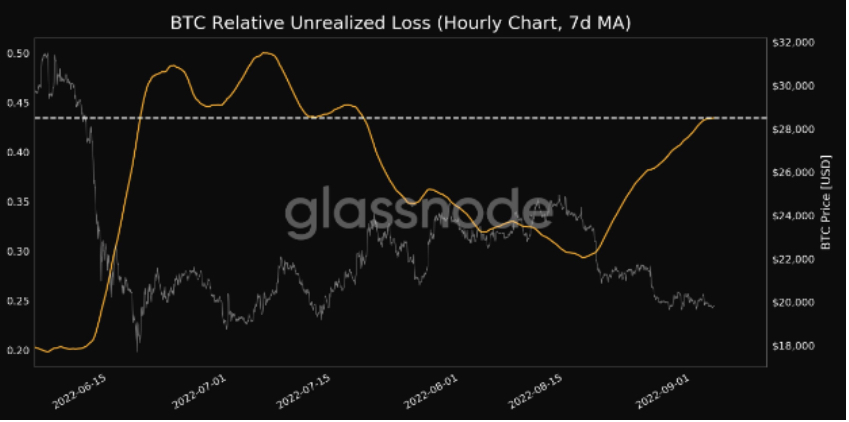

- Bitcoin’s (BTC) Relative Unrealized Loss (7d MA) just reached a 1-month high.

- BTC is currently trading at $19,783.70 after a 0.88% drop in price.

- Bears stood firm and were able to keep the price below the descending line.

The on-chain market intelligence firm, Glassnode, took to Twitter on September 4 to announce the fact that Bitcoin’s (BTC) Relative Unrealized Loss (7d MA) had just reached a 1-month high.

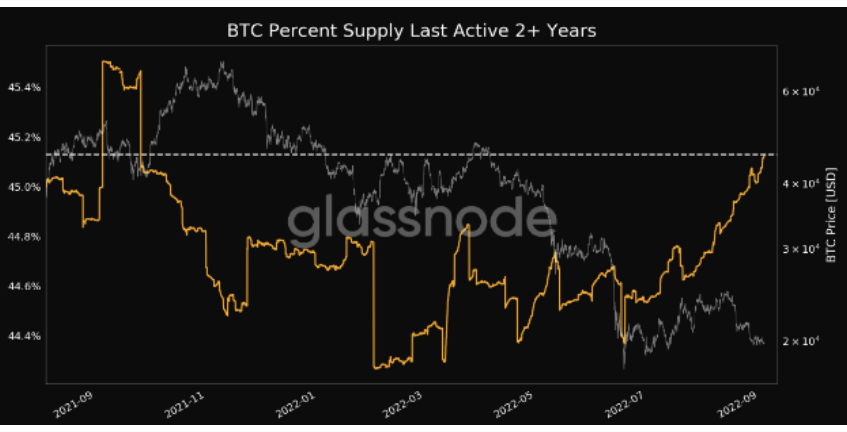

In addition to this, Glassnode made another announcement on Twitter on the very same day, which stated that BTC’s “percent supply last active 2+ years” had also just reached an 11-month high.

The high now stands at 45.129%, while the previous 11-month high stood at 45.126%, which was observed only a day before on September 3 of 2022.

According to the market tracking website, CoinMarketCap, BTC is currently trading at $19,783.70 after a 0.88% drop in price over the last day and after reaching a high of $19,912.91 over the same time period. The crypto market leader is also still down about 1.30% over the last seven days.

The 24-hour trading volume for the king of crypto is also down just over 15% to now stand at $23,645,045,049. When it comes to market cap, BTC is still at the top of the list of cryptocurrencies with a market cap of $378,764,276,522.

The daily 9 EMA is positioned below the 20 EMA and continues to diverge from the 20 EMA, which is a potential indication that BTC’s price will continue to face bearish pressure for the coming days.

BTC’s price did attempt to break above the 9 EMA, but bears stood firm and were able to keep the price below the descending line.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.