- Michael Van de Poppe says altcoins are close to trend reversals.

- A breakout above key moving averages may occur within 4 to 6 weeks.

- Technical indicators for Wormhole show a bullish divergence and potential for a rally.

Crypto analyst Michael Van de Poppe says altcoins are nearing a crucial moment that could define their next market cycle. In a post on X, Van de Poppe urged traders to position for long exposure once altcoins start breaking their long-term trends.

Van de Poppe noted that most tokens have yet to reclaim key moving averages, which remain an important signal for trend reversals. According to his outlook, this shift is likely to occur within the next four to six weeks, potentially setting the stage for a strong rally across the altcoin market.

Among the leading altcoins expected to break new all-time highs this year are XRP, Cardano, and Dogecoin, which are still trading below their previous cycle peaks.

Chart Shows Key Technical Signals

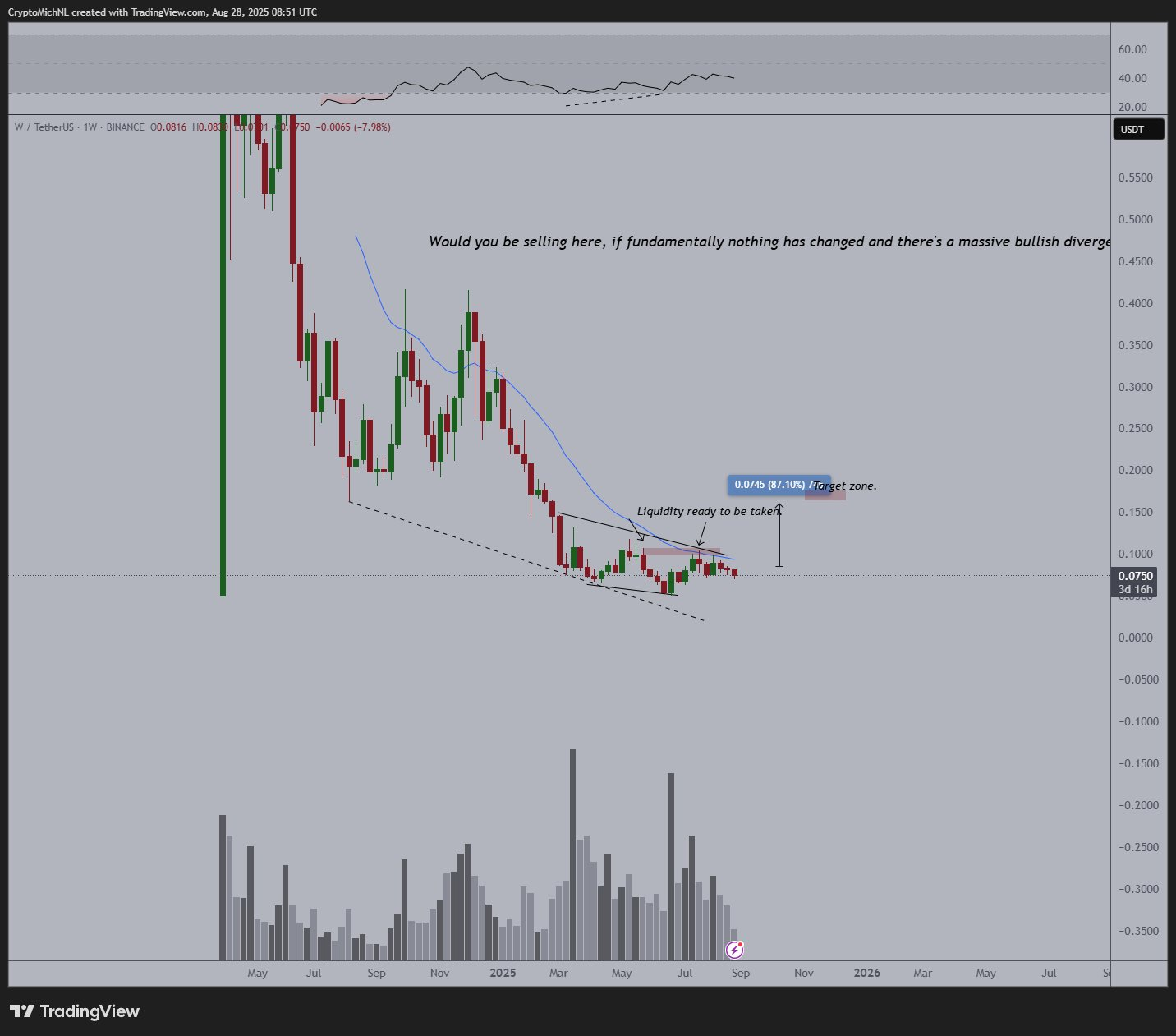

The chart shared by the analyst featured Wormhole (W) trading near $0.075 against USDT on Binance. The weekly chart displayed a falling wedge pattern, a technical setup often associated with market reversals.

Related: Crypto Market Discount: Ethereum, Cardano and XRP Added to September Altcoin List

Despite the prolonged downtrend, the relative strength index (RSI) signaled a bullish divergence, as momentum rose while the price moved lower. Such divergences are often seen as early signs of a potential reversal.

The analysis also pointed to a target zone near $0.15, nearly 87% above the current level for the W token, if the price breaks above resistance. Volume trends in the chart also indicated that selling pressure has slowed, with recent trading activity lighter compared to earlier sell-offs.

Altcoin Season Soon?

In a separate analysis, crypto analyst Giannis Andreou has suggested that the market may be on the brink of a new altcoin season, citing key signals from the TOTAL3/ETH ratio, which measures the performance of altcoins relative to Ethereum.

According to Andreou, this ratio has historically bottomed ahead of strong altcoin rallies, and the current setup mirrors those past cycles. While Ethereum has recently outperformed, Andreou noted that its momentum appears exhausted, with the broader altcoin market cap (TOTAL3) consolidating after a sharp correction.

He emphasized that this consolidation structure has often preceded explosive upward moves, making the risk/reward profile for altcoins the strongest it has been in months, and suggesting that capital rotation into altcoins could drive the next major market leg higher.

Related: Bitcoin’s Market Share Slips as Investors Rotate Capital Into Altcoins

Similarly, analyst Ash Crypto had earlier mentioned that the altcoin season is underway, following Bitcoin’s dominance falling to 57.5%, which broke a two-year, eight-month trendline. He noted that the decline signals a shift in momentum from Bitcoin to altcoins, with Ethereum’s dominance rising to 14.2% and broader altcoin capitalization increasing to 28.3%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.