- Tom Lee noted that the upcoming Fed monetary policy decision will be a major catalyst for crypto.

- Fundstrat’s Lee stated that Bitcoin does well in the fourth quarter, which begins in three weeks.

- The Bitcoin network has accumulated several game-changing fundamentals, but economic uncertainty has suppressed its value.

Tom Lee, co-founder and head of research at Fundstrat Global Advisors, has issued a bold midterm prediction for Bitcoin (BTC). In a CNBC interview on Monday, Lee stated that the BTC price could easily reach $200k before the end of 2025.

Bitcoin price traded around $112,609 on Tuesday September 9, during the mid-European session. The flagship coin has rebounded from a crucial support level above $107.5k in the past few days and is currently approaching a resistance level around $113,370.

As such, if Lee’s prediction materializes by the end of this year, BTC holders will record a 78% gain in their portfolio.

Why is Lee So Confident in a Q4 Bitcoin Liftoff?

According to Lee, Bitcoin and the wider crypto market are awaiting next week’s Fed monetary policy report. With last week’s report of a weak labor market, Kalshi and Polymarket traders are betting an 86% chance that the Fed will initiate a 25 bps rate cut.

As such, Lee believes that Bitcoin will obtain a much-needed catalyst for a bullish liftoff during the fourth quarter. Moreover, Lee highlighted that the crypto market often performs well during the fourth quarter.

Related: Bitcoin ETFs See $246 Million Inflows, But Overall Market Remains Cautious

“Bitcoin and cryptocurrencies like Ethereum are very sensitive to monetary policy. If the Fed moves toward rate cuts, it could set the stage for a very strong fourth quarter,” Lee stated.

Cautionary Tale

On Monday, JPMorgan’s trading desk warned traders that the market may experience a pullback after the Fed initiates a rate cut. According to JPMorgan, a potential sell-the-news could affect the wider market.

However, the bank noted that the markets could continue in a bullish outlook even after the Fed initiated a rate cut since there is no recession.

What Will Fuel the Anticipated BTC Rally in Q4?

Supply vs Demand Shock

The Bitcoin market has experienced bullish sentiment in the past months largely due to heightened demand from institutional investors. According to market data from BitcoinTreasuries, Michael Saylor’s Strategy has led an army of 319 entities that hold 3.71 million Bitcoin for their treasury management.

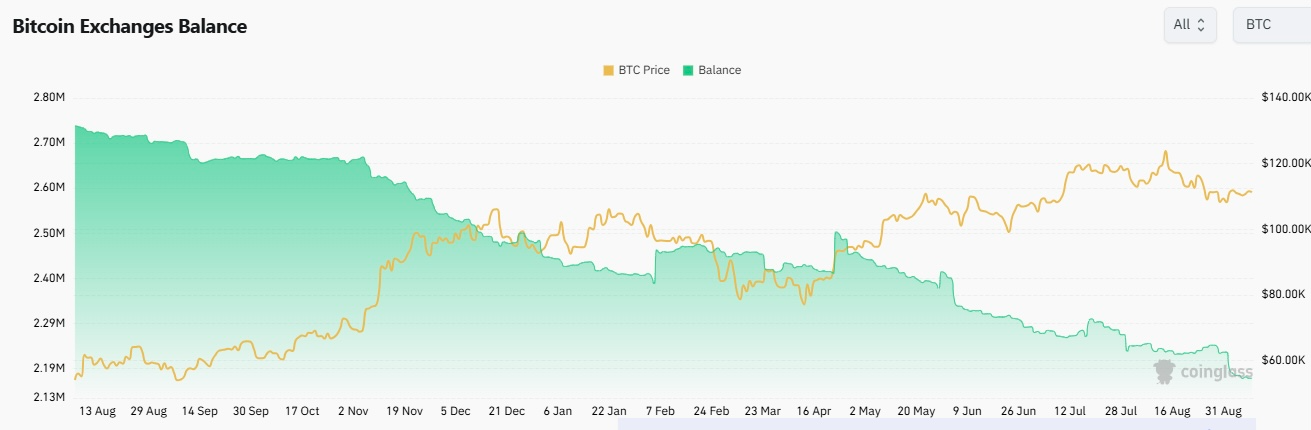

With the notable demand from other whale investors, especially the spot BTC ETFs, the fourth quarter rally will be fueled by a strong demand vs supply shock. According to market data from CoinGlass, Bitcoin’s supply in centralized exchanges has dropped to a multi-year low of around 2.1 million amid the ongoing BTC price consolidation.

Fed Monetary Policy

After holding its benchmark interest rate between 4.25% and 4.5%, the Federal Reserve is expected to initiate at least one rate cut before the end of this year. Moreover, Wall Street experts have noted that the inflation caused by tariffs is temporary.

Related: Chances for a September Rate Cut Surge to 90.4% After Weak Jobs Report

Imminent Capital Rotation from Gold

Bitcoin price has over the years followed Gold price action, but in a higher bullish intensity. Moreover, Bitcoin has been regarded as digital gold, with more investors buying it to hedge against inflation and macroeconomic uncertainties.

Notably, the Gold price recently broke out of a mid-term consolidation and has reached a new all-time high of around $3,647 per ounce earlier today.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.