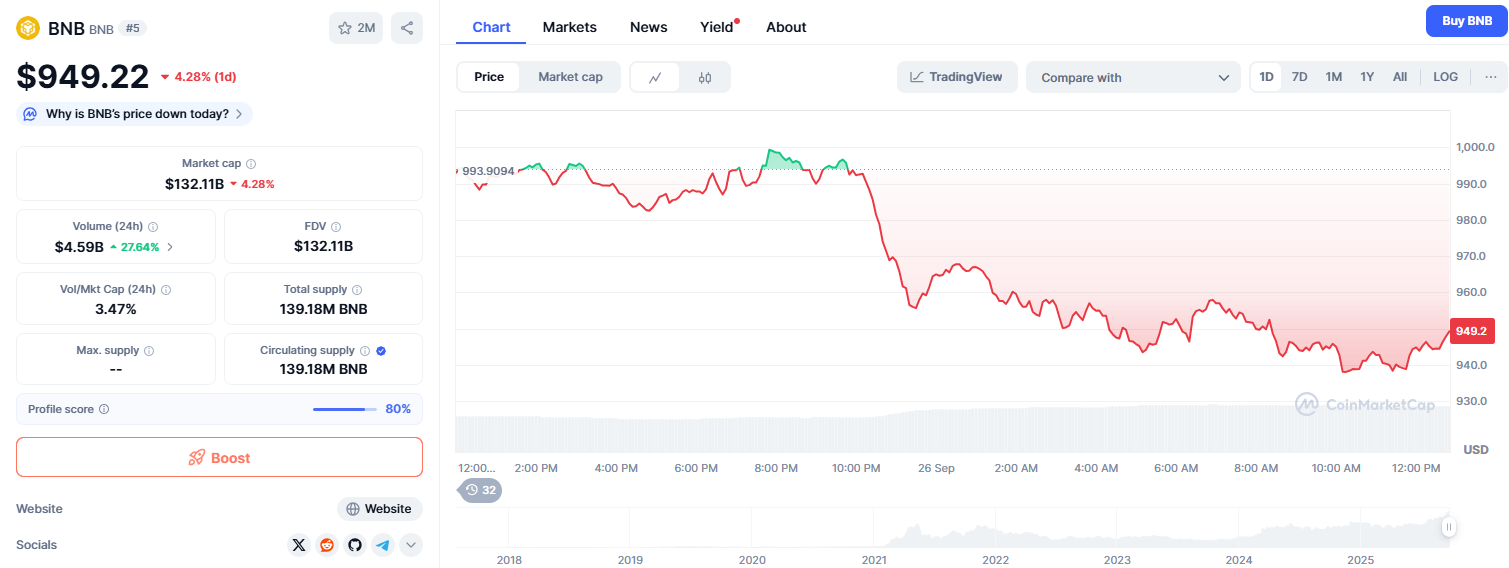

- BNB dropped to trade under $950 after losing $1,000 support, with $945 now the key level to defend.

- MACD flattening and RSI near 70 suggest fading momentum and risk of deeper correction.

- ETF outflows of $360M BTC and $120M ETH mirror the cautious mood weighing on BNB price.

Binance Coin (BNB) has come under renewed pressure, sliding toward $955 as part of a broader market pullback.

James Seyffart, an analyst at Bloomberg Intelligence, noted on Bankless that BNB is still absent from top crypto ETFs, even as peers such as Cardano (ADA) gain traction with fund managers.

That gap matters. ETF inclusion often signals a form of legitimacy and tends to funnel long-term institutional flows. Without it, BNB remains dependent on spot market demand just as Bitcoin and Ethereum ETFs record steady outflows.

According to Bitget, U.S. spot Bitcoin funds lost 3,211 BTC (roughly $360 million), while Ethereum ETFs shed 25,851 ETH (about $120 million) on September 24.

BNB Price Action Tests Support

BNB began trading near $1,017 but quickly encountered selling pressure during the session. Intraday supports around $1,000 and $980 failed to hold, driving the price down to a low near $945.

The token later rebounded slightly but closed at $967.29, representing a 4.79% decline on the day. Traders should monitor the $945 level closely, as a decisive breach could open the door for a further drop toward the $930–$940 demand zone. Conversely, overcoming the $980 resistance and reclaiming $1,000 on a daily close could neutralize near-term bearish momentum.

Technical Indicators Suggest Short-Term Strain

Momentum indicators show that BNB faces some near-term pressure. The MACD line remains above zero but has flattened, indicating fading upward strength. Similarly, the 14-day RSI sits at 69.83, close to overbought territory, suggesting that recent gains may require consolidation.

Additionally, 24-hour trading volume reached $4.31 billion, up nearly 17% from the previous day, which confirms that selling momentum has intensified. Hence, buyers need a strong rebound to counter the current downward trend.

Market Sentiment and Institutional Factors

ETF redemptions highlight the cautious stance of institutional investors, who are waiting for clarity on Federal Reserve policy before committing fresh capital. BNB’s slide, then, is less about its own fundamentals and more about the environment it trades in.

Until broader flows stabilize, BNB’s struggle to defend $1,000 will mirror the market’s unease rather than a project-specific setback.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.