- BTC has been showing signs of exhaustion after its recent rally.

- The token’s short-term retracement could be seen as bearish.

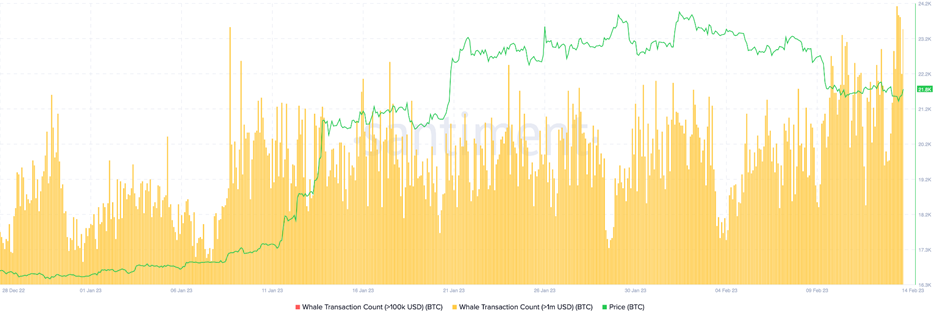

- The Whale Transaction Count metric indicates a considerable spike despite BTC’s price tanking.

The price of Bitcoin (BTC) has been showing signs of exhaustion after its rather successful move in 2023. Despite this, however, it seems like whales have been buying the dip.

BTC’s short-term retracement could be seen as bearish, but the opinion of the whales differs. The 2023 bull rally was able to produce a higher high above the November 5 swing high at $21,480, which caused a shift in market structure on the daily timeframe. This move could cause the start of an uptrend, and BTC’s current bearish case could thus be seen as just a retracement.

The whales seem to agree with this theory as the Whale Transaction Count metric indicates a considerable spike despite BTC’s price tanking. If this metric indicates a spike after a sell-off, it could indicate that the whales are trying to buy the dip, which might be the case at the moment. This large transaction metric saw an increase from 150 to 280 over the last five days.

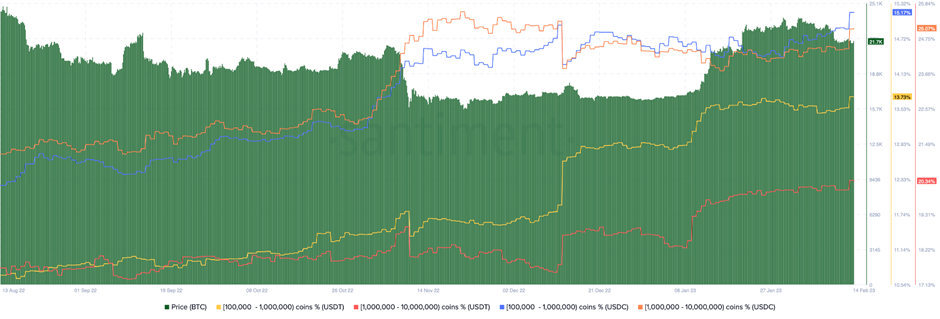

To add more merit to the whales’ theory is the number of stablecoins they hold. The last time whales holding stablecoins spiked was in late December 2022, before BTC kick-started a 49% upswing in the following month.

At the moment, the amount of Tether (USDT) and Circle (USDC) whales holding between 100,000 to 10,000,000 stablecoins saw a spike over the last two days. This also supports the idea that the whales are buying the dip.

BTC is currently trading hands at $21,748.48 after a 0.40% drop in price over the last 24 hours. The crypto king is also still in the red by more than 5% over the last week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.