- Dozens of countries with low crypto taxes will begin automatic data sharing under CARF by 2027 and 2028.

- Zero-tax crypto policies remain in place but apply under specific legal conditions.

- The OECD framework targets transparency, not new crypto taxes.

Countries known for low or zero cryptocurrency taxes are entering a new phase of global transparency. Many of these jurisdictions have committed to the OECD’s Crypto-Asset Reporting Framework, which is set to roll out in 2027. The framework expands cross-border reporting without directly changing national tax rates.

Low-Tax Crypto Jurisdictions Continue to Attract Investors

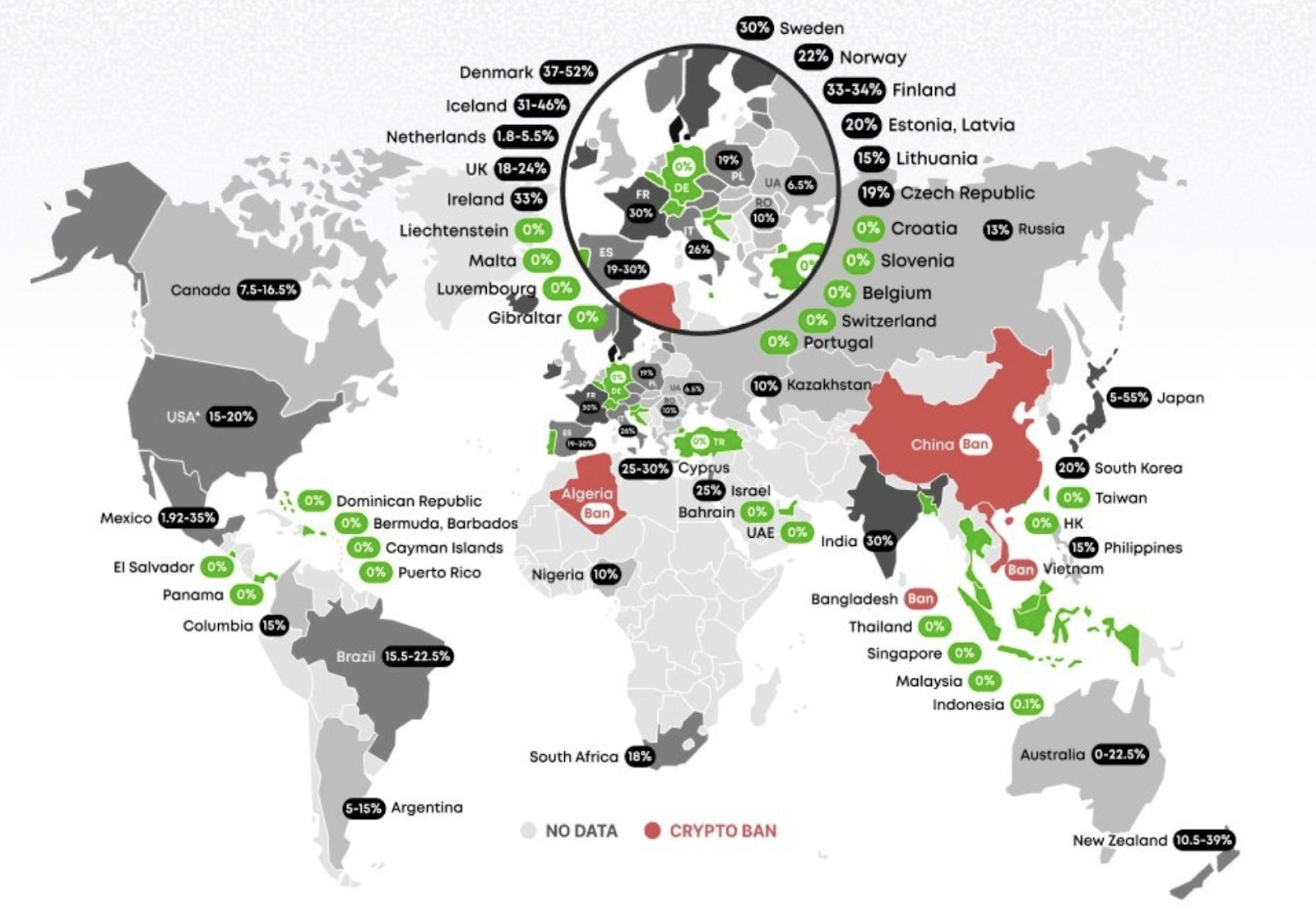

Several countries continue to offer favorable tax treatment for cryptocurrency holders. In recent posts, X users Star Platinum and Alex Mason published lists of countries with low or zero taxes on cryptocurrency.

The lists included jurisdictions such as the United Arab Emirates, Singapore, Cayman Islands, Bermuda, Portugal, Germany, Switzerland, Hong Kong, Panama, and El Salvador.

Star Platinum’s post outlined varying tax treatments, noting that some countries impose no capital gains or income taxes on crypto for individuals, while others apply exemptions only under specific conditions.

Examples included Germany and Portugal, which do not tax crypto gains if assets are held for more than 12 months. In Germany, gains from shorter holding periods are taxed at rates between 14% and 45%. Portugal applies a 28% tax on gains from assets sold within one year.

Other jurisdictions apply conditional exemptions. Switzerland does not tax capital gains for private investors but levies an annual wealth tax ranging from 0.5% to 0.8%. Slovenia applies a 10% tax on crypto withdrawals and payments, while Malta and Cyprus tax crypto only when it is treated as business income.

Meanwhile, Alex Mason’s post focused on countries described as having 0% crypto tax, including the UAE, Cyprus, Malta, Switzerland, Slovenia, Puerto Rico, and the Cayman Islands.

CARF Introduces Global Crypto Reporting Standards

In a notable development, the OECD released an updated list of jurisdictions committed to implementing the Crypto-Asset Reporting Framework (CARF). CARF requires crypto service providers to collect and share user transaction data with tax authorities, which then exchange the information across borders.

A total of 48 jurisdictions plan to begin their first exchanges by 2027. This group includes Germany, France, Japan, the United Kingdom, Italy, Spain, Portugal, Malta, Gibraltar, Liechtenstein, South Africa, and the Cayman Islands.

Another 27 jurisdictions, including the UAE, Singapore, Switzerland, Hong Kong, Panama, Bermuda, Barbados, Malaysia, and Mauritius, have committed to begin exchanges in 2028. The United States is scheduled to begin exchanges in 2029.

Countries Yet to Commit Remain in the Minority

Five jurisdictions identified as relevant by the Global Forum have not yet committed to a CARF implementation timeline. These include El Salvador, Georgia, Vietnam, Argentina, and India.

Argentina has adhered to a joint statement signaling intent to implement CARF, while India is in the process of making a political commitment.

Despite their current status, these jurisdictions may still face pressure to align with global reporting standards as international cooperation expands.

CARF does not impose new taxes or harmonize tax rates across countries. Instead, it focuses on information sharing to reduce tax evasion and improve compliance. Crypto tax policies remain determined at the national level, but authorities will gain broader visibility into cross-border crypto activity.

As the framework takes effect, tax residency and income classification are expected to play a greater role in determining individual tax obligations.

Related: South Korea Signs OECD Crypto Reporting Agreement, Eyes 2027 for Implementation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.