- Within an eight-year timeframe, Bitcoin generated returns exceeding seven times those of gold and surpassing eight times the returns of stocks.

- DCA (dollar cost averaging) is a good option for both beginners and experts, but it isn’t without faults.

- It’s the preferred investment strategy for a majority of crypto investors, with 59% utilizing it as their primary approach.

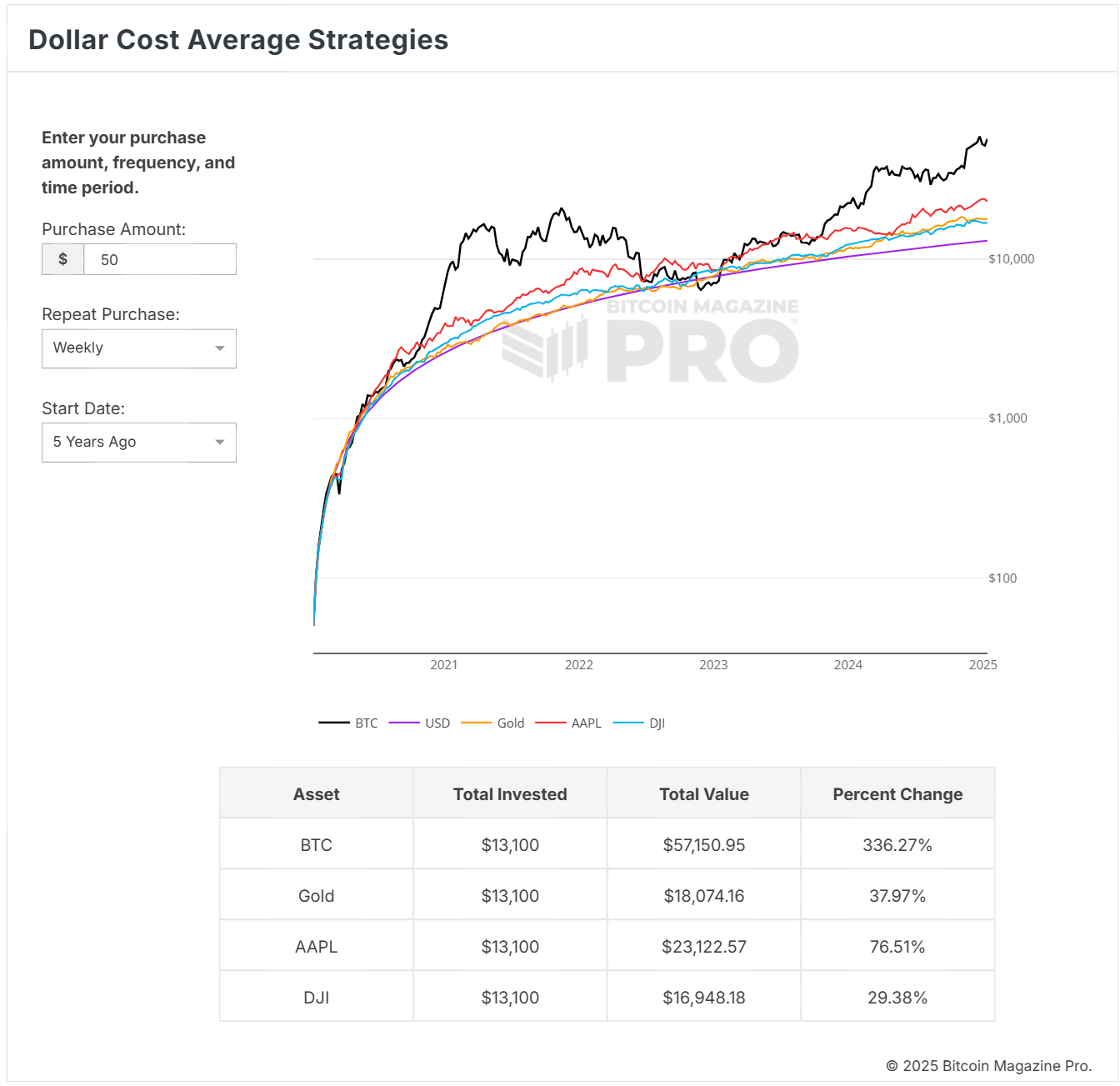

With the price of Bitcoin hovering around 93k, there isn’t a shortage of conversations about its consistently rising value. So what if you jumped on board in 2017 and DCA-ed (consistently investing a predetermined sum of money in a specific asset, irrespective of its current market price) $25 every week?

Spoiler alert: you’d have a whole lot of money now. What’s more, in those 8 years, Bitcoin would surpass gold and stocks in ROI.

Let’s break it down. Starting in 2017, if you DCA-ed $25 a week, you’d now have approximately a $10,450 investment. As such, your investment would return roughly $16,946.00 in gold or around $15,358.23 in stocks.

However, for Bitcoin, it would be a whopping $133,689.39! That’s 8 times more than the returns of stocks and 7 times more compared to gold. While this is a ‘what if’ situation, it does show the huge growth of Bitcoin over the years, and the potential of dollar cost averaging.

If you want to see for yourself and play around with different time spans and investment levels, check out this chart here.

What is DCA good for?

The main use of DCA is to reduce market volatility since investing a fixed amount at regular intervals helps smooth out the impact of market fluctuations.

It’s also newbie-friendly because it simplifies investing, making it accessible even to those without extensive market knowledge or experience. Furthermore, DCA eliminates the need for constant market monitoring and obsessing if the market is doing well.

As such, it became a popular strategy, with last year’s survey showing that a substantial 59% of crypto investors prioritize dollar-cost averaging as their primary investment strategy.

Do note though that DCA doesn’t offer guarantees of any sort, and it’s possible that you could miss out on higher returns if the market consistently rises during your investment period. Hence, it isn’t for everyone.

That being said, if you decide to experiment with DCA in crypto, start by selecting the cryptocurrency you wish to invest in. Next, establish your investment budget and the frequency of your contributions. In addition, make sure to conduct a thorough assessment of your financial situation, as well as any research needed.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.