- TRX holds near key Fibonacci levels, signaling a potential short-term bullish reversal

- Futures open interest remains steady, reflecting continued trader confidence in TRON

- On-chain inflows suggest renewed accumulation as investors anticipate further recovery

TRON (TRX) is showing early signs of recovery after recent declines, with traders watching closely for confirmation of a short-term reversal. The token trades around $0.3222 as buyers cautiously reenter the market.

After slipping to a local low of $0.2946 earlier this month, TRX has stabilized near crucial retracement zones, suggesting that a technical rebound phase may be underway. The broader structure on the 4-hour chart indicates that while bearish control persists, momentum is gradually shifting toward the bulls.

Price Structure and Key Technical Levels

TRX’s latest rebound aligns with the 38.2% Fibonacci retracement level at $0.3176, marking the first critical resistance area. Higher retracement zones lie near $0.3272 and $0.3360, levels that traders view as decisive for confirming a breakout. The token continues to trade just below the 20-EMA at $0.3193 and the 50-EMA at $0.3237, showing that momentum remains mixed.

If the price holds above $0.3170, a move beyond $0.3270 could trigger a short-term surge toward the $0.3360 resistance cluster. Conversely, failure to maintain this range might lead to renewed weakness toward $0.3070 or even the $0.2946 support zone. Hence, market participants are monitoring these levels closely for signals of sustained direction.

Related: Cardano Price Prediction: ISO 20022 Hype Sparks Attention

Open Interest and Market Activity Trends

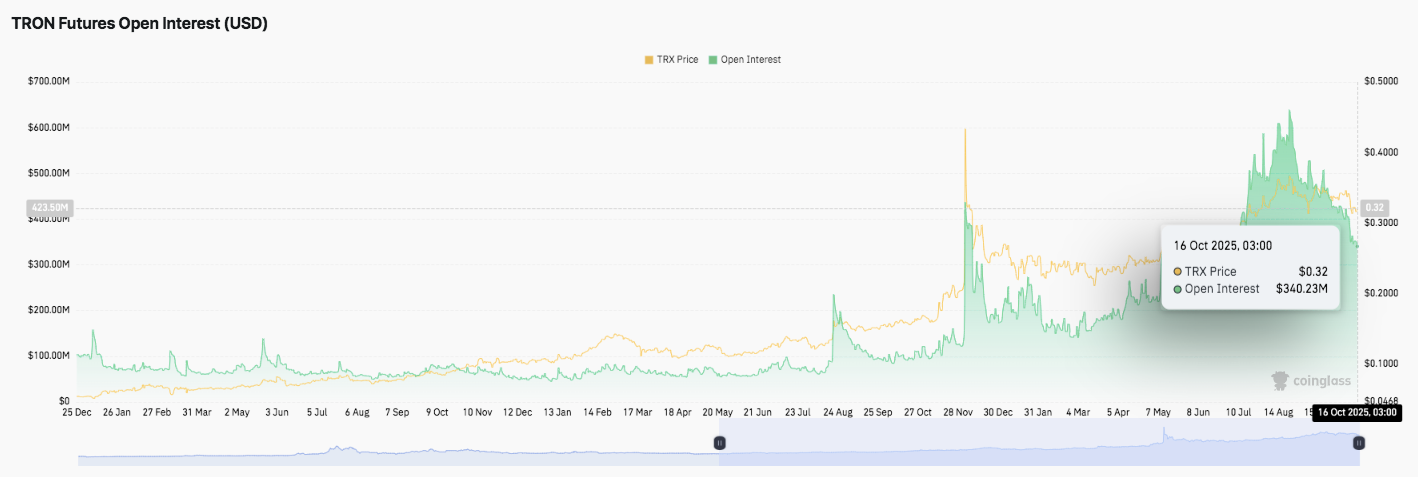

Futures market data shows fluctuating open interest throughout 2025, mirroring shifts in trader confidence. After a quiet first half, activity increased sharply from late June, corresponding with TRX’s price recovery.

The metric peaked above $600 million in mid-August before moderating to $340 million by October 16. This decline, while significant, still reflects healthy speculative participation, suggesting that traders remain active and expect further volatility.

Moreover, consistent interest despite recent corrections signals an ongoing appetite for TRX exposure, likely supported by optimism around TRON’s network stability and transaction efficiency. This resilience in futures positioning underscores the broader market’s readiness for another potential price swing.

Capital Flows Indicate Gradual Accumulation

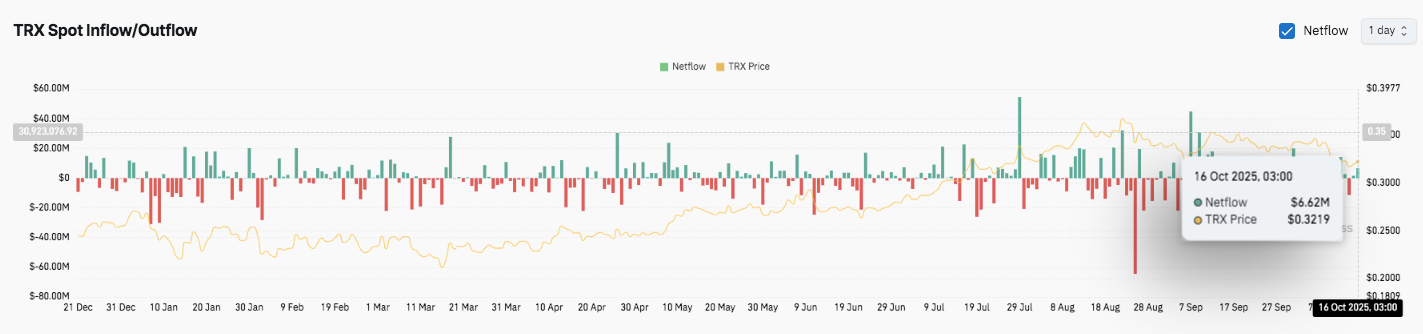

On-chain inflow and outflow data reveal mixed investor behavior across 2025. Positive netflows in April, July, and September indicate strong accumulation phases, while late August outflows reflected profit-taking before consolidation. Notably, TRX recorded a $6.62 million inflow on October 16, coinciding with its current price stabilization.

The steady inflows since early October highlight growing confidence among investors, suggesting that TRX may be entering an accumulation stage ahead of its next decisive move. Consequently, maintaining momentum above $0.3170 could strengthen the recovery outlook and potentially attract new buyers in the coming weeks.

Related: Ethereum Price Prediction: Traders Eye Key Support as BitMine Adds $417M in ETH

Technical Outlook for TRON (TRX) Price

Key levels remain clearly defined heading into late October:

- Upside levels: $0.3237, $0.3272, and $0.3337 as immediate hurdles. A breakout above $0.3337 could extend the recovery toward $0.3420 and $0.3500.

- Downside levels: $0.3170 remains the first support, followed by $0.3070 and $0.2946 (swing low).

- Resistance ceiling: $0.3337 a confluence of the 200-EMA and the 78.6% Fibonacci retracement stands as the critical level to flip for medium-term bullish momentum.

The current structure suggests TRX is compressing within a corrective channel, with volatility tightening under key resistance zones. A decisive close above $0.3272 may confirm a breakout, reinforcing the potential for a short-term reversal phase.

Will TRON Extend Its Rebound?

TRON’s near-term trajectory depends on whether buyers can defend the $0.3170–$0.3200 zone long enough to spark continuation. Sustained inflows since early October and a rebound in open interest support the case for recovery. If bullish momentum strengthens, TRX could retest the $0.3337–$0.3420 resistance cluster and potentially push toward $0.3500.

Failure to maintain the $0.3170 base, however, could expose TRX to deeper retracements toward $0.3070 and $0.2946. For now, TRX remains at a pivotal point its ability to reclaim the 200-EMA will determine whether the market transitions from a corrective rebound to a sustained bullish trend.

Related: Bitcoin (BTC) Price Prediction: Bulls Defend $111K as Analysts See Catch-Up With Gold

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.