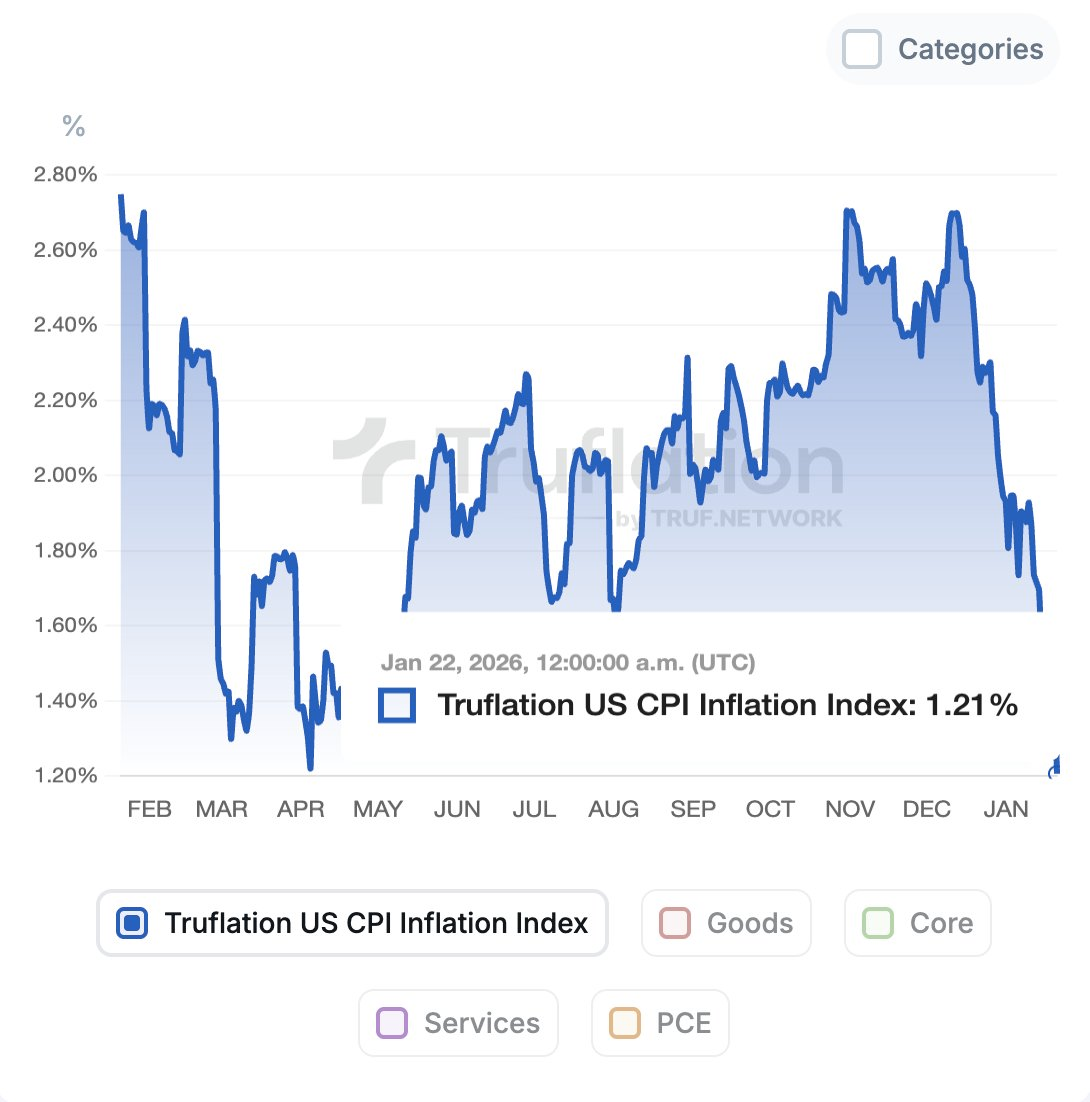

- Inflation drops to 1.21%, signaling cooling price pressures entering 2026.

- Stocks rebound after the U.S. reversed Greenland-related tariffs.

- Supreme Court raises concerns over Fed independence amid governance dispute.

U.S. inflation declined to 1.21% as of Jan. 22, 2026, according to the Truflation U.S. CPI Inflation Index, marking a drop in price growth heading into early 2026. The real-time index tracked volatile inflation trends throughout 2025, with multiple spikes and pullbacks before the latest decline.

The reading comes as U.S. equities rebounded amid a reversal of tariffs tied to tensions over Greenland, reversing a recent market sell-off and easing pressure across equities, bonds, and currencies.

The Truflation index showed inflation above 2.6% at the beginning of the tracked period before falling below 1.5% around March and April. Mid-year data reflected a rebound, with inflation fluctuating between roughly 1.6% and 2.3%.

Toward the end of 2025, inflation pressures rose, peaking near 2.7% in November and December. The latest drop in January signals a cooling in price momentum as we enter 2026, with the index collecting real-time price data across multiple goods and services categories.

Stocks Rebound After Tariff Reversal and Greenland Deal Framework

U.S. equities rose after President Donald Trump said he would not impose tariffs scheduled for Feb. 1 following what he described as a structure for a future deal involving Greenland and the Arctic region.

The Dow Jones Industrial Average rose by 588.64 points (1.21%) to 49,007.23, the S&P 500 gained 1.16% to 6,875.62, and the Nasdaq Composite advanced 1.18% to 23,224.82. Despite the rally, all three indexes remained lower for the week, with the Dow down 0.6%, the S&P 500 down 0.9%, and the Nasdaq down 1.2%.

Following the tariff reversal, the recent “sell America” trade unwound. U.S. Treasury prices rose, and yields declined. Technology stocks, including Nvidia and AMD, led gains as investors returned to growth stocks.

Policy and Legal Developments

Earlier in the week, markets declined after rising tariff threats and uncertainty over possible military actions tied to Greenland.

Separately, U.S. Supreme Court justices questioned whether the president has the authority to remove Federal Reserve Governor Lisa Cook, with Justice Brett Kavanaugh noting that such authority could weaken the Fed’s independence.

Related:Upcoming US CPI Report to Test Fed Rate Cut Hopes After Strong Jobs Data

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.