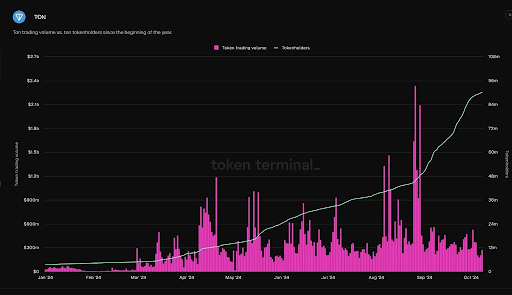

- TON’s token holders surged 2400% in 2024, surpassing 90 million by October.

- Despite volatility, TON’s trading volume peaked in September 2024, showing strong activity.

- Technical indicators suggest potential bullish momentum, with RSI signaling increased buying pressure.

TON has exploded in popularity in 2024, with the number of token holders skyrocketing by 2400%. As of October 2024, there are over 90 million $TON holders, showing the platform’s rapidly growing user base.

Steady Growth in Token Holders, Sharp Rise Since June

The number of TON holders has steadily increased from January to October 2024, with a significant jump starting in June. By October, the number of token holders exceeded 84 million.

TON’s trading volume has been more volatile, with notable spikes in mid-March, late July, and September. The highest trading volume occurred in September, topping $2.4 billion. Even with a dip after this peak, trading volume remains high compared to earlier months.

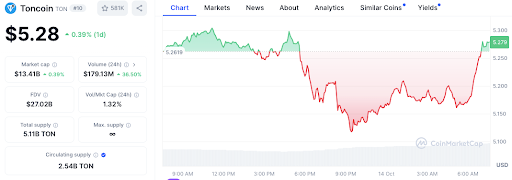

TON’s Current Market Performance

As of press time, Toncoin (TON) was priced at $5.28, reflecting an increase of 0.60% over the past day. The token’s market capitalization stands at $13.40 billion, driven by the circulating supply of 2.54 billion tokens.

Toncoin’s price initially climbed above $5.30 before falling in the afternoon, followed by a late recovery. Despite a downward trend since its mid-July peak of $8.50, the token has shown signs of recovery in recent weeks.

Read also: Toncoin Surges 342% in 2024, Analysts Eye $20 Target

After dropping to around $4.50, the price has rebounded to $5.29. The recent formation of green candles suggests growing bullish momentum. However, it’s still uncertain whether this is a short-term bump or the start of a longer uptrend.

The MACD has recently shown a bullish crossover, with the MACD line moving above the signal line.

Moreover, the RSI has moved to 52.10, indicating the market is neither overbought nor oversold and suggesting a neutral to bullish outlook as buying pressure increases.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.