- Vitalik Buterin disclosed that 36.5% of the Ethereum Foundation’s 2023 budget was allocated to new foundations.

- Buterin’s annual salary is set at SGD 182,000, approximately $134,000, providing transparency on Ethereum’s financial operations.

- Ethereum’s market shows mixed signals with a 4.94% price drop and a 62.47% rise in options trading volume.

Ethereum (ETH) co-founder Vitalik Buterin shared new information about the Ethereum Foundation’s 2023 expenses and his own salary. Buterin, known for influencing the market with his posts, provided a detailed breakdown of the Foundation’s spending.

In a post on his X account, Buterin outlined the primary spending categories. The largest portion; 36.5%, was allocated to “New Foundations,” including organizations such as the Nomic Foundation, The DRC, L2Beat, and 0xPARC. Besides this, investments were directed towards tier-1 research and development, accounting for 24.9% of the budget, and community development, which received 12.7%.

Buterin also disclosed his annual salary, set at SGD 182,000, equivalent to approximately $134,000. This disclosure offers a glimpse into the financial operations of the Ethereum Foundation.

The crypto market reacted to Buterin’s post, and Ethereum is currently trading at $2,589.24, with a 24-hour trading volume of $14.09 billion. The price dropped by 4.94% in the past 24 hours, bringing Ethereum’s market cap to $311.48 billion. Ethereum’s circulating supply stands at 120.30 million ETH coins.

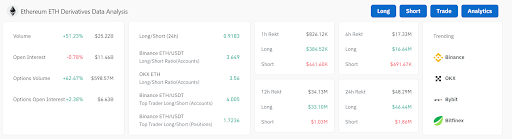

Ethereum derivatives trading data also showed a surge in activity. Trading volume increased by 51.23% to $25.22 billion, although open interest saw a slight decrease. Options trading experienced a substantial 62.47% rise in volume. Additionally, the long/short ratios reflect a generally bullish sentiment, especially on Binance and OKX, where long positions dominate.

However, the overall 24-hour long/short ratio stands at 0.9183, indicating a slight preference for short positions across the market. Binance’s top traders display a strong long bias, suggesting confidence in Ethereum’s potential despite recent price declines.

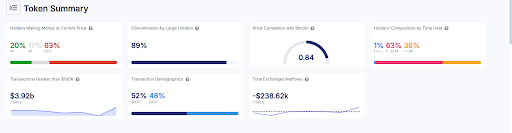

Additionally, Ethereum’s current market status presents mixed signals. ETH trades at $2,588.92, down 2.16% in the last 24 hours, with a market cap of $326.69 billion. Only 20% of holders are currently profiting, while 63% are at a loss. Large holders control 89% of the supply, signifying high centralization. Moreover, ETH shows a strong correlation (0.84) with Bitcoin’s price movements.

Despite short-term bearish trends, the data indicates ongoing interest and potential for Ethereum in the broader market. The negative exchange net flow of $238.62K over the past week may hint at accumulation. Therefore, these metrics would suggest Ethereum remains a key player in the crypto market, with its future outlook closely tied to broader market conditions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.