- Crypto prices rise as Bitcoin leads a broad market rally.

- VanEck issues its first Bitcoin buy signal since the 2025 market bottom.

- Market sentiment improves as more altcoins start outperforming Bitcoin.

The crypto market is showing new life as the year begins, with prices moving higher on January 6, with Bitcoin leading the charge and most altcoins trading in the green.

Bitcoin’s steady rise has helped lift confidence across the market. Unlike past rallies driven solely by Bitcoin, this move is seeing broader participation, with several altcoins outperforming the world’s largest cryptocurrency.

VanEck Flashes Bitcoin Buy Signal

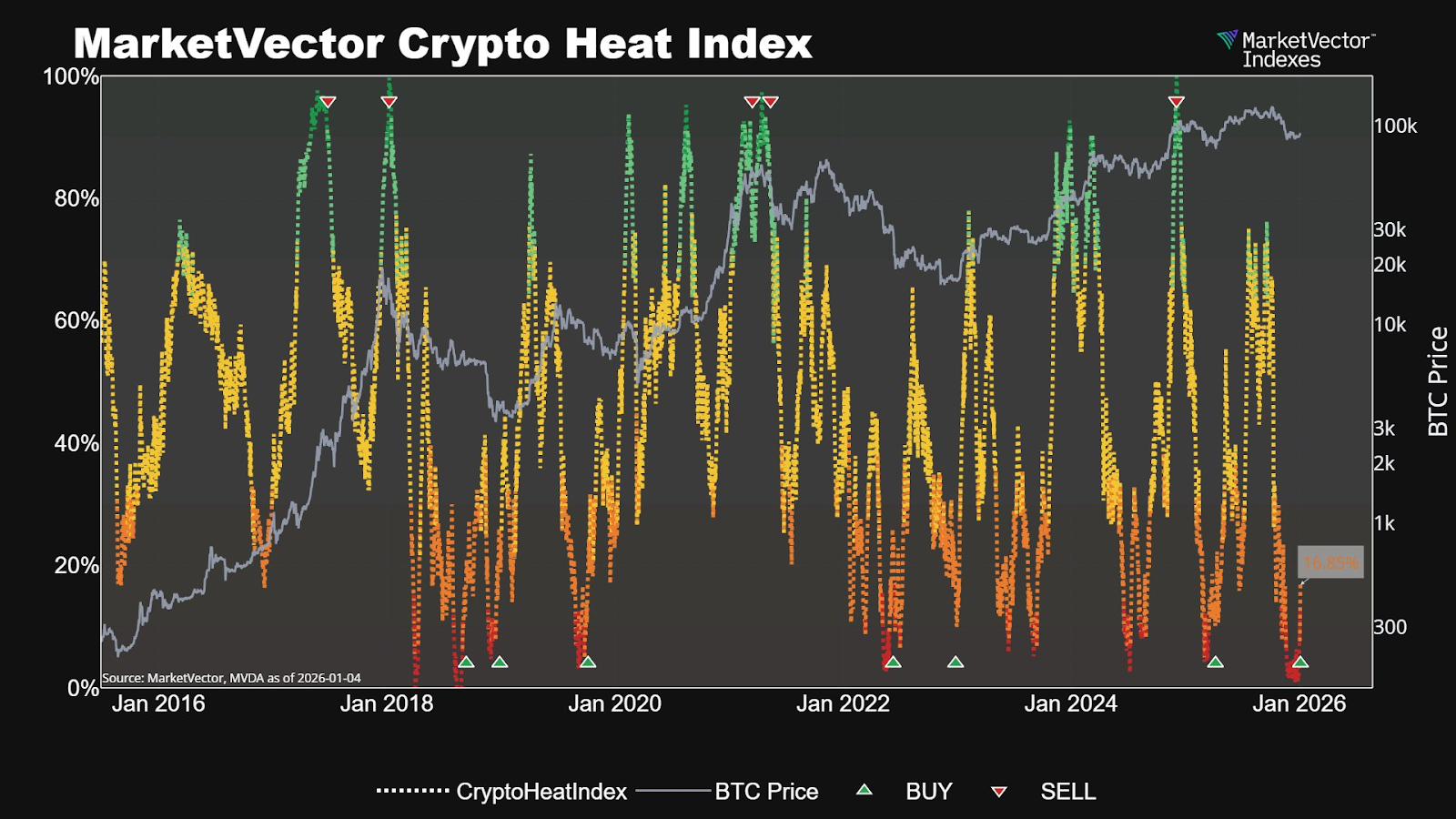

One of the strongest bullish signals came from asset manager VanEck. Matthew Sigel, VanEck’s Head of Digital Assets Research, revealed that the firm’s internal market indicator has issued its first Bitcoin buy signal since April 2025, a period that marked a price bottom. He requoted Martin Leinweber’s tweet.

Leinweber’s said, “Looking across our Top 100 Crypto Index, we’re seeing: Breadth stabilizing, More constituents outperforming Bitcoin, Signs that capitulation-level sentiment may be behind us.”

VanEck’s MarketVector Crypto Heat Index tracks price trends, volume, and overall market participation across the top 100 cryptocurrencies. In the past, similar signals have appeared just before major Bitcoin uptrends began.

Fear Fades as Market Participation Improves

Market sentiment, which stayed deeply negative through much of last year, now appears close to cycle lows. Historically, these moments often create opportunities as selling pressure weakens and buyers slowly step back in.

Leinweber said that investors who stayed on the sidelines may want to rethink their exposure. “For investors still underallocated to crypto, this could be an opportune moment to reassess portfolio exposure rather than react later to price momentum,” he said.

The bigger question now is whether 2026 becomes the year when gains spread beyond Bitcoin into the wider crypto market. Early signs suggest that the shift may already be starting.

Bitcoin Near a Key Price Test

Technically, Bitcoin is entering a crucial zone. Analysts are watching for confirmation of a double-bottom pattern, a setup that has previously led to strong rallies. To confirm it, Bitcoin needs to hold above the low-$92,000 range on higher-time-frame closes. A stronger signal would be if prices remain above the mid-$94,000 level.

If confirmed, analysts say Bitcoin could target the $100,000 to $101,000 range in the near term. Beyond that, the next major resistance sits closer to $106,000.

As prices move higher, short sellers are forced to exit their positions, adding momentum to the rally.

Related: Venezuela’s Hidden Bitcoin Could Trigger a Major Supply Lock-Up

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.