- Tom Lee forecasts Bitcoin at $1 million and Ethereum at $60,000.

- He says sovereign buyers and institutions are reshaping crypto cycles.

- Stablecoins could fund U.S. Treasuries and reinforce dollar dominance.

Fundstrat’s Tom Lee has laid out a super-cycle thesis that sees Bitcoin climbing to $1 million and Ethereum to $60,000. Speaking in an interview with Mario Nawfal, released this week, the chairman of BitMine said institutional adoption, sovereign demand, and stablecoins will anchor the next phase of crypto growth.

Lee, a former chief equity strategist at JPMorgan, became known in 2017 when he predicted Bitcoin would reach $25,000. At the time, Bitcoin traded under $1,000, and his outlook was widely dismissed. Some hedge funds even canceled services with his firm, claiming digital assets lacked legitimacy.

Related: Fundstrat’s Tom Lee Predicts a $15,000 Ethereum by Year-End, Calls It the “Biggest Macro Trade”

Lee explained that attitudes have shifted since then. “Crypto was met with a lot of skepticism by institutional investors until recently,” he said, noting that U.S. policymakers were also hostile until this year. Notably, he projects Bitcoin to reach $200,000 in 2025 and eventually climb to $1 million in the years to follow.

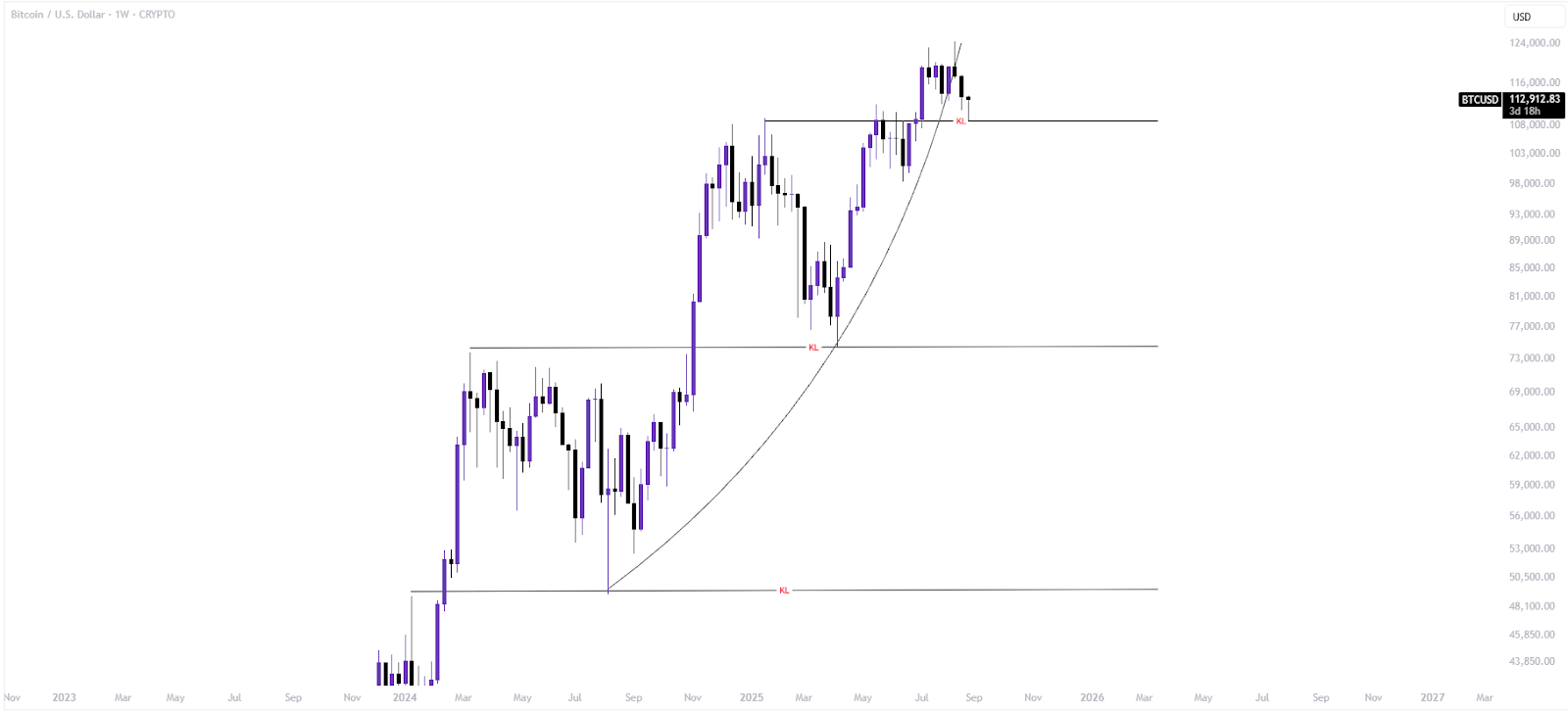

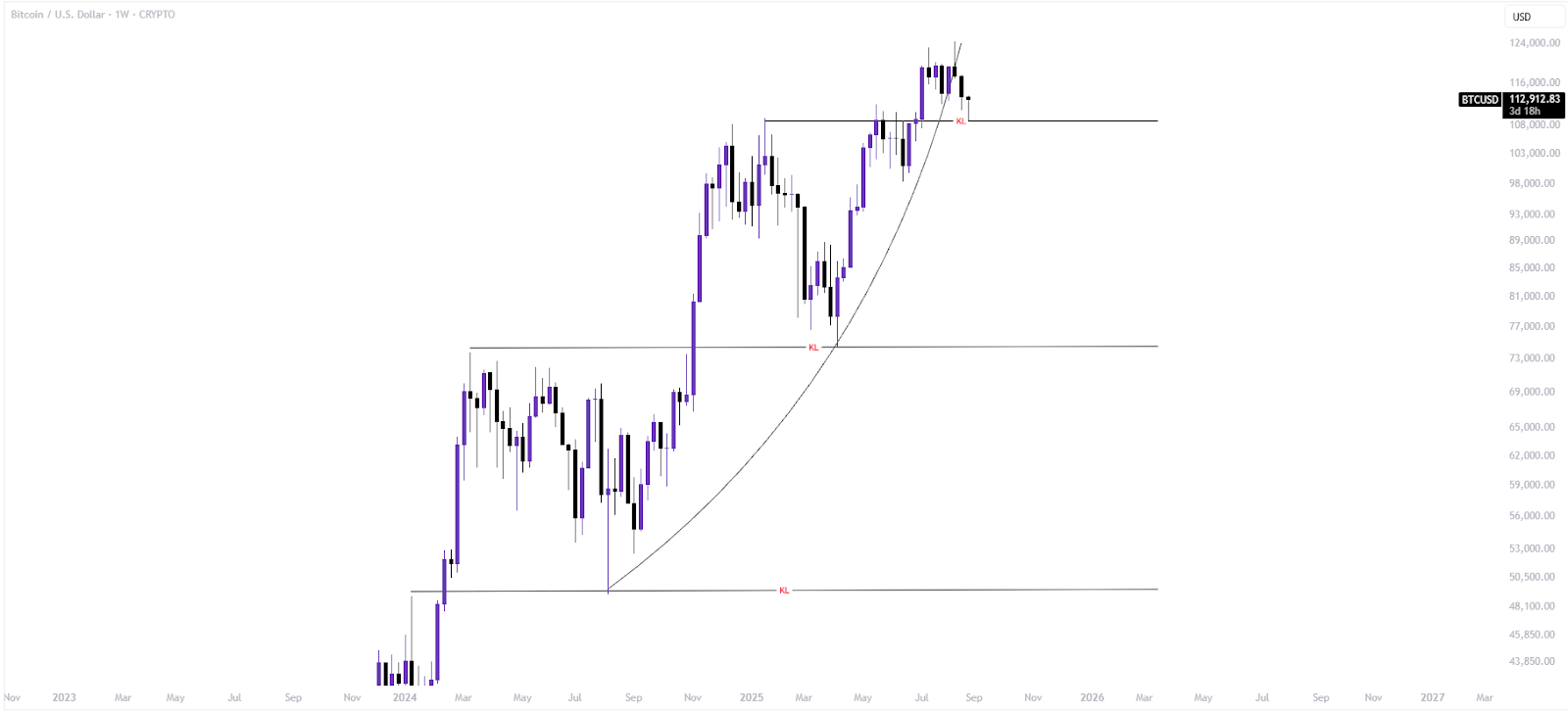

Bitcoin (BTC) Monthly Chart

- The chart shows BTC breaking into new all-time highs above $110,000, continuing the multi-cycle parabolic structure that began in 2013.

- This reflects Tom Lee’s thesis: the 4-year cycle remains in effect, institutional flows are pushing BTC structurally higher, and sovereign adoption could establish a permanent floor under the price.

- The long-term parabola supports his call for $200,000 near-term and $1 million long-term. Other industry leaders like Brian Armstrong of Coinbase and Charles Hoskinson of Cardano have previously said Bitcoin will reach $1 million by 2030.

Bitcoin (BTC) Weekly Chart – Parabolic Advance

- On the weekly chart, Bitcoin shows a rounded parabola with key levels holding ($73K, $108K). BTC is respecting these curves.

- This further correlates with Lee’s argument that institutional treasuries & sovereign demand create velocity in BTC treasuries, supporting higher price floors and smoother parabolic runs.

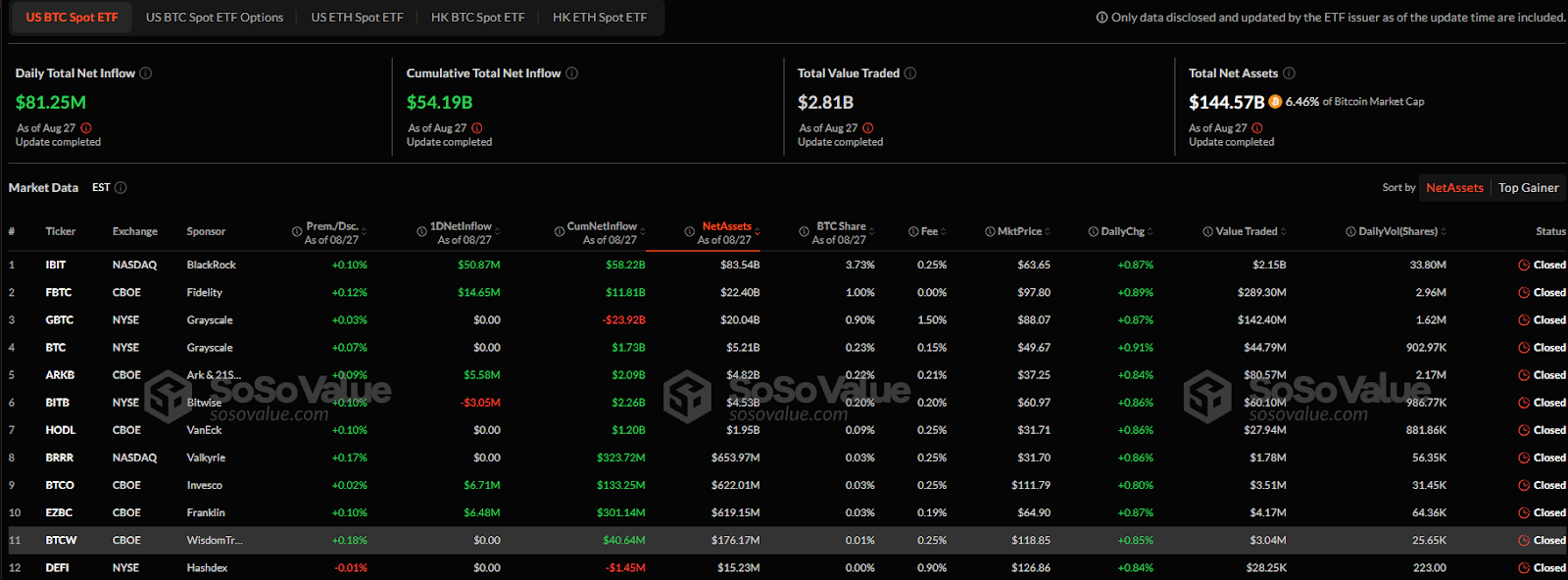

BTC ETFs Show Overall Positive Inflows

Data from Bitcoin ETF inflows further supports the argument for continued upside. Bitcoin spot ETFs broke a six-day outflow streak this week by recording a massive $219 million in inflows on Monday.

The trend remained positive, with $88 million on Tuesday and $81 million on Wednesday. Major investors include BlackRock, Fidelity, and Ark Invest.

Ethereum Going to $60K

Meanwhile, Lee also said that Ethereum, currently trading at $4,580, could also expand in price to $60,000. He noted that ETH has lagged in price performance compared to Bitcoin, but recent changes, including reduced supply and growing demand from stablecoins, are strengthening the network.

He added that Wall Street values reliability and staking over speed, positioning Ethereum as a core infrastructure layer. “Wall Street wants 100 percent uptime,” he said, noting that institutions could use Ethereum for stablecoins, AI agents, and authenticated transactions.

With this, he set a price target of $60,000. Additionally, Lee noted Ethereum has a 50% chance of surpassing Bitcoin in market value.

Ethereum (ETH) Monthly Chart

- On the monthly chart, ETH is breaking out of consolidation, now at ~$4.5K, still below the ATH relative to BTC.

- This matches Lee’s comments about ETH underperforming in 2024, but poised for revival as AI agents, authenticated transactions, and stablecoin infrastructure shift demand back to Ethereum.

- If ETH reclaims momentum, the path toward $60K aligns with the chart’s bullish reversal.

Ethereum (ETH) Weekly Chart – Breakout Structure

- Meanwhile, the weekly ETH chart shows the coin has just cleared a key level (~$3,800) after retesting a deep corrective structure.

- The chart aligns with Tom Lee’s statement, “ETH has been dead for 5 years, but it’s not dead tech.” It highlights breaking back above major resistance, entering the acceleration phase.

- This structure validates ETH as a late-cycle outperformer, possibly even challenging BTC (the “50% flip chance” Lee mentioned).

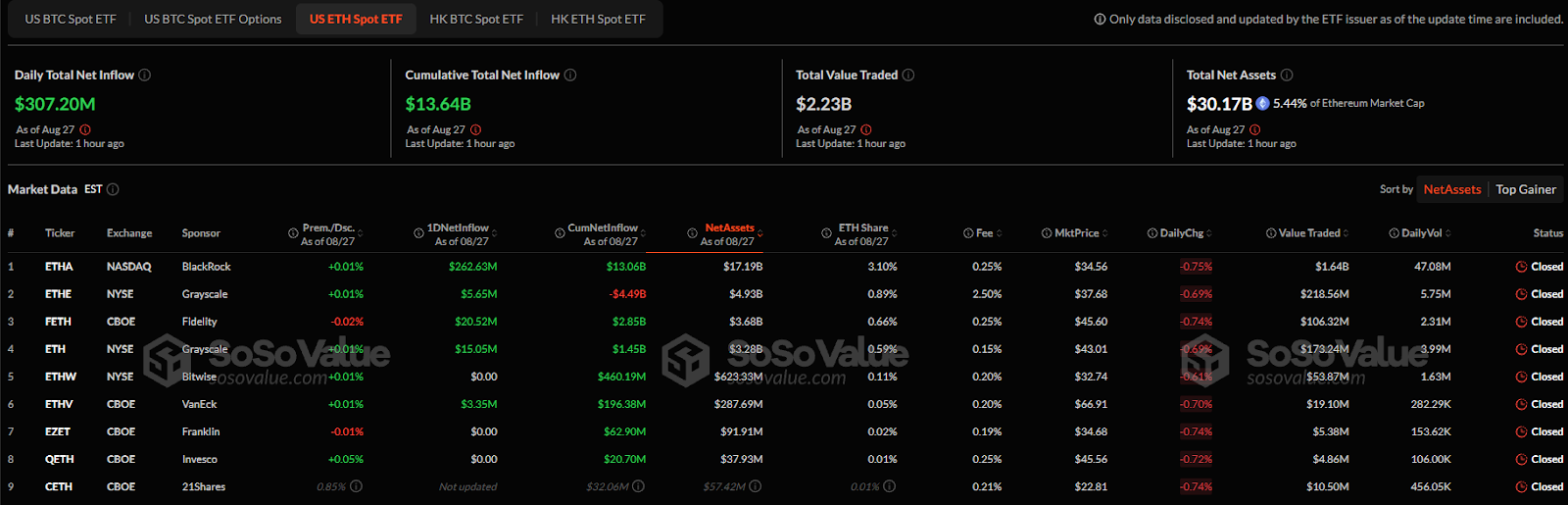

ETH ETFs Show Overall Positive Inflows

On the ETF front, massive investment has also been flowing into Ethereum. Since last week, ETH ETFs have attracted over $1.6 billion in inflows. The biggest ETH buyers among the ETFs have been BlackRock, Fidelity, and Bitwise.

Stablecoins and the Dollar’s Dominance

Speaking further, Lee said stablecoins are emerging as a critical component of the financial system. He argued that issuers who buy U.S. Treasuries could surpass Japan and China as the largest holders. This, he said, would link stablecoins permanently to U.S. fiscal stability.

Related: Bitget CEO Gracy Chen Lays Out the Case for an “Inevitable” $1 Million Bitcoin Price

Lee emphasized that nearly all crypto transactions are already denominated in dollars. “Almost everything in crypto is quoted in dollars,” he said, suggesting the dollar-backed stablecoin market will strengthen U.S. influence.

CoinEdition Opinion

While Tom Lee’s super-cycle vision targets Bitcoin at $1M and Ethereum at $60K, our analysis points to nearer-term milestones that could materialize much sooner.

Bitcoin, aligned with the broader structural thesis and the Fed’s anticipated rate cuts by early September 2025, shows the strength to break past its $124K peak. A new all-time high in the $130K–$135K range appears increasingly likely.

Ethereum, currently consolidating, appears primed for acceleration, with a realistic trajectory toward $10K–$15K by mid-2026.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.