- Thailand bans short-selling temporarily to reduce market volatility.

- Emergency measures are in effect from April 8 to April 11, 2025.

- Bitcoin crashed to $74K today, with traders facing over $1.46 billion in liquidation.

Thailand’s Stock Exchange (SET) will temporarily ban the short-selling of all securities and reduce daily price limits, starting tomorrow, April 8th through April 11th. This emergency action addresses significant market volatility linked to recent shifts in global tariff policies.

Both SET and the Thailand Futures Exchange (TFEX) approved the temporary measures late Monday to curb excessive price swings driven by global trade uncertainties and give investors time to assess conditions, according to reports confirmed by Bloomberg.

Emergency Trading Rules Enacted

For context, short-selling involves borrowing shares to sell them at a high price and then repurchasing them later at a lower price to make a profit. In light of market stress, Thailand has temporarily suspended the practice to reduce volatility.

SET’s Board of Governors approved a set of emergency trading rules, which TFEX swiftly adopted. These measures are to stabilize the market over the next three days, from April 8 to April 11, 2025.

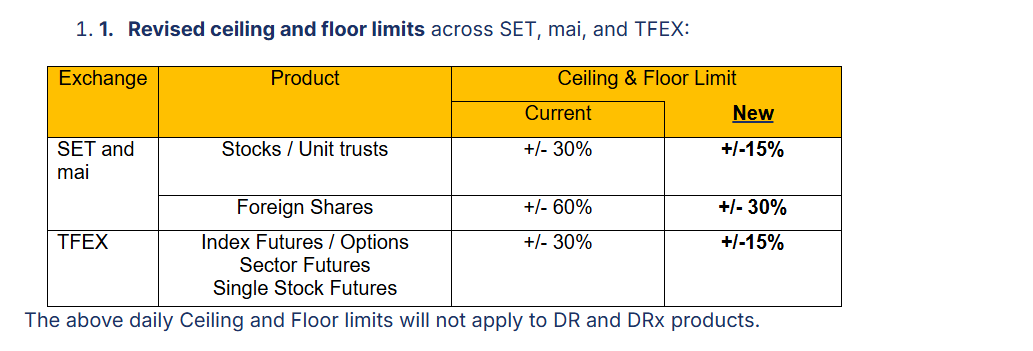

One of the major changes is the reduction of daily price movement limits. Stocks and unit trusts on SET and mai will now have a ±15% range, down from ±30%. Foreign shares will have a ±30% range, reduced from ±60%.

Additionally, futures contracts on TFEX, including index, sector, and single stock futures, will be limited to a ±15% movement, down from ±30%.

Related: Thailand Turns to Bitcoin to Boost Economy in Tourist Hotspot Phuket

While the short-selling ban applies to all securities, registered market makers are exempt and may continue their operations during suspension.

SET has stated that these measures aim to give investors time to assess market conditions and make more informed decisions. The exchange will monitor the situation and adjust its approach as needed.

Global Market Turbulence with Massive Crypto Liquidations

Thailand’s intervention occurs against a backdrop of widespread global market turbulence. Investors have responded cautiously, prompting regulators worldwide to intervene to prevent further market declines.

In related developments, stocks plummeted across global markets, sparking emergency measures in Asia and Europe. In France, the trading of major bank shares was suspended after sharp declines at the market open.

Related: $2.5M Crypto Stash Linked to Human Trafficking Seized in Thailand-China Bust

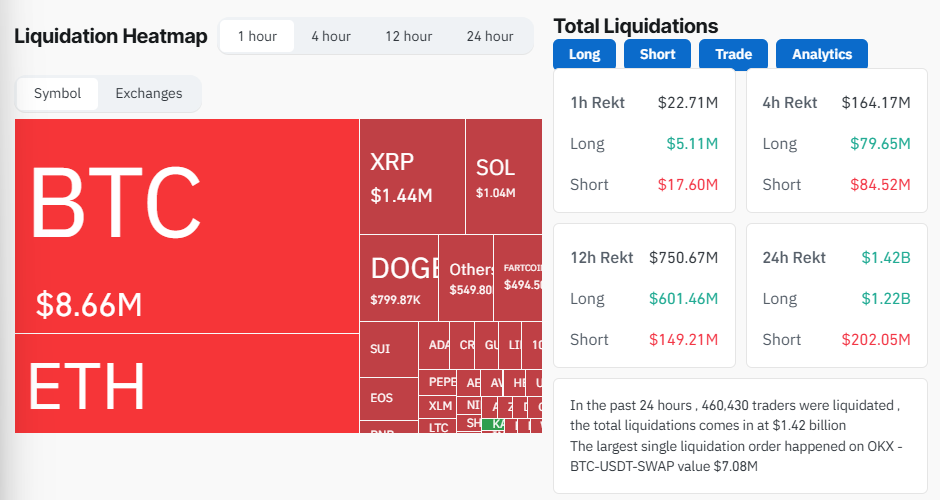

Notably, the crypto market is also feeling the heat of the global financial market turmoil. Today, Bitcoin crashed to $74K for the first time since November 2024. In particular, 46,427 traders have been liquidated with over $1.46 billion in losses.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.