- On-chain data suggests whales may soon begin accumulating BTC, USDT, and USDC.

- This signals a bullish trend despite the current market downtrend.

- Shark and whale holdings of Bitcoin have reached a six-year low.

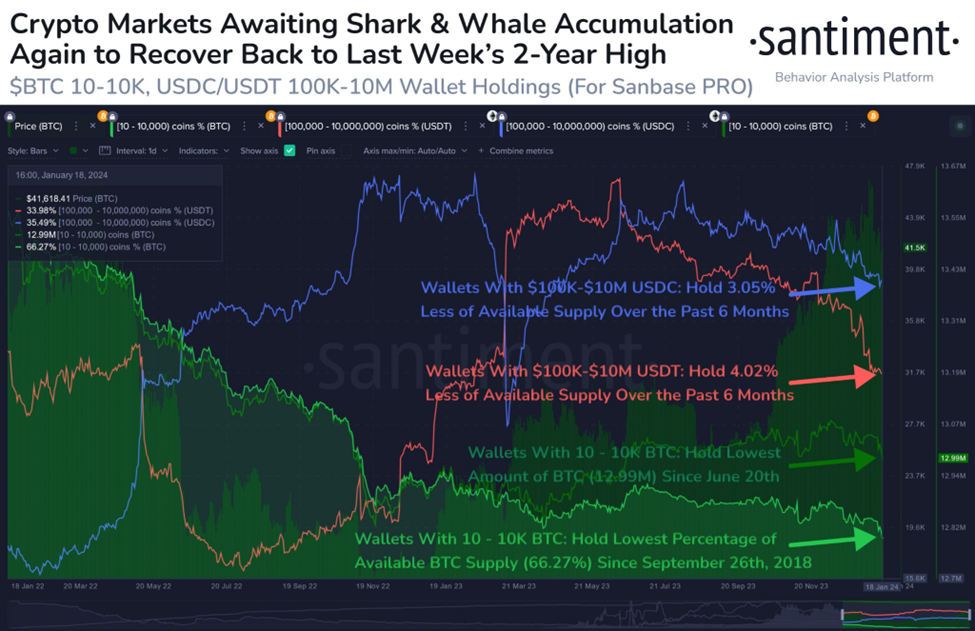

Amid the current bearish trend sweeping through the crypto market, leading market intelligence platform Santiment has identified a potential key bullish signal. Santiment sees the optimistic signal in the potential activities of influential investors of Bitcoin (BTC), Tether (USDT), and USD Coin (USDC). In a recent tweet, Santiment highlighted that whale accumulation of Bitcoin, USDT, and USDC could be a crucial indicator for a possible recovery.

The market sentiment analysis suggested that strategic accumulation by large holders may pave the way for a bullish reversal to reclaim last week’s 2-year high. It examined the current distribution tiers for Bitcoin and the top stablecoins, revealing a slight downturn in the shark and whale holdings.

Specifically, Santiment’s analysis highlighted that wallets with 10-10K Bitcoin (BTC) presently constitute 66.27% of the total supply. This marked the lowest percentage since September 26, 2018.

Meanwhile, the report underscored that the current supply represents the smallest quantity of BTC since June 20, 2023, with 12.99 million BTC. Notably, these tokens hold a market value exceeding $530 billion.

Similarly, the shark and whale tiers for Tether (USDT) and USD Coin (USDC) showed interesting dynamics. Wallets holding 100,000 to 10 million USDT represent 33.98% of the supply. Those holding 100,000 to 10 million USDC account for 35.49% of the supply. Over the past six months, these wallets have decreased their holdings by 4.02% and 3.05%, respectively.

Despite the current bearish trend, Santiment remains optimistic about the potential for another bull cycle, as witnessed in late 2023. Significantly, with the Bitcoin halving just under 14 weeks away, whales’ accumulation of BTC, USDT, and USDC is a key indicator that many traders are closely watching.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.