- President Trump said that the Fed will not raise interest rates three years from now due to inflation fears.

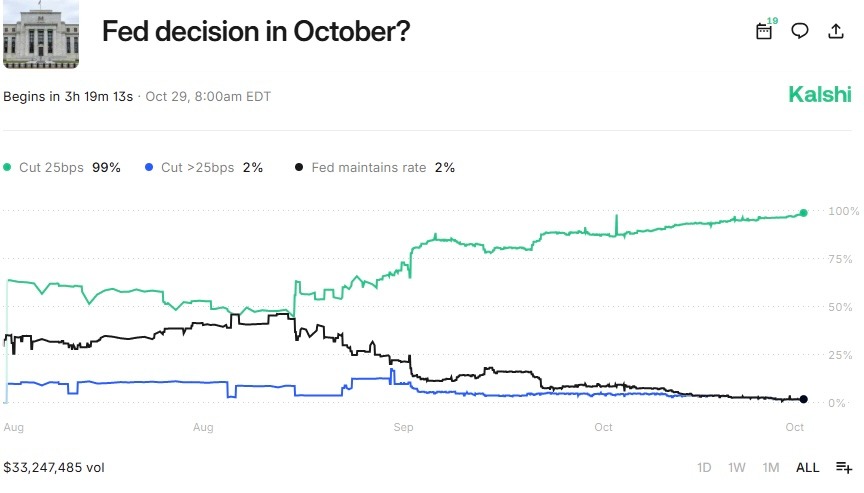

- Investors are betting nearly a 100% chance that the Fed will initiate a 25 bps rate cut.

- Wednesday’s anticipated Fed rate cut will coincide with the ending of its Quantitative Tightening.

President Donald Trump has called on Fed Chair Jerome Powell to initiate another rate cut later today. While speaking to delegates at the Asia-Pacific Economic Cooperation summit, President Trump urged ‘Too Late’ Powell to lower the lending rate to boost economic growth.

According to President Trump, the imposed import tariffs will not be a hindrance to economic growth. Instead, President Trump predicted that the U.S. economy would record a 4% growth in the first quarter of 2026, which is higher than the median economist forecast.

“We will not let the Fed raise interest rates because they are worried about inflation three years from now,” President Trump noted.

Related: Crowd FOMO-Buys Dip, Santiment Warns of ‘More Pain’ Ahead of FOMC Meeting

Investors Bet on 25bps Fed Rate Cut Today and QT End

Following the softer-than-expected U.S. Consumer Price Index (CPI) earlier this week, the odds of a 25 bps Fed rate cut have solidified. According to data from prediction marketplace Kalshi, investors are betting 99% chance that the Fed will initiate a 25 bps rate cut today.

Similarly, Polymarket traders have been betting a 98.3% chance that the Fed will initiate a 25 bps rate cut on Wednesday. Meanwhile, Wall Street analysts led by Wells Fargo have predicted that the Fed will initiate a shift in its monetary policy through kickstarting a Quantitative Easing (QE) after years of shrinking its balance sheet.

What’s the Expected Market Impact on Today’s FOMC Data

Midterm Market Correction as Bullish Momentum Fades

Amid the ongoing U.S. government shutdown, today’s Fed rate cut is likely to have already been priced into the recent crypto rebound. Furthermore, President Trump has been pushing the Fed to make aggressive rate cuts to offset the economic impact of tariffs.

As such, a potential sell-the-news scenario is likely to happen in the coming few days. Investors who have been busy buying the rumors of a potential Fed rate cut are likely to take some profits and distribute them to the oversold markets.

Macro Bull Market Gains Traction

In the long term, today’s potential Fed rate cut and the anticipated end of its Quantitative Tightening (QT) will fuel a bullish outlook. Furthermore, the Fed is expected to print over $1.5 trillion to kickstart its Quantitative Easing (QE) period, which will make it easier for investors to access credit.

Already, the wider crypto market, led by Bitcoin, has been preparing to rally parabolically after Gold signaled a potential cycle top. The capital inflows to the crypto market will increase in the long term, especially through the growing number of spot alt exchange-traded funds (ETFs).

Related: FOMC Day: Bitcoin Stays Strong as Altcoin Catalysts Build with these 4 Altcoins

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.