- The crypto market has continued to underperform the precious metal industry in the recent past.

- The ongoing geopolitical tension between the US and NATO members is the primary driver.

- Gold overtakes the dollar as reserves shift, setting the stage for BTC rotation.

The divergence between the crypto market and the precious metal industry has surged. During the past two days, the total crypto market has dropped by over 2% to hover about $3.09 trillion at press time.

On the other hand, Gold and Silver prices have led the wider precious metal industry in a bullish outlook during the past few days. On Tuesday, the gold price surged over 1%, reaching a new ATH above $4,700 per ounce.

Silver price has surged nearly 6% during the past 24 hours to trade above $95 per ounce.

Main Reasons Why Gold and Silver are Outperforming Crypto

Geopolitical Tensions and Tariff Fears

The main reason why Gold and Silver prices have outshone the wider crypto space in the past few days is the rising global geopolitical tensions. Notably, the United States and the rest of the NATO countries have been at loggerheads over Greenland.

Meanwhile, Russia has escalated its attacks on Ukraine, amid strained diplomatic relations between European countries and the U.S.

As such, traders have been shifting their focus to the wider precious metal industry amid fears of renewed tariff wars. Moreover, President Donald Trump announced a new 10% tariff on Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland beginning February 1st.

Additionally, President Trump intends to increase tariffs indefinitely to 25% on June 1st, 2026, until a deal is reached on Greenland.

Technical Breakout

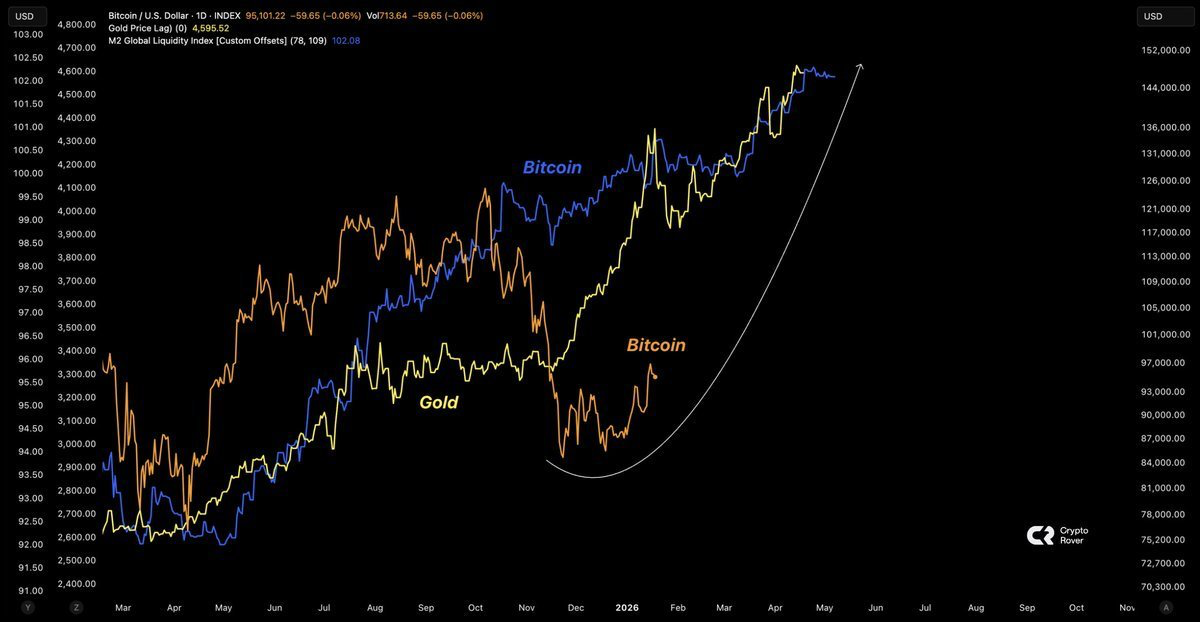

Another reason the precious metal industry has outperformed the crypto space is due to its technical breakout. For the past nine consecutive months, Gold and Silver prices have recorded new all-time highs.

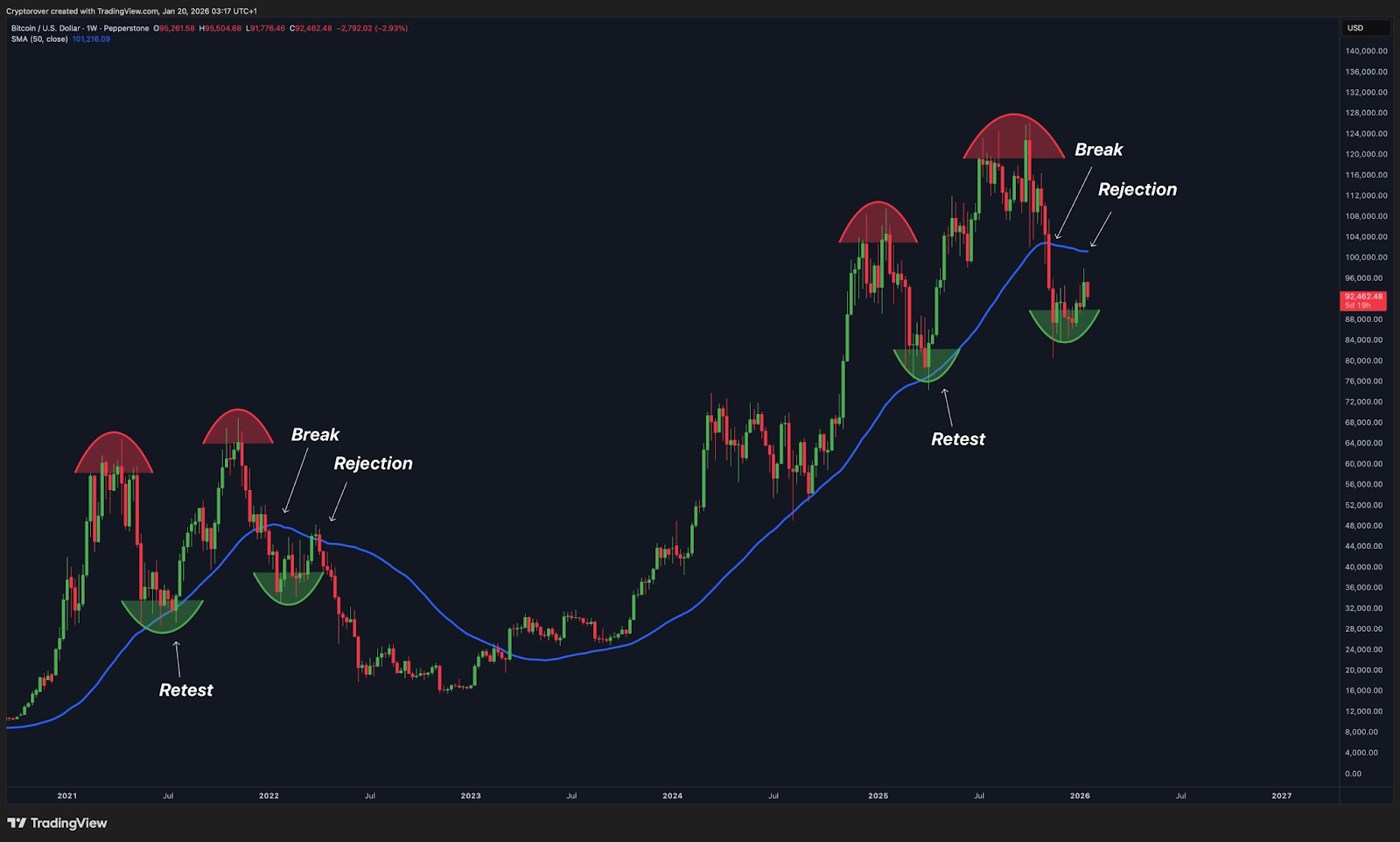

On the other hand, Bitcoin price has led the wider crypto industry in choppy consolidation. From a technical analysis standpoint, traders have shown fear of further crypto correction in the near term.

Moreover, crypto traders have unanimously agreed that the four-year crypto cycle is over, and any potential 2026 bull rally will be catalyzed by renewed capital inflows.

What’s Next?

In the past, traders have perfected the TACO (Trump Always Chicken Out) trade. Currently, the heated geopolitical tensions and the impending tariffs announced by President Trump signal potential choppy consolidation for the crypto market.

As such, the rising demand for Gold and Silver as a hedge against macroeconomic uncertainty will likely push their prices higher. Moreover, more nations, led by China, have been dumping U.S. securities and accumulating more Gold.

As such, Gold has already overtaken the U.S. dollar as the leading global reserve currency. With the rising global money supply, the crypto market, led by BTC, will benefit from an imminent capital rotation from Gold and Silver.

According to crypto analyst @CryptoCapo on X, the Bitcoin price will likely rebound towards $100k if its current support level around $90k holds.

Related: Why Is Crypto Crashing Today? Bitcoin Dips to $92K, Gold Hits New All-Time High

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.