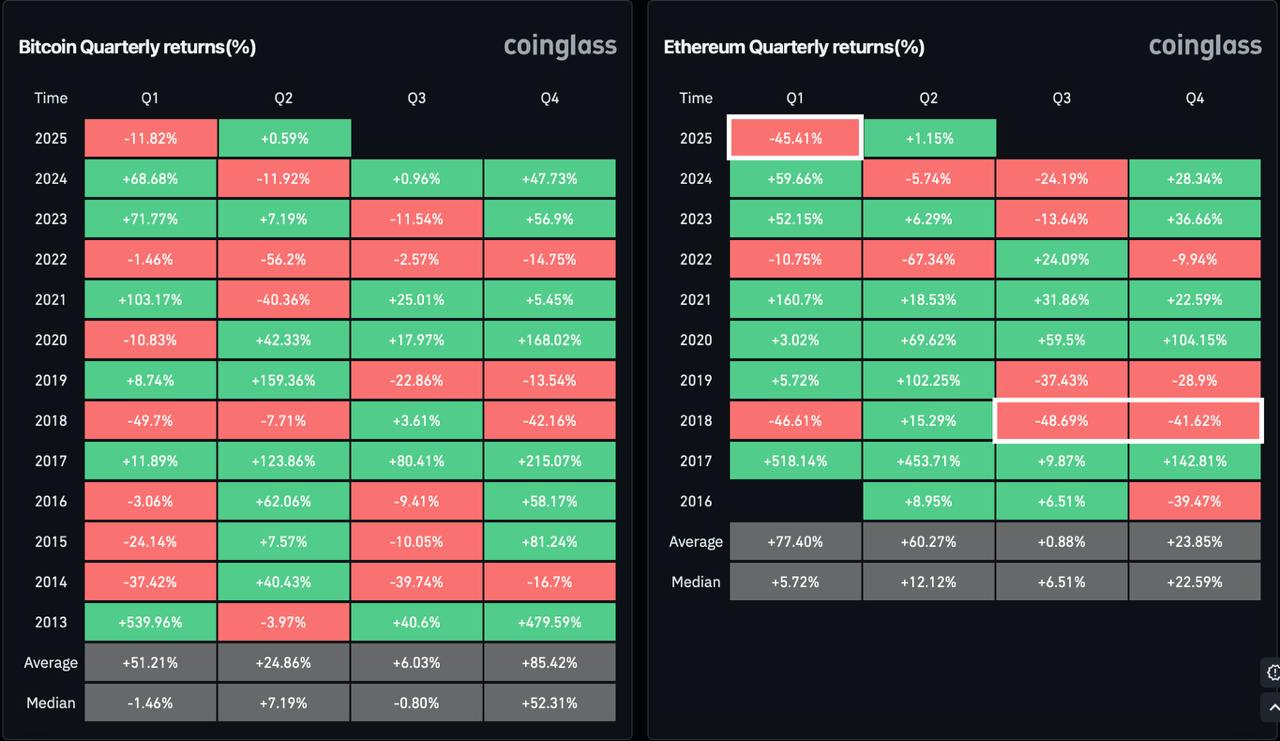

- Ethereum plunged 45.41% in Q1 2025, marking one of its worst quarters.

- Bitcoin dropped 11.82%, reflecting overall market struggles.

- Q2 could see ETF approvals, Fed rate cuts, and FTX’s $11.4B payout.

The cryptocurrency market closed the first quarter of 2025 with significant losses, marking one of its more challenging quarterly periods historically. Ethereum (ETH) suffered a steep decline reported at 45.41% during Q1, while Bitcoin (BTC) dropped 11.82% over the same three months.

This sharp downturn reflected a turbulent start to the year for crypto assets. The period saw widespread liquidations across derivatives markets and signs of declining investor confidence. Currently, Bitcoin trades near $83,719, showing a modest 1.8% uptick over the past 24 hours after finding support at recent lows.

Ethereum’s Q1 performance ranked among its worst quarterly results since 2018. This highlighted the severity of the market’s recent struggles. While Bitcoin’s Q1 losses were less severe, its negative performance still contributed to the overall bearish sentiment across the market during the quarter.

Related: Bitcoin $100k FOMO Returns: Santiment Warns It Could Be a Bull Trap

Many traders were forced out of the market, and liquidity in the crypto sector thinned as investors pulled back from high-risk assets. Ethereum is now trading at $1,876 after a 15.5% drop in the past month.

What Could Spark a Crypto Recovery in Q2?

Despite the harsh conditions of Q1, there is growing anticipation that the second quarter may bring a reversal in market trends per Newsmaker.

The U.S. SEC is expected to make crucial decisions on several pending spot crypto exchange-traded fund (ETF) applications by the end of Q2. Positive approvals for products beyond Bitcoin could facilitate greater institutional investment inflow, potentially injecting fresh capital into the specific assets approved and the broader market.

The Federal Reserve is also expected to lower interest rates in the coming months. A rate cut would ease financial conditions, potentially making crypto investments more attractive.

Historically, periods of lower interest rates have often supported performance for risk-on assets, including technology stocks and crypto.

Are There Other Potential Q2 Catalysts?

While Q1 2025 proved difficult for crypto investors, historical market trends suggest the second quarter often sees stronger performance on average for major cryptocurrencies. Bitcoin’s average Q2 return historically stands at +24.86%, based on past data cycles. Ethereum has often performed even better than Bitcoin during the second quarter historically.

Related: Ethereum April 2025 Forecast: Analyzing the Bull vs Bear Case After Dip

Another key event on the horizon is the FTX payout scheduled for May 30. The collapsed crypto exchange is set to return $11.4 billion to creditors, with some estimates suggesting the amount could be as high as $16 billion. This could release significant liquidity into the market, potentially driving renewed trading activity.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.