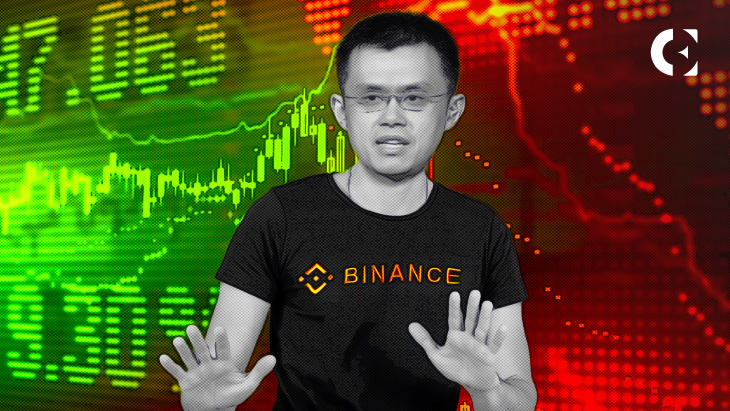

- Binance CEO tweeted that crypto investors who bought BNB dip should be happy.

- BNB is currently at $300.32, with a 9.5% increase in the last seven days.

- Solana is on track to reclaim the 10th position from Polygon (MATC).

The price of Binance Coin (BNB) recently touched $305, up from the $221 low at the height of FUD late last month. The CEO of Binance, Changpeng Zhao, tweeted that crypto enthusiasts who bought dip because of the widespread fear, uncertainty, and doubt should be happy.

Zhao added that those who sold because of FUD have themselves to blame, given the global recovery of the crypto market. He encouraged them to unsubscribe from people who often preach panic messages about the crypto market.

However, a crypto influencer on Twitter with the username “CryptoCapo_” sees the Binance CEO’s tweet in a bad light. The influencer claimed Zhao was trying to silence and eliminate things he did not want to hear.

Twitter verified user “DonCryptoDraper” hinted that CryptoCapo’s bitterness was because they are at a loss for betting against the price of BNB.

CryptoCapo often encouraged crypto traders to short the price of BNB. Since last year, he repeatedly posted that his main target for the price of BNB is $45. Currently, the Binance coin trades at $300.32, with a 9.5% increase in the last seven days. Similarly, Bitcoin (BTC) trades at $21,126, with over 22.7% growth in the previous week.

The best-performing coin among the top 11 was Solana (SOL), with over 42% growth in the last seven days, trading at $23.4. At the moment, Solana is on track to reclaim the 10th position from Polygon (MATIC), as both coins now have nearly similar market capitalizations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.