP ETF (XXRP).

The rebound followed a sharp dip during Monday’s market turmoil.

First US XRP ETF (Teucrium XXRP) Details

XXRP will start trading on the NYSE Arca, even as the U.S. Securities and Exchange Commission (SEC) continues to review various applications for spot XRP ETFs. Interestingly, this debut comes ahead of any standard spot ETF approval, a rare move in the cryptocurrency space where unleveraged spot funds typically lead the charge.

Teucrium’s leveraged ETF comes with a management fee of 1.85%. However, the firm has warned that XRP’s price volatility and declining usage on the Ripple network could pose challenges to the fund’s performance.

“XRP and XRP-related investments are relatively new investments. They are subject to unique and substantial risks and historically have been subject to significant price volatility. The value of an investment in the Fund could decline significantly and without warning, including to zero,” the company said.

Related: Ripple Calls on UK Government to Expedite Crypto Asset Regulation

Broader ETF Context and Bullish Sentiment

The launch of XXRP comes as major asset managers like WisdomTree, Bitwise, 21Shares, Canary Capital, Grayscale, and Franklin Templeton have applications pending with the SEC for spot XRP ETFs.

An unnamed crypto analyst noted the Teucrium launch, coupled with these pending applications and positive developments in the SEC’s case against Ripple (a reported $50 million settlement agreement), boosts the overall bullish narrative for a regulated XRP access.

XRP Price Jumps 12%

XRP has jumped 12% in the past 24 hours, reaching $1.90. This rebound comes after a severe market crash that wiped out millions from the cryptocurrency sector, which was triggered by President Trump’s tariff announcement impacting Asian markets as well.

Related: Don’t Ignore This XRP Signal: Strong XRP/ETH Ratio Defies Market Crash

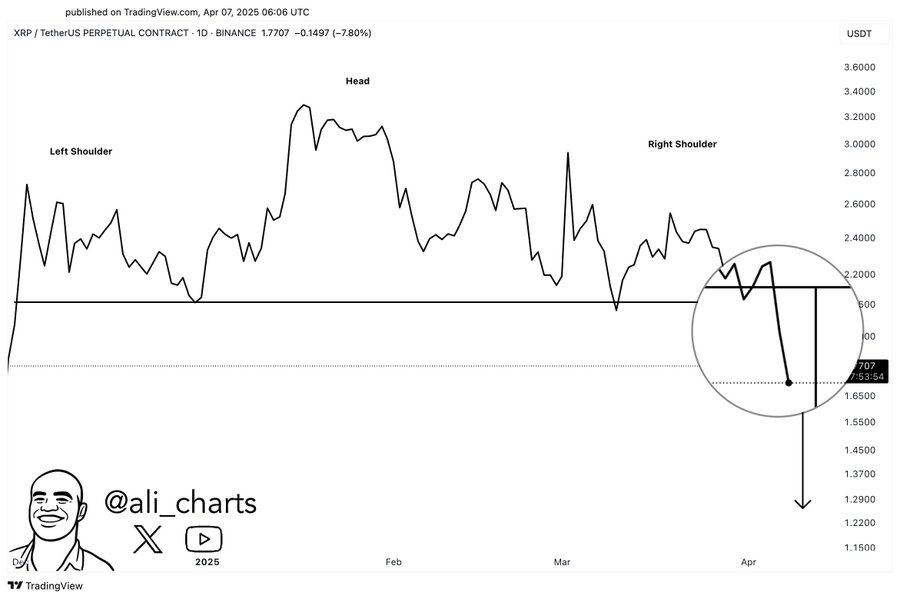

However, analyst Ali Martinez recently flagged a potential bearish head-and-shoulders pattern on XRP’s chart, warning that if confirmed, it could target levels near $1.30.

This provides a technical counterpoint traders are watching while the market digests the positive ETF news. Holding the current support zone near $1.90 remains key for bulls aiming for resistance levels higher up.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.