- Venture capitalist Adam Cochran raised doubts about Binance Holding’s accounting system.

- According to Cochran, Binance US, as a regulated entity, failed to generate an audit report for legal proceedings.

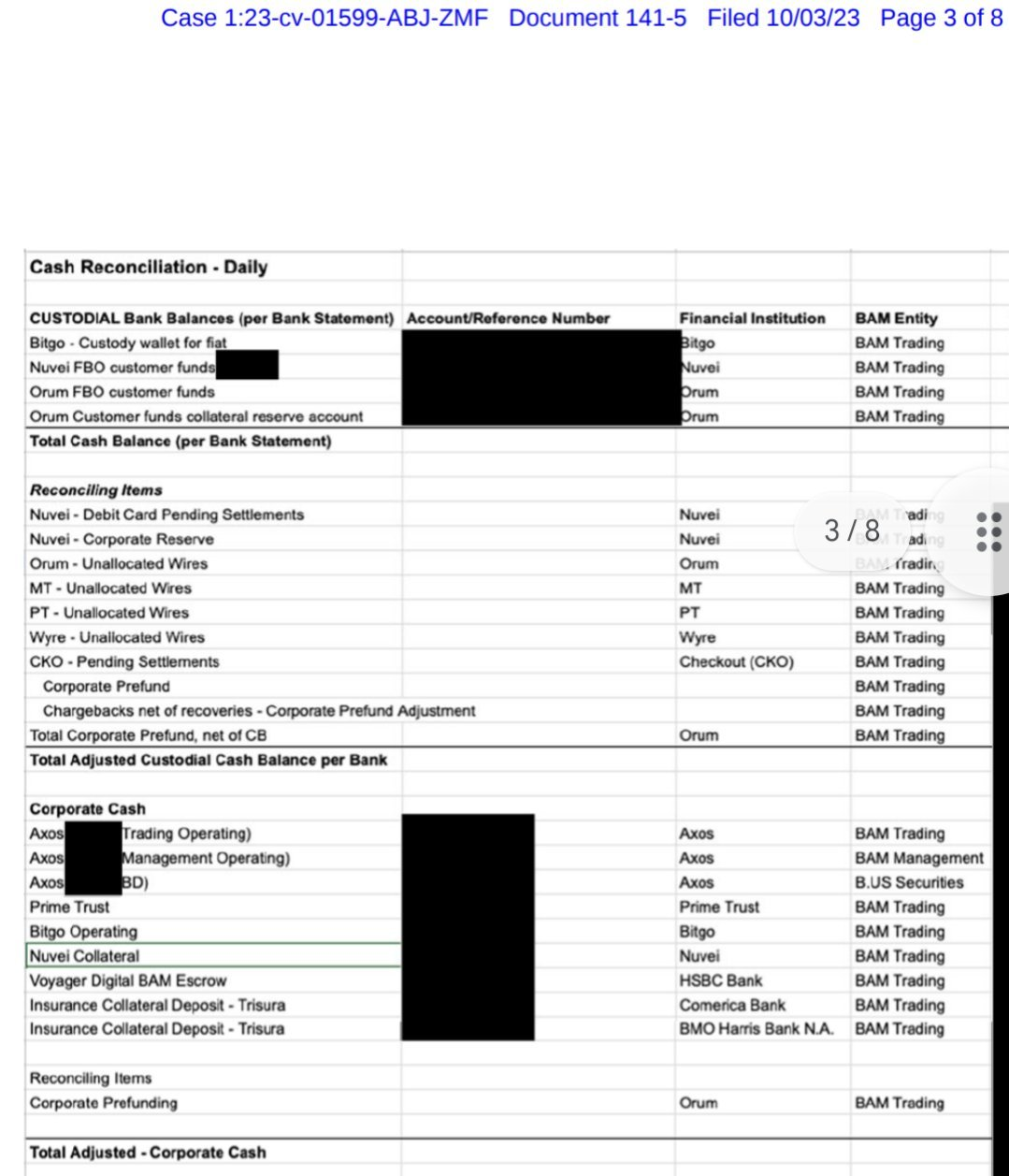

- A post on X highlighted the SEC’s claim that Binance has submitted financial documents without any confirmation or evidence.

Venture capital fund Cinneamhain Ventures partner Adam Cochran recently called out Binance’s U.S. subsidiary for the lack of an accounting system, maintaining minimal records, and struggles to effectively generate an audit report for legal proceedings, despite being “small and regulated.”

This post on X (formerly Twitter) was a reply to a crypto user’s post highlighting the US SEC’s reaction to Binance’s cash reconciliation table. The SEC stated that despite allowing multiple extensions under the Consent Order, BAM Trading Services Inc. refuses to provide relevant information. The regulator noted that BAM had submitted just over 220 documents comprising unclear screenshots of bank account details, documents lacking dates or signatures, and correspondences from legal representatives, as well as “tables that appear to be prepared for purposes of this litigation,” devoid of any evidence.

Cochran emphasized that if Binance US failed to establish a “proper accounting method,” it would be unreasonable to expect Binance Holdings Ltd., which is a global company, to implement an accounting system. He added,

But you think international, with all its cut corners, TUSD deals and Russian shell spin-offs is ok? I’m sure CZ took much more care in his large complex unregulated offshore entity.

Binance and its CEO, Changpeng Zhao are facing multiple lawsuits – including a class-action lawsuit filed for hurting its competitor exchange platform, FTX as a result of a tweet made by Zhao on November 6, 2022. Additionally, a report from the Wall Street Journal cited that Zhao could potentially encounter criminal charges from the U.S. Department of Justice after an extensive investigation.

On the other hand, Bloomberg revealed that according to CCData, once the world’s leading crypto exchange now holds only a 34% share of the market. Moreover, Binance has experienced a significant 57% decrease in its 7-day average trading volume for Bitcoin since the beginning of September.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.