- Ethereum co-founder Vitalik Buterin expresses frustration with the US crypto regulations.

- Buterin addresses the US regulatory framework as an anarcho-tyranny.

- A good-faith engagement from both regulators and industry is needed to tackle the situation.

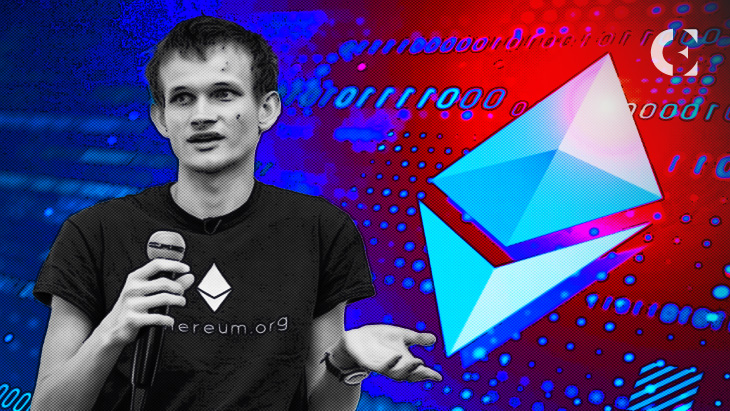

Vitalik Buterin, the co-founder of Ethereum, has recently expressed dissatisfaction with the US crypto regulatory framework, calling it an “anarcho-tyranny.” He advocated for a “good faith engagement” from both regulators and industry to tackle the situation.

Colin Wu, a Chinese crypto journalist, shed light on Buterin’s strong frustration with the regulatory system on the Wu Blockchain page. According to Wu’s post, Buterin criticized the US classification of securities. He reportedly added that the “existing system encourages useless things and vague potential returns.”

Buterin’s comments came in response to a Warpcast user’s thoughts on US regulations. Addressing Buterin, a user named Jason wrote on Warpcast,

This was tweeted during the SBF frontend regulation debate, but even now, I still think all these “regulations” would be extremely helpful to lower the amount of grifters/opportunists and make the industry safer (would be curious to hear your thoughts on them now.

However, Buterin argued against the “safer” industry claims and posited instead that the US crypto regulation is currently worse. He elaborated on the inconvenient and futile regulatory notions, citing,

If you do something useless, or something where you’re asking people to give you money in exchange for vague references to potential returns at best, you are free and clear, but if you try to give your customers a clear story of where returns come from, and promises about what rights they have, then you’re screwed because you’re “a security”.

Further, Buterin clarified the safer side of the regulation, which needs “good-faith engagement, both from regulators and from industry.” He added that issuing a token without giving a clear picture of its long-term potential is riskier, whereas tokens that highlight the long-term story are safer.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.