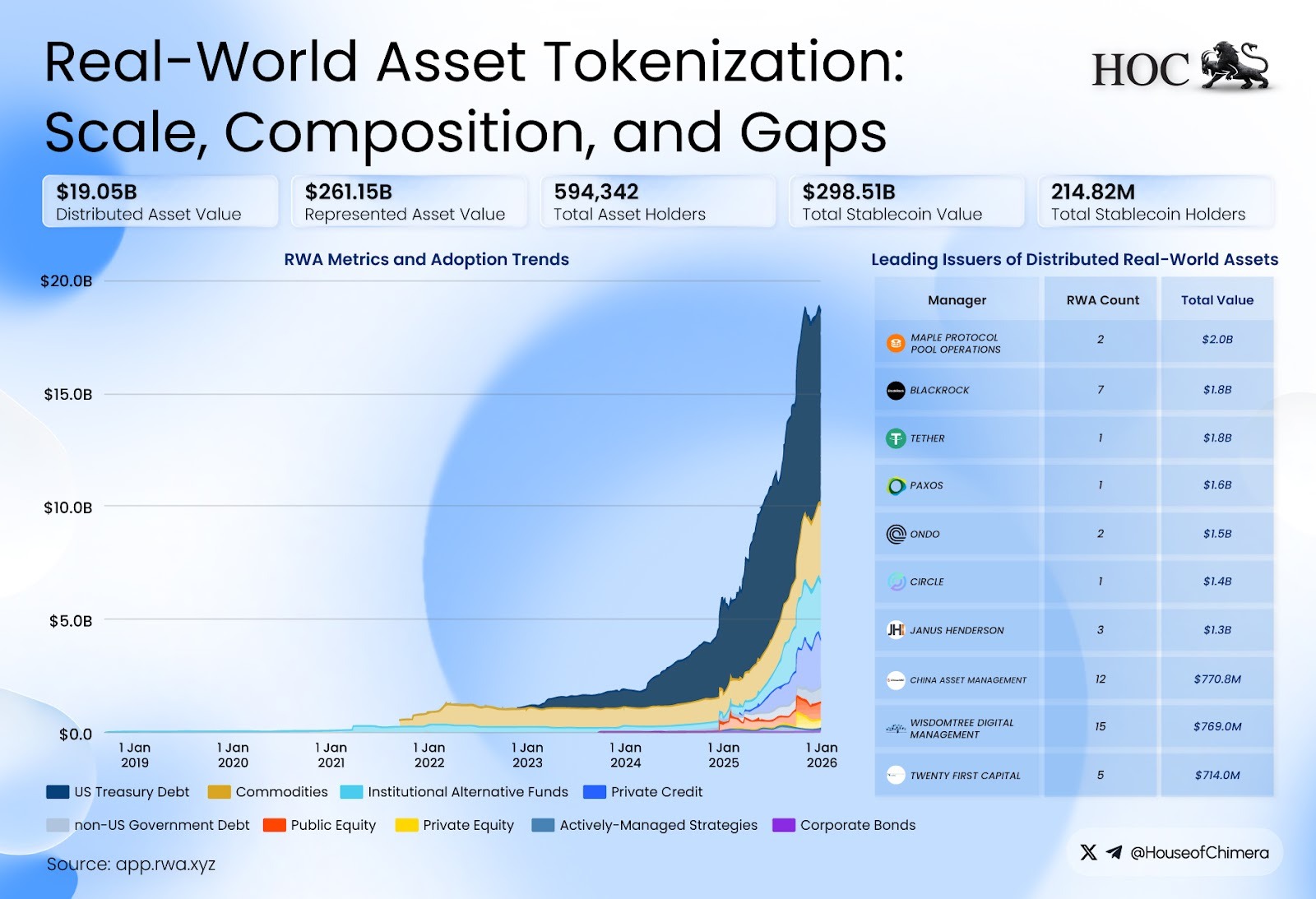

More than $260 billion in real-world assets are now represented on blockchain networks. But only around $19 billion of that value is actively distributed and usable within decentralized finance as 2026 begins.

The imbalance highlights both the rapid growth and the structural limitations of real-world asset (RWA) tokenization, one of the fastest-emerging sectors in the crypto market.

Source: X

Despite the gap, momentum is building. Tokenized U.S. Treasuries, private credit, commodities, and regulated funds are attracting increasing attention from institutional issuers and investors seeking yield, transparency, and operational efficiency.

Stablecoins still dominate on-chain real-asset value. However, non-stablecoin RWAs are expanding, supported by improving compliance frameworks and maturing blockchain infrastructure.

With this growth, we examine the top RWA tokens to watch in 2026, and why they could play a defining role as tokenization moves from experimentation toward programmable financial infrastructure.

What Defines an RWA Token in 2026

In 2026, an RWA token is a verifiable claim on an off-chain asset, issued and managed on a blockchain. These are factors that set top tokens apart:

- Legal clarity: Tokens map clearly to assets like treasuries, real estate, or commodities, with enforceable rights.

- On-chain utility: They are transferable, composable, and usable as collateral or yield instruments.

- Infrastructure: Reliable oracles and cross-chain frameworks ensure accurate pricing, accruals, and compliance.

- Regulatory alignment: Compliance with KYC, permissioned access, and institutional standards builds trust and adoption.

2026’s Most Important RWA Tokens

1. Chainlink (LINK)

Chainlink’s decentralized oracle network remains the primary source of real‑world data for tokenized assets, including price feeds, proof-of-reserves, and cross‑chain messages. Its integration with major RWA issuers makes LINK a foundational infrastructure token in 2026.

- Current Price: $12.87, with a 5.5% rise in the past day, reducing its monthly loss to 9.8%

- Market Cap: $9.11 B

- Circulating Supply: 708M

- 1‑Year Performance: 42% down from early‑2025 prices.

LINK has outperformed many large‑cap tokens in recent weekly action, likely due to demand for oracles in RWA issuance and DeFi infrastructure. However, like many crypto assets, it remains below its all-time high.

2. Ondo Finance (ONDO)

ONDO is a core RWA play focused on tokenized U.S. Treasuries and yield products. Institutional interest and regulatory alignment make it one of the most closely watched pure RWA tokens.

- Current Price: $0.39 after 8.9% rise in the past day, reducing its monthly loss to 24%.

- Market Cap: $1.23 B

- Circulating Supply: 3.16B

- Performance: 81% down from early all-time highs.

ONDO’s price trends show significant correction over the year and month. Short‑term weakness appears to be driven by broader market-risk-off sentiment in RWA yields. Still, the token’s strategic relevance to tokenized yield products keeps it central to RWA narratives.

3. Stellar (XLM)

Stellar’s blockchain supports high‑speed, low‑cost settlement and decentralized exchange functionality. These are important for tokenized assets that require liquidity and transfers. Its adoption for stablecoins and token issuance positions XLM as a leading settlement layer for RWAs.

- Price: ~$0.205, after a 1.7% rise in the past day, still down by 20.7% in the past month.

- Market Cap: $6.66 B

- Circulating Supply: 32B

- 1‑Year Performance: 51% down from early 2025 highs.

Stellar has seen its price movement mirror other RWA tokens, trading with lower volatility and market participation over the past year. XLM’s performance profile is typical of large‑cap utility tokens: less reactive to short‑term crypto cycles, yet supported by ongoing asset issuance and liquidity demand.

4. XDC Network (XDC)

XDC is tailored for enterprise tokenization, with adoption in trade finance, cross‑border settlement, and regulated issuance. Its design prioritizes compliance and scalability for institutional use.

- Price: $0.05

- Market Cap: $0.98 B

- 1‑year: 39% from prior multi‑year highs.

XDC has shown greater resilience in short‑term price patterns than higher‑beta RWA tokens like ONDO, possibly due to enterprise interest and lower retail speculation.

Although it has pulled back from peaks seen in prior cycles, its adoption in regulated blockchain use cases supports a steadier performance profile.

5. Algorand (ALGO)

Algorand is a high-throughput, low-latency blockchain designed for tokenization of real-world assets, including government bonds, real estate, and corporate securities. Its pure proof-of-stake protocol enables fast settlement at low fees, making it appealing to both institutional and retail RWA products.

- Price: $0.12, 9.2% rise in the past day

- Market Cap: $1.07B

- Circulating Supply: 8.8 B

- 1-Year Performance: 69% decline

Algorand’s architecture emphasizes compliance-friendly issuance and programmable asset settlement, allowing RWAs to be integrated with smart contracts while meeting regulatory requirements.

It has seen adoption in national digital currency pilots and tokenized real estate projects, which positions ALGO as a key infrastructure and issuance token for RWA in 2026. Its short-term gains reflect renewed interest in utility Layer-1s for tokenized assets.

Speciality RWA Tokens to Watch in 2026

While the top RWA tokens like LINK, ONDO, XLM, and XDC dominate, 2026 is also shaping up to be the year for speciality RWA tokens. These are projects that target niche asset classes, offer innovative structures, or provide exposure to underrepresented markets.

1. Quant (QNT)

Quant offers cross‑chain and legacy integration tooling, a fundamental piece for RWA markets that need to move assets across chains and systems.

- Price: $77, an 11% rise in the past day, reducing loss to 21% in the past month.

- Market Cap: $1.16 B

- Circulating Supply: 14.5K

- 1‑year Performance: 34.2 % decline

QNT’s positive weekly moves contrast with broader market weakness and indicate potential rotation into infrastructure tokens. Its 1‑year drawdown also reflects that Quant, like many crypto assets, has retraced from prior speculative highs.

2. Tether Gold (XAUT)

XAUT represents physical gold on‑chain, making it one of the most tangible assets‑backed tokens. While not a purely crypto-speculative asset, its price generally tracks gold market trends, adjusted for premiums and trading volumes.

- Price: $4,381, a 1.4% rise in the past day, and 4.3% in the past month.

- Market Cap: $2.28 B

- Circulating Supply: 520K

- 1‑year Performance: 67% rise

XAUT’s performance over short intervals typically reflects gold dynamics, often showing stability or modest gains in risk‑off environments. In contrast to higher‑beta crypto tokens, commodity‑backed RWAs often provide hedge‑like behavior. This makes XAUT an important diversifier in the RWA universe.

3. Polymesh (POLYX)

Polymesh is a blockchain specifically designed for regulated security tokens and tokenized RWAs. Its permissioned architecture integrates KYC/AML compliance, corporate governance, and auditability.

- Price: $0.05. 15.2% decline in the past month

- Market Cap: $68M

- Circulating Supply: 1.2B tokens

- 1‑year Performance: 80% decline

Unlike open DeFi blockchains, Polymesh focuses on institutional-grade asset issuance. The network allows corporations and funds to tokenize private securities, bonds, and real estate while remaining fully compliant with local regulations.

Its value proposition lies in bridging the gap between blockchain innovation and legacy financial compliance, making it a likely winner as regulated tokenized finance grows.

4. Realio (RIO)

Realio specializes in tokenizing private real estate and venture assets, enabling fractional ownership and secondary market trading.

- Price: $0.15, 5.4% rise in the past day and month.

- Market Cap: $23 M

- Circulating Supply: 149M RIO

- 1‑year Performance: 82% decline

Realio represents illiquid asset tokenization, particularly in private real estate markets where traditional entry barriers are high. Its platform enables investors to access fractionalized, on-chain ownership of properties and venture assets.

5. Centrifuge (CFG)

Centrifuge focuses on invoice and trade finance, allowing businesses to tokenize receivables and bring them on-chain for financing.

- Price: $0.11, 16.3% decline in the past month.

- Market Cap: $63 M

- Circulating Supply: 574M CFG

Centrifuge introduces RWA tokenization to SME finance, a niche often overlooked by mainstream DeFi. By enabling receivables to be fractionalized and traded on-chain, Centrifuge provides liquidity to businesses while allowing investors to participate in structured, short-duration RWA products.

Related: RWA Tops Crypto Returns in 2025 as Bitfinex Eyes Trillion-Dollar Market

Emerging & Underdog RWA Tokens to Watch

While the top RWA tokens dominate market share, a growing ecosystem of emerging projects is bringing innovation to niche segments of tokenized real-world assets.

These tokens often represent private credit, real estate, yield farming, or community-driven RWA ecosystems, areas poised for growth in 2026.

1. TokenFi (TKNF)

TokenFi is a protocol designed to aggregate RWA yields from multiple platforms and tokens, enabling investors to optimize returns on tokenized treasuries, credit instruments, and structured products.

- Price: $0.005, 147% rise in the past week.

- Market Cap: $19 M

- Circulating Supply: 3.3B TKNF

TokenFi’s value proposition lies in simplifying RWA portfolio management. Investors can access diverse tokenized yields in one smart-contract wrapper, making it particularly appealing for retail and smaller institutional players.

2. YieldBricks (YBR)

YieldBricks focuses on real estate fractional ownership, tokenizing rental and commercial property income streams for on-chain investors.

- Price: $0.00035, 14% decline in the past day

- Market Cap: 89 K

- Circulating Supply: 251M YBR

YieldBricks is among the first RWA platforms targeting global real estate with a DeFi-style yield layer. Investors benefit from programmed dividend streams, liquidity on secondary markets, and fractional ownership that was previously inaccessible to outside large institutions.

3. Maple Finance (MPL)

Maple Finance is a leading on-chain private credit marketplace that connects institutional borrowers with lenders and offers yield to liquidity providers.

- Price: $0.186

- Market Cap: $325 K

- Circulating Supply: 1.7M MPL

Maple represents a specialty credit-focused RWA, offering exposure to institutional lending yields on-chain. Its strong short- and mid-term performance reflects growing institutional adoption and the appeal of private credit as a programmable, tokenized RWA.

Regulatory & Market Considerations of RWA Tokens in 2026

In 2026, the growth of real-world asset (RWA) tokens depends on three things: institutional adoption, clear regulations, and real market demand.

Large projects—like billion-dollar real estate tokenizations in Dubai—show that tokenization can provide liquidity, transparency, and fractional ownership at scale. At the same time, major asset managers are testing tokenized treasuries and structured products, moving RWAs from experiments to mainstream finance.

Regulation plays a key role. Standards like ISO 20022 allow tokenized assets to work smoothly with traditional financial systems, including cross-border payments. In addition, new stablecoin and digital asset laws give banks and corporations the legal confidence to participate.

Overall, RWA tokens that follow regulatory standards and financial infrastructure are more likely to gain institutional trust, liquidity, and wider adoption.

Market Dynamics at Play

- Liquidity vs. adoption: Over $260B in RWAs is on-chain, but only $19B is actively deployed in DeFi. Unlocking this liquidity is key.

- Emerging market growth: Tokenized assets are expanding fastest in regions with limited traditional finance infrastructure.

- Asset diversification: Multi-asset platforms (WhiteRock, TokenFi) and fractionalization solutions (Realio, YieldBricks) are attracting a broader investor base.

What Investors Should Watch in 2026

Investors should focus on signs of real adoption and long-term value, not short-term price movements.

1. Adoption Metrics: Users vs. Real Usage

If the number of token holders grows much faster than the amount of value actually being used, it may signal speculation rather than real demand. Tracking both holder growth and deployed liquidity helps identify projects with real utility.

2. Regulation as an Advantage

Projects that follow regulatory standards or operate within approved stablecoin and digital asset frameworks are more attractive to institutions. Compliance is becoming a key differentiator, not a limitation.

3. Cross-Chain Liquidity

Cross-chain protocols like Quant and Algorand allow RWAs to move across multiple blockchains, increasing liquidity and access. Tokens that work across ecosystems are better positioned for institutional use and long-term scale.

4. AI + RWAs + Tokenization

AI is improving how tokenized assets are analyzed, managed, and optimized. Projects using AI for risk analysis, automated decision-making, or liquidity optimization could gain a major efficiency edge in 2026.

Overall, the strongest RWA investments will combine real usage, regulatory alignment, cross-chain flexibility, and smart automation.

Conclusion

2026 is likely to be a major turning point for real-world asset (RWA) tokens. Large platforms like Chainlink, ONDO, Stellar, XDC, Algorand, and Quant are building the core infrastructure and liquidity.

At the same time, newer and specialized projects such as Tether Gold, Polymesh, Realio, Maple, YieldBricks, WhiteRock, and TokenFi are expanding access to real estate, private credit, and other traditionally illiquid assets.

The projects that succeed will be those that support cross-chain movement, meet regulatory standards, and use AI to improve efficiency. Investors should prioritize real-world use, growing adoption, and compliance. Tokens that solve real financial problems are positioned to change how assets are owned, traded, and accessed worldwide.

Related: Hong Kong Unveils 10-Year Plan for RWA Tokenization and Digital Markets

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.