- Uniswap is now live on X Layer, an Ethereum Layer 2 network built by OKX.

- All swaps on X Layer carry zero Uniswap Labs interface fees at launch.

- Uniswap remains one of the largest DEXs, with over $4 billion in total value locked.

Uniswap has launched on X Layer, an Ethereum Layer 2 network developed by OKX. The deployment enables token swaps and liquidity provision with zero interface fees. Support is live across the Uniswap Web App, Wallet, and Trading API.

Uniswap Expands Its Multichain Footprint

On X, Uniswap Labs noted that the development has expanded its decentralized exchange protocol, adding another network to its growing list of supported blockchains. The launch allows users to swap tokens, provide liquidity, and explore decentralized finance tools directly on X Layer using Uniswap’s existing applications.

X Layer is an Ethereum-compatible Layer 2 built by the OKX crypto exchange. The network brings OKX’s ecosystem on-chain while offering lower transaction costs and faster settlement compared with Ethereum’s main network.

Related: Uniswap Burns 100 Million UNI Tokens as Fee-Burning Upgrade Goes Live

Zero Interface Fees for Swaps

A central feature of the launch is the removal of Uniswap Labs interface fees on X Layer. According to Uniswap Labs, users can execute swaps with zero interface fees across the Uniswap Web App, Uniswap Wallet, and the Uniswap Trading API. Standard network gas fees still apply, but the absence of interface fees reduces the total cost of trading.

This pricing structure applies to every swap conducted through Uniswap’s supported interfaces on X Layer. The move aligns with Uniswap’s efforts to improve accessibility and reduce friction for users across multiple networks.

Access to Core Markets and Liquidity Provision

At launch, Uniswap on X Layer supports core markets, including USDG and other major stablecoins. This enables traders and liquidity providers to access widely used trading pairs immediately, rather than waiting for liquidity to develop over time.

Liquidity providers can supply assets through the Uniswap Pools page by selecting X Layer from the network menu. The process follows the same steps used on other networks, including choosing a token pair, selecting a fee tier, and confirming the transaction.

Liquidity provision remains a key component of Uniswap’s automated market maker model, which relies on pooled assets to facilitate trades.

Trading API Support for Developers

Beyond retail users, Uniswap Labs has extended X Layer support to its Trading API. This allows developers and institutional users to access Uniswap Protocol liquidity on X Layer directly, with zero Uniswap Labs interface fees.

The API integration enables teams to build applications and trading tools that interact with Uniswap liquidity without relying on the consumer-facing apps. Uniswap Labs said teams interested in integrating X Layer through the Trading API can begin the onboarding process immediately.

Uniswap’s Market Position

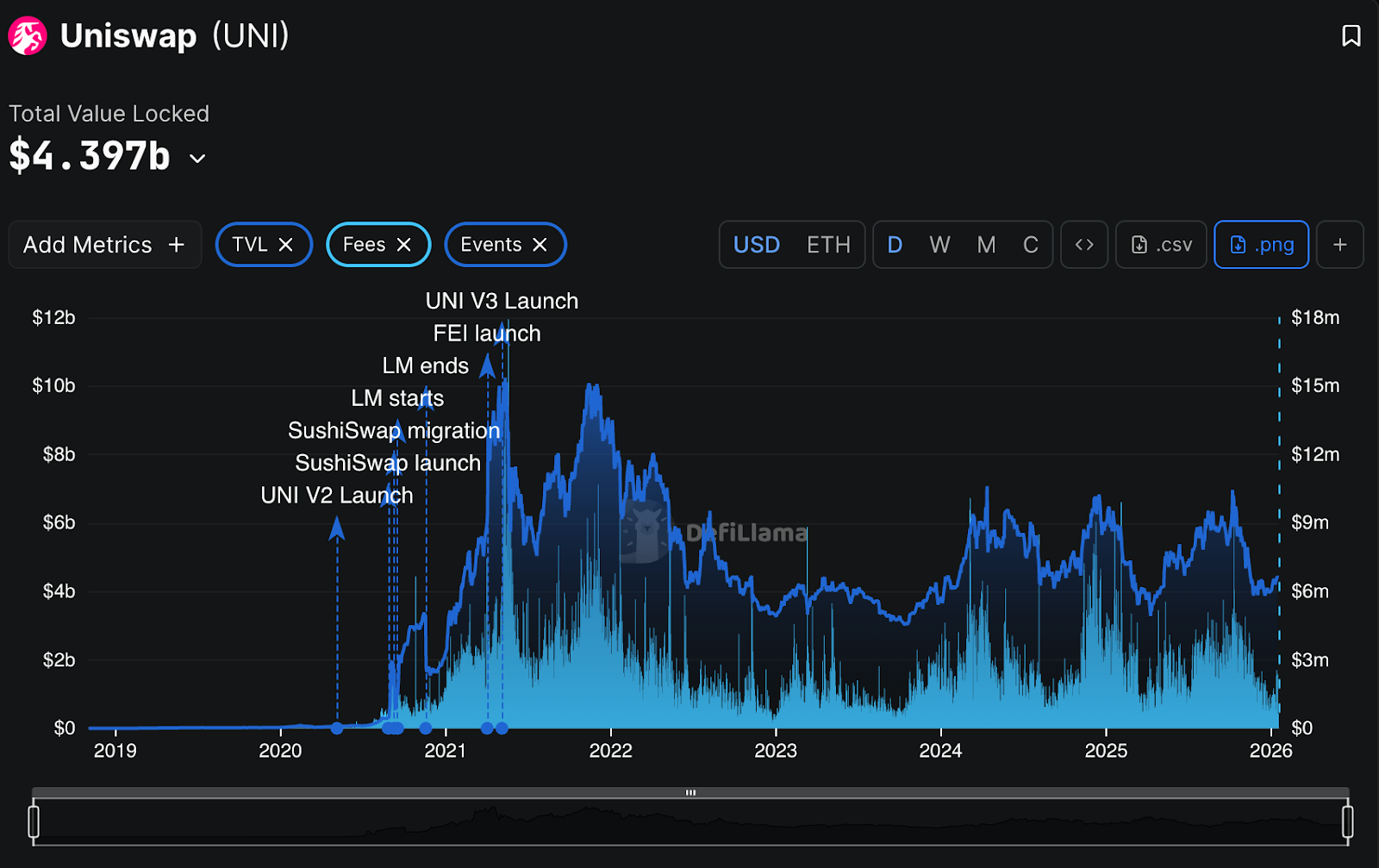

Data from DefiLlama shows Uniswap remains one of the largest decentralized exchange protocols by total value locked. The protocol holds nearly $4.4 billion in total value locked across all supported networks. Ethereum accounts for the largest share, with additional liquidity distributed across Layer 2s and alternative chains.

Source: DefiLlama

Uniswap has also processed significant trading activity over time. DefiLlama data indicates a cumulative trading volume of more than $3 trillion, with tens of billions of dollars traded over the past 30 days. Annualized fees generated by the protocol are estimated at over $515 million, reflecting ongoing usage across its markets.

What Comes Next for X Layer

Uniswap Labs also plans to deploy EIP-7702 delegation contracts on X Layer. These contracts are intended to support one-click transactions and simplify user interactions for applications built on the network.

Related: Uniswap Community Passes UNIfication Proposal With Strong Backing

The launch on X Layer follows Uniswap’s broader multichain expansion, which already includes Ethereum, Base, Arbitrum, and other networks. By integrating with OKX’s Layer 2, Uniswap extends its reach into another on-chain ecosystem as competition among Layer 2 networks continues to increase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.