- Glassnode released the first edition of the Week On-Chain Newsletter to discuss the volatility slumber of Bitcoin and Ether.

- The platform discussed the realized volatility of both coins.

- It concluded that on-chain activity for the two majors remains extremely weak.

The on-chain market intelligence platform Glassnode published the article “A Volatility Slumber” as the first edition of its Week On-Chain Newsletter, to provide insight into the stagnant condition of crypto, especially Ethereum and Bitcoin.

Mainly, the platform discussed three significant points including the “extremely low realized volatility,” “softness in on-chain activity for BTC and ETH,” and “drawdowns in the realized cap”.

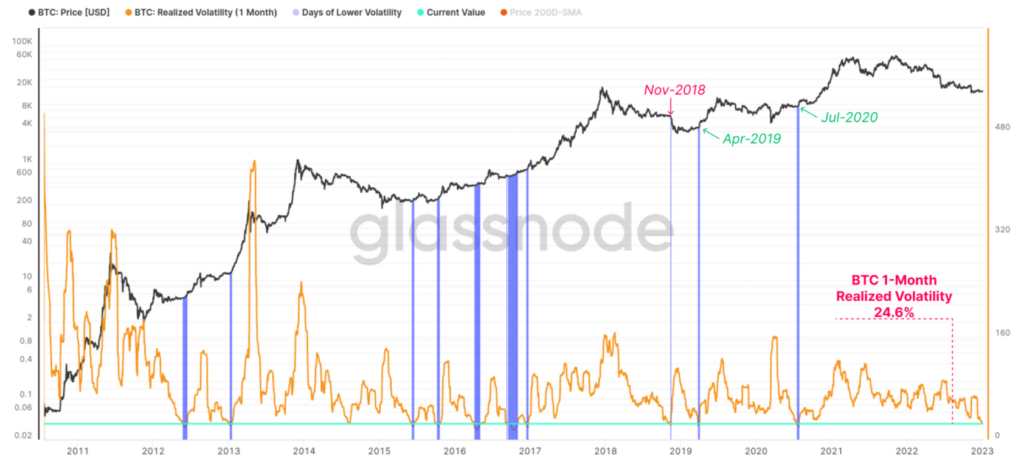

Notably, Glassnode pictured the overall performance of both Bitcoin and Ethereum. After the low volatility week, the realized volatility over the last month for BTC declined to multi-year lows of 24.6%.

Specifically, the platform drew focus on the early bull market in 2012-13, and the late bear market in 2015, when the performance of BTC was quite bearish. In addition, the cases in the years 2018, 2019, and 2020 were also discussed.

Similarly, there were some quiet periods for ETH, which witnessed monthly realized volatility collapse to 39.8%. Generally, such stagnant periods were preceded by extreme volatility as in the years 2018 and 2020.

Further, Glassnode went on to narrate the effects of the fall of the once-prominent crypto firm FTX in the short-term burst of Bitcoin’s new addresses.

The monthly average of New Addresses is returning towards the yearly average baseline, indicating that network usage is yet to establish a convincing and sustained recovery.

Overall, the platform has covered all the details regarding the performance of Bitcoin and Ethereum including the New Address Volume, the Total Transfer Volume, the Relative Transfer Volume, Ethereum Gas Usage, etc.

In conclusion, the platform said that the on-chain activity for the two majors remains extremely weak, despite a short-term bump following FTX.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.