- USDT price in Venezuela drops 40% since January 7 on peer-to-peer platforms.

- Binance P2P quotes fell from around 800 bolivars to near 500 bolivars.

- Analysts attribute the decline to positive economic expectations, not technical issues.

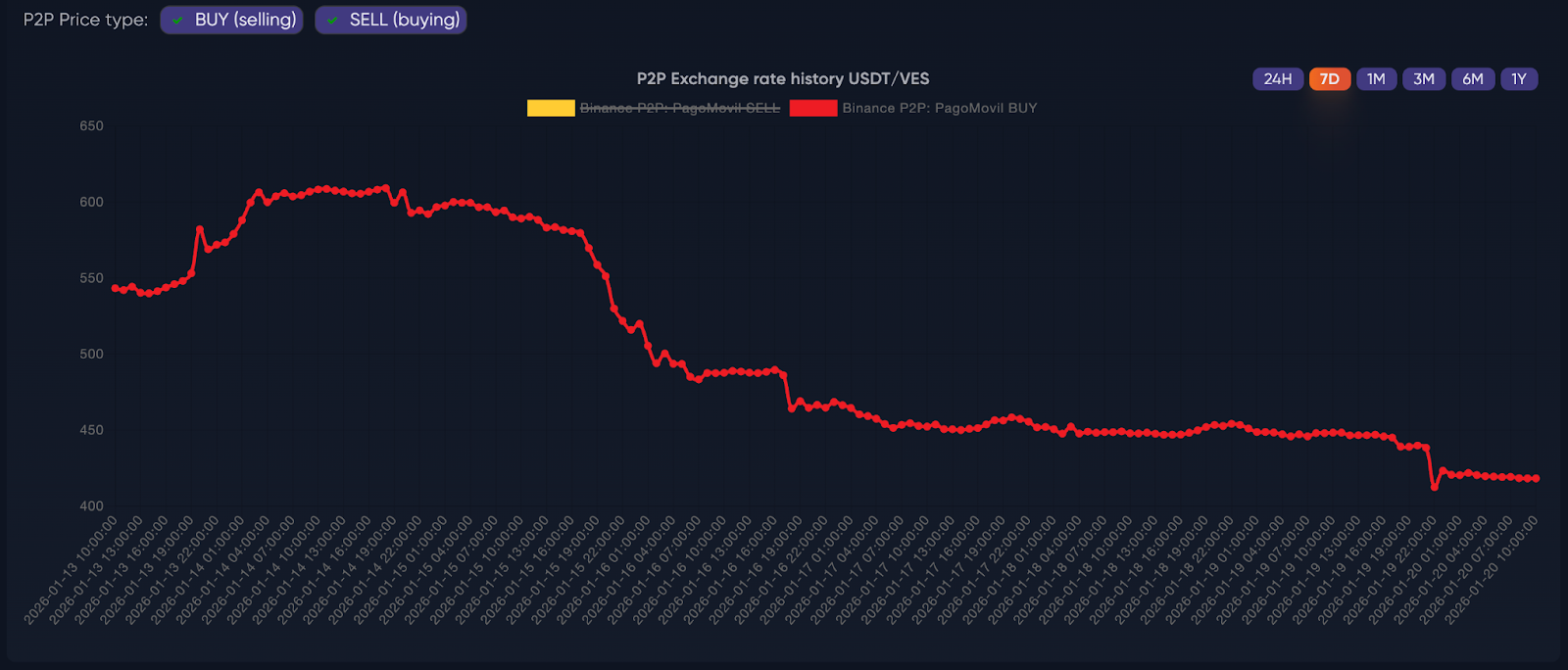

The price of Tether’s USDT stablecoin in Venezuelan bolivars has declined approximately 40% on cryptocurrency exchange platforms since January 7. The drop reverses gains seen at the beginning of the year, returning the rate to levels last observed in December 2025.

Data from P2PArmy shows the digital currency price on Binance’s peer-to-peer market has fallen sharply over the two-week period. Quotes briefly dropped from around 800 bolivars per USDT to near 500 bolivars during the decline. Platforms authorized to operate in Venezuela with digital assets display similar pricing patterns.

Exchange Platforms Show Bolivar Depreciation Against Stablecoins

Kontigo lists USD Coin, the second-largest dollar stablecoin by market capitalization, at 450 bolivars, according to local media verification. Crixto shows USDT pricing around 456 bolivars during the same period. The consistency across multiple platforms suggests broad market movement rather than isolated exchange behavior.

Socioeconomic analysis firm Ecoanalítica stated that dollar-pegged digital currencies have undergone considerable volatility since January. The firm characterized the movement as an “overreaction” to sudden developments rather than fundamental issues with USDT itself.

The phenomenon follows a process known as overshooting or market overreaction. This concept, proposed by economist Rudi Dornbusch, details how large shocks generate real-time expectation adjustments in response to uncertainty. This often produces sharp price movements within hours before markets seek equilibrium.

Positive Economic Expectations Drive Correction

Aníbal Garrido, consultant and director of the Blockchain, Trading and Crypto Academy at Andrés Bello Catholic University, indicated that observers are witnessing a price correction driven by positive expectations. The adjustment stems from potential recovery in Venezuela’s economy, according to Garrido’s analysis.

Market participants perceive a greater possibility of liquidity injections and smoother access to foreign currency through traditional financial systems. When expectations arise for reduced exchange rate gaps, the USDT price tends to adjust based on forward-looking sentiment rather than panic selling.

Garrido advised users to remain calm and make rational, non-emotional decisions to avoid reacting like the masses during high volatility periods. The decline does not originate from technical failures of the digital asset but from changing perceptions among economic participants.

USDT serves as a benchmark for U.S. currency in Venezuelan society despite not being identical to the dollar. The rate is commonly referred to as the “Binance rate” in local commerce.

Related: NYSE Moves Toward 24/7 Markets With Tokenized Stocks on Blockchain

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.