- Senate Banking Committee moves crypto market structure markup into early 2026.

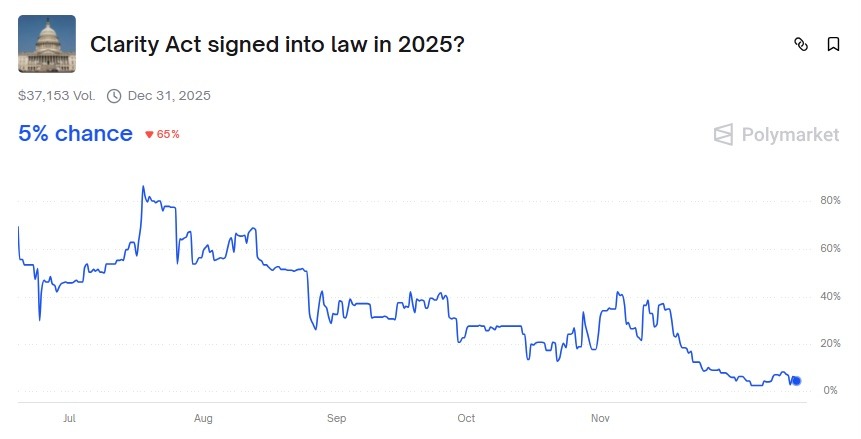

- Polymarket odds for CLARITY in 2025 sit near 5% as of Dec. 15.

- Bitcoin trades near $87,000 as traders reset timelines for US crypto rules.

The United States Senate will not advance the crypto market structure bill before the end of 2025. With year-end holidays just days away, Senate Banking Committee plans now point to early 2026 for a markup.

On Polymarket, the chances of the CLARITY Act getting signed into law in 2025 have dropped from over 87% on July 18, to about 5% on December 16.

U.S. Senate Disappoints Crypto With a Delay in Passing the Clarity Act

The crypto community, both in the United States and global markets, has reset its timeline for a market structure clarity. According to a spokesperson of the U.S. Senate Banking Committee, bipartisan progress has been made on the Clarity Act, but more negotiations are still ongoing.

The Chairman of the Senate Banking Committee Tim Scott has been pushing to align the crypto market structure bill with the Federal policy with no success to-date. Earlier last week, Chair Scott supported President Donald Trump’s executive order to limit the influence of proxy advisory firms.

Related: Senate Committees Set December Vote for Crypto Market Structure Bill

As such, the negotiations impasse with the opposite side of the political divide has slowed down the passing of the Act. Notably, the Clarity Act passed the U.S. House on July 17, 2025, by a vote of 294 to 134, thus sent to the Senate for further consideration.

Crypto Market Bleeds, But Hopes for Relief Rally in 2016 Stands

Following the lack of consensus on the Clarity Act in the U.S. Senate, the hopes for a crypto relief rally before the end of this year have dimmed. Bitcoin (BTC) led the wider crypto market in a mild selloff, amid the palpable fear of a multi-month bear market.

According to market data from CoinMarketCap, the total crypto market had declined by 4.14% to hover around $2.94 trillion at press time. Bitcoin price dropped 5% to trade around $86.3k. Ethereum (ETH) price led the wider altcoin market in a selloff after slipping below $3k again.

The U.S. Senate is however keen to observe a quick timeline for passing the crypto market structure bill in 2026. Moreover, the 2026 midterm elections will be heavily influenced by the 50 million-plus crypto voters, as observed in the main election last year.

The bipartisan consensus will likely come in handy before the 2026 midterm elections, especially if the government funding bill is passed earlier enough. Such a move would boost an anticipated crypto bull market in 2026, as experts lean towards an extended bull cycle catalyzed by the mainstream adoption of digital assets by institutional investors, retail individuals due to the ongoing global crypto legalization.

Related: Senate Set to Confirm Trump’s CFTC and FDIC Picks; ‘CLARITY Act’ to Redefine Crypto Oversight

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.