- More than $1.2 billion in USDT entered exchanges this week.

- The Tron blockchain processed most of these transfers.

- Stablecoin’s on-chain volume reached $72 billion yesterday, marking the highest since February.

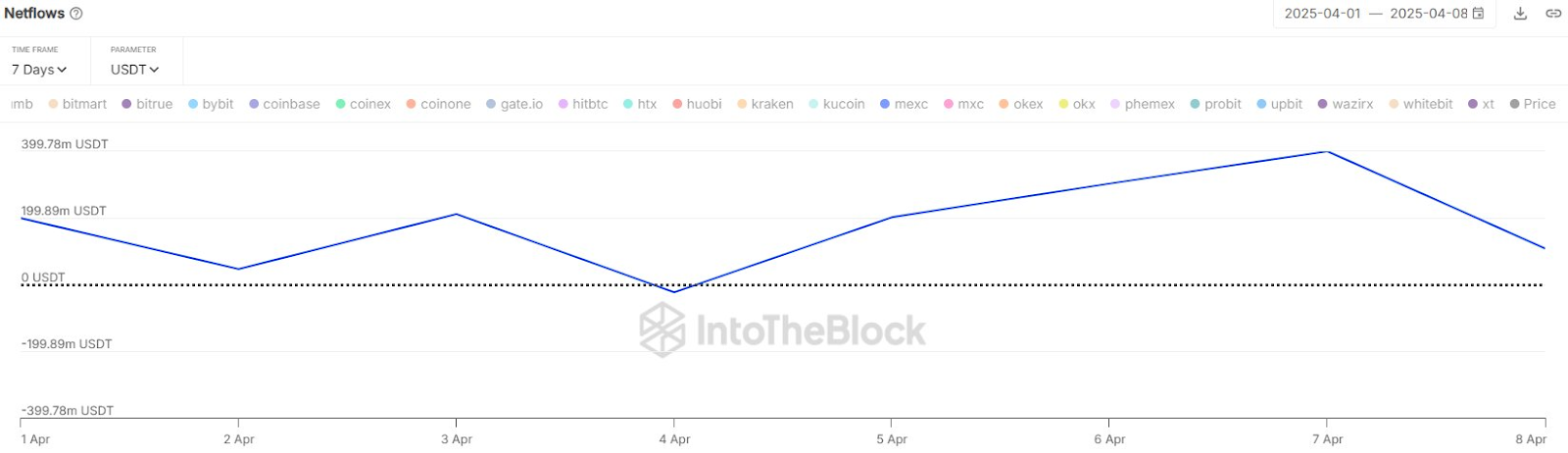

Between April 1 and April 8, over $1.2 billion worth of Tether (USDT) flowed into centralized exchanges, primarily through the Tron blockchain.

This movement suggests active repositioning by crypto traders during the recent market pullback, as per IntoTheBlock.

What Does the Inflow Data Show?

Data from IntoTheBlock shows a steady increase in USDT inflows across major exchanges during the week. The trend peaked on April 7 with a day of strong net positive flow, meaning much more USDT entered exchanges than left.

Specifically, net inflows approached $200 million on April 1, followed by a brief dip. Activity surged again around April 7 before cooling slightly on April 8.

The bulk of these transfers reportedly occurred via the Tron network, a popular choice for stablecoin movements owing to its typically low fees and fast transaction times.

Related: Trump Tariffs Shock Markets: Crypto Loses $100B, Bitcoin Price Unstable

Why Are Traders Moving USDT to Exchanges?

As the leading stablecoin pegged to the U.S. dollar, USDT is commonly held as a trading reserve. Therefore, seeing over $1.2 billion move onto exchanges often points to traders preparing for market activity. Two common interpretations exist: Traders may be looking to ‘buy the dip’ after recent market corrections or or they might need the stablecoins as collateral to cover leveraged long positions threatened by falling prices.

Related: Engineered Recession Response? Theory Swirls as Tariffs Send Markets Reeling

More Activities in Stablecoin Market

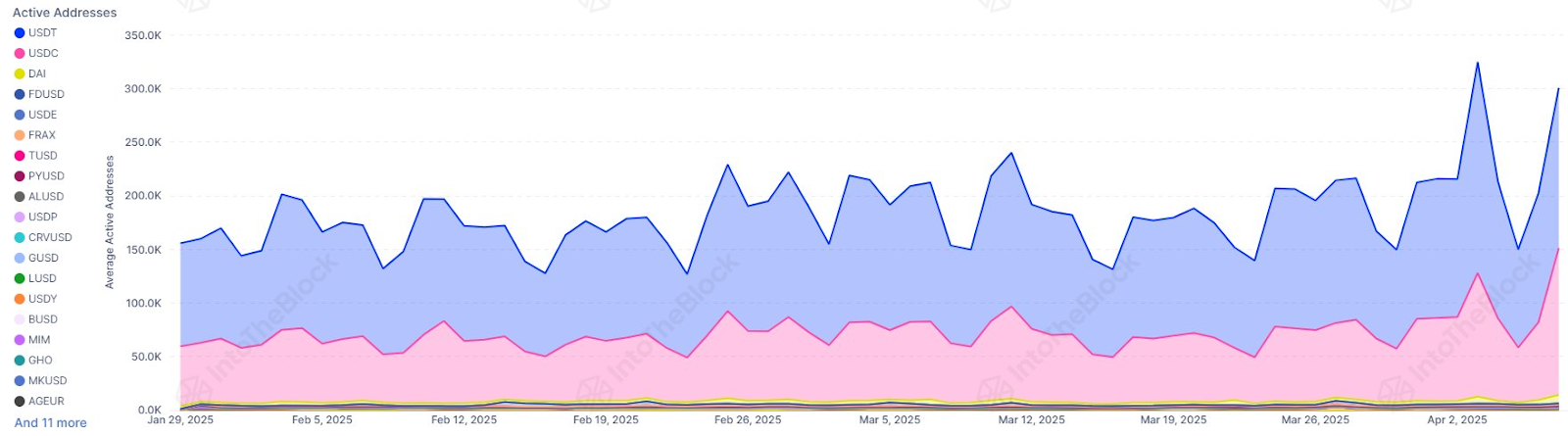

In a separate post, IntoTheBlock revealed that stablecoin activity expanded with daily active addresses surpassing 300,000. Additionally, on-chain volume reached $72 billion yesterday, marking the highest level since February. This general spike highlights increased reliance on stablecoins during volatile market periods.

Market Backdrop: Fear and Recession Worries

The rise in stablecoin inflows highlights increased trading readiness and the strategic role of the Tron network in market operations. As volatility persists, more inflows may follow.

Meanwhile, USDT Inflow may be a result of recession fears triggering a massive sell-off. Over $100 billion was reportedly wiped off the total crypto market cap since the start of April, with Bitcoin dropping near $74,700 and Ethereum testing $1,300 at points during the sell-off.

The downturn follows President Donald Trump’s aggressive tariff policies, and JP Morgan raised the probability of a U.S. recession to 60%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.