- Chainlink has attracted more whale investors in the recent past following its partnership with the U.S. government.

- Hoskinson joins ADA holders in criticizing CF over missed LayerZero, Chainlink deals.

- Crypto analysts are expecting a blow-off altseason before the end of this year.

The altcoin market holders have been expecting a major bull rally before the end of 2025. The rising odds of a Federal Reserve interest rate cut on September 17, currently over 85% on Kalshi and Polymarket, have increased the chances of a crypto parabolic bull rally akin to the 2017 end-of-year rally.

As such, the capital rotation to TOTAL3 altcoins, which excludes Ethereum (ETH), is expected to increase in the coming weeks. Consequently, Cardano (ADA) and Chainlink (LINK) are well-positioned to gain a bullish trend but at different paces, since they have robust fundamentals and are still undervalued.

Which of the Two Altcoins (Cardano and Chainlink) Has Stronger Fundamentals?

Why Are Whales Buying More Chainlink?

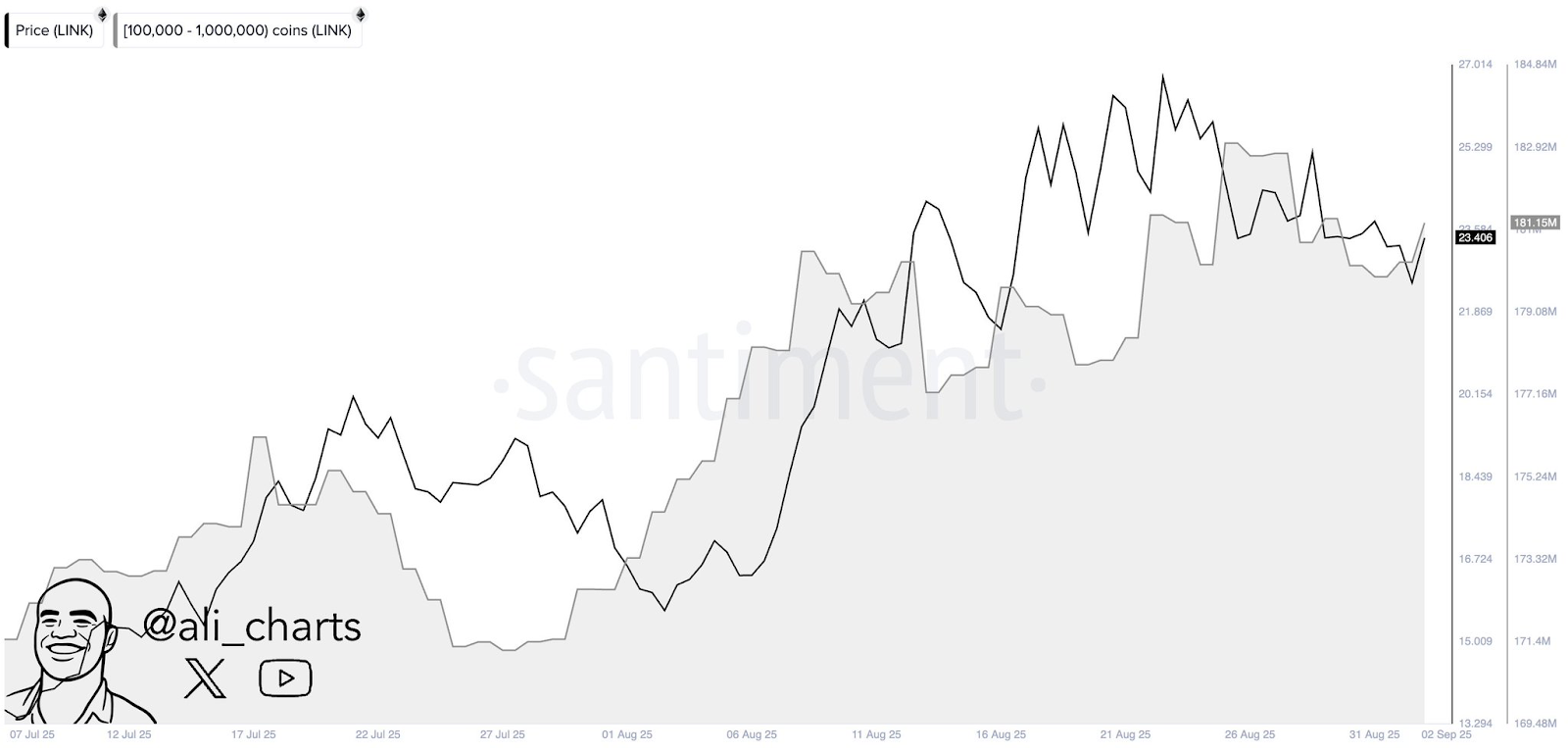

According to on-chain data analysis, the Chainlink network has attracted more whales during the past few days. For instance, Chainlink wallets, with an address balance of between 100k and 1 million coins, have loaded up more than 1.25 million LINK coins during the past week, thus increasing their total to 181.5 million coins.

The notable demand for LINK is proportional to its robust fundamentals. For instance, the Chainlink network was recently selected by the U.S. Department of Commerce, through the Bureau of Economic Analysis (BEA), to facilitate cross-chain onboarding of the country’s macroeconomic data, including GDP. With dozens of strategic integrations in the DeFi space, LINK adoption by whale investors has grown significantly.

Why are Cardano Whales Selling?

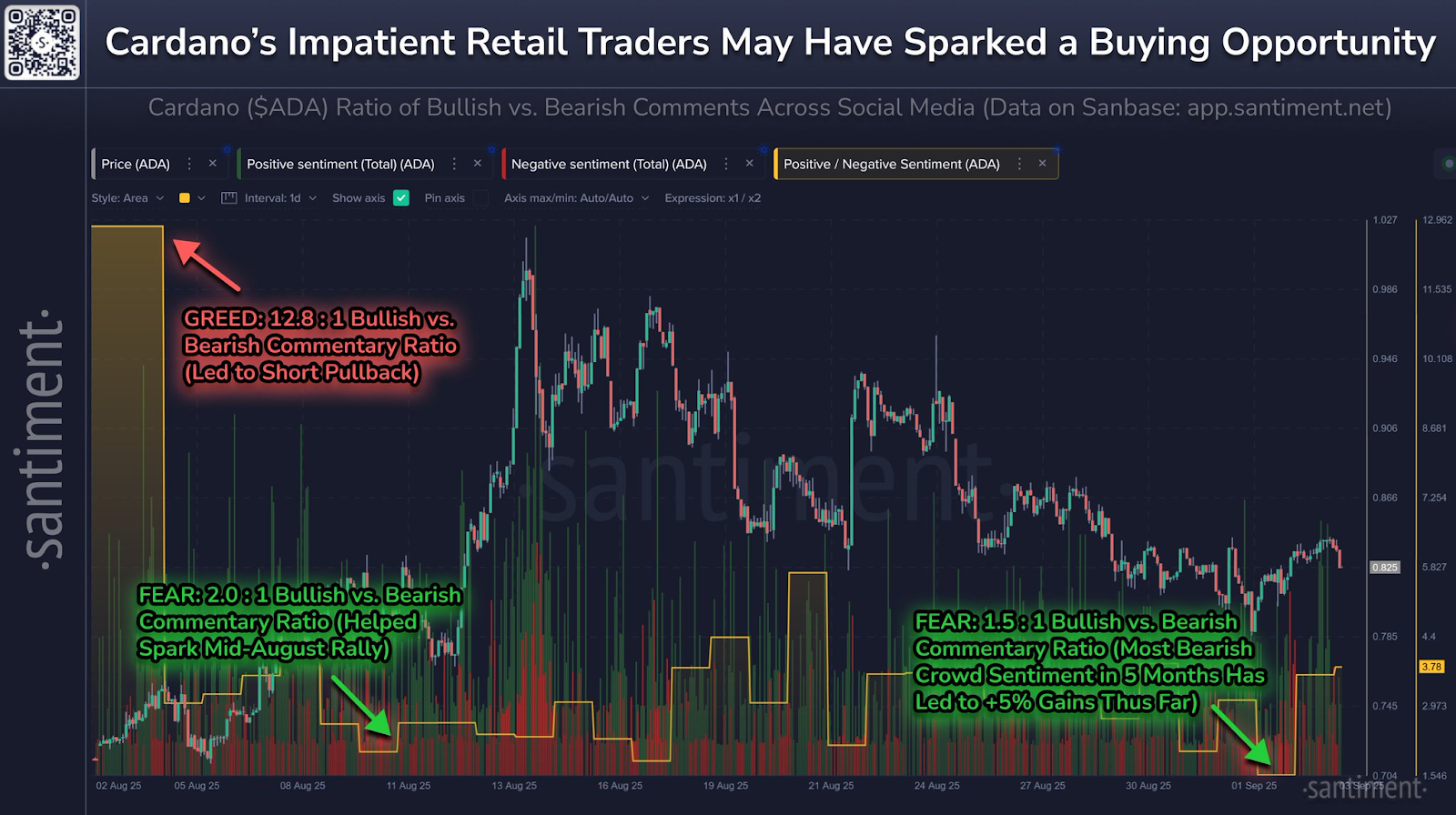

The Cardano community has suffered several FUD (Fear Uncertainty, and Doubt) events in the past few months. As a result, market data analysis from Santiment shows the ADA holders have bought into the fear of peak FUD in the past five months.

Cardano’s founder, Charles Hoskinson, recently joined the ADA holders in condemning the Cardano Foundation (CF) for failing to secure crucial network integrations led by LayerZero and Chainlink. Consequently, Cardano wallets, with a balance of between 1 million and 10 million ADA, sold 30 million coins during the last few days.

Nonetheless, Cardano stays optimistic following Midnight’s Aug 2025 airdrop, with the Leios upgrade slated for 2026. Furthermore, the recent audit report regarding the ADA Voucher program has helped restore confidence in Cardano’s leadership.

Key Takeaway: LINK Poised to Outpace ADA

Based on the available information, LINK price has a higher chance of outpacing ADA price in the upcoming months. Moreover, LINK has stronger fundamentals and a fully diluted valuation (FDV) of about $22 billion with a 24-hour average trading volume of around $982M.

On the other hand, Cardano’s ADA has struggled with crucial fundamentals, although it is anticipating major network upgrades, and has recorded an FDV of about $37 billion. Historically, crypto prices, led by Bitcoin, have recorded diminishing returns, fueled by rising competition in the wider Web3 space.

Related: Cardano (ADA) Defends Critical $0.80 Support as Analysts Outline Long-Term Bull Case

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.