- Saylor pushes back on claims that too many companies are copying the Bitcoin treasury model.

- He argues Bitcoin is not the risk, but weak business models are.

- Saylor says Bitcoin holdings can offset losses better than stock buybacks or bonds.

What started as a routine question quickly turned into a heated exchange.

During a recent interview, Michael Saylor pushed back against skepticism around the growing number of companies adopting Bitcoin as a treasury asset. The interviewer questioned whether the market is becoming crowded with firms that simply issue equity or debt to buy Bitcoin, without building real businesses.

Saylor was not having it.

“Why Single Out Bitcoin Buyers?”

The interviewer acknowledged that Strategy (formerly MicroStrategy) stands in a league of its own, holding more than 650,000 Bitcoin, but argued that many smaller treasury-focused companies are struggling and trading at deep discounts, hurting shareholders.

Saylor flipped the argument on its head.

He compared Bitcoin ownership to families and individuals investing. Not everyone will own the same amount, he said, and that is fine. In his view, criticizing companies simply for buying Bitcoin makes little sense when millions of other companies do not own any Bitcoin at all.

“Why criticize the ones that bought Bitcoin,” he argued, “and ignore the hundreds of millions that did not? Why don’t you focus upon criticizing the money-losing companies that don’t own Bitcoin?”

The Core of Saylor’s Argument

Saylor made a clear distinction. The real problem is not Bitcoin. It is bad business.

He said companies losing money are weak, whether or not they own Bitcoin. But if a struggling company holds Bitcoin on its balance sheet, that asset can help offset operating losses over time.

To explain, Saylor offered a simple example:

- A company loses $10 million a year from operations

- It holds $100 million in Bitcoin

- If Bitcoin rises 30%, that equals $30 million in gains

In that case, Bitcoin does not increase risk, he said. It keeps the company afloat.

Stock Buybacks vs Bitcoin

Saylor also criticized alternatives such as stock buybacks or Treasury bills for companies that are already losing money.

Buying back shares of an unprofitable company, he said, only accelerates failure. Parking cash in low-yield government bonds may slow losses slightly, but it does not change the outcome.

Bitcoin, in Saylor’s view, is the only option with the potential to outpace losses over time.

“The Bitcoin Community Eats its Own”

As the exchange grew more intense, Saylor accused critics, even within crypto, of targeting Bitcoin adopters while giving traditional companies a free pass.

He argued that some investors are more comfortable attacking Bitcoin treasury firms than questioning why many cash-burning companies without Bitcoin still attract capital.

The Saylor and Bitcoin Saga

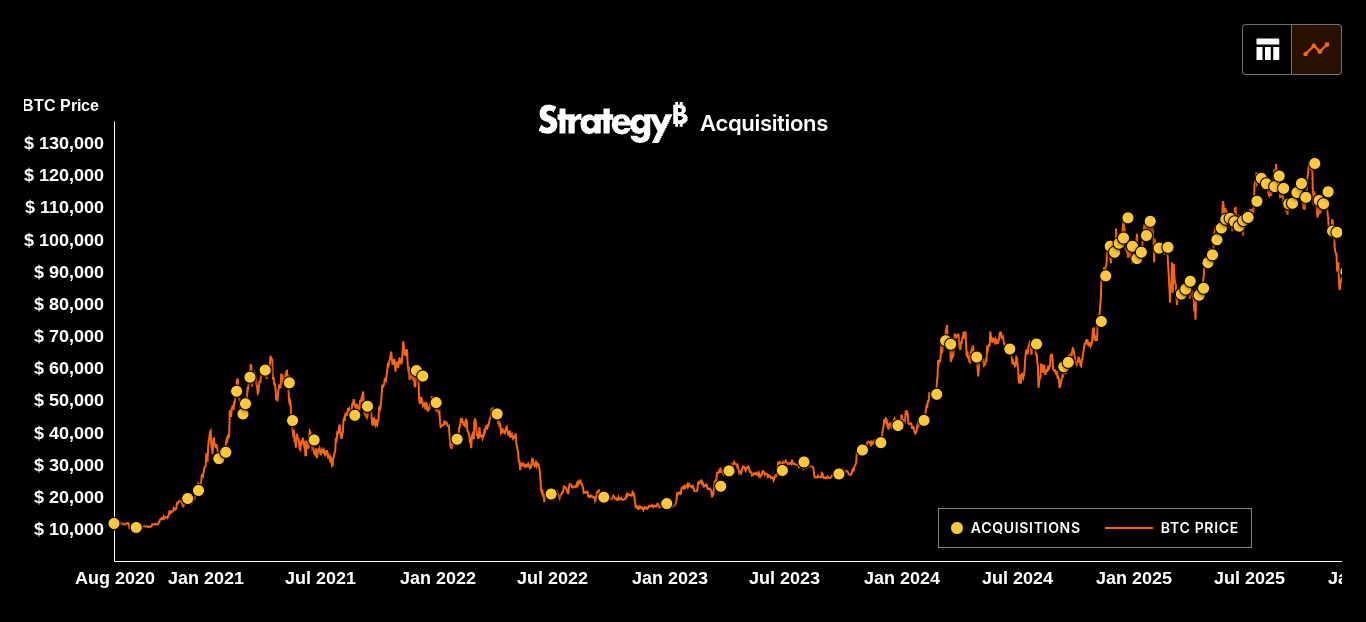

Saylor began building his Bitcoin position in August 2020, when MicroStrategy invested $250 million to buy over 21,000 BTC. The company continued buying later that year using funds raised through convertible notes, pushing its holdings past 70,000 BTC by December.

Over the next few years, the firm kept accumulating steadily through equity sales and other financing. By March 2025, its Bitcoin holdings crossed 500,000 BTC. Under Saylor’s leadership, the now-renamed Strategy Inc. continued aggressive purchases into late 2025 and early 2026, lifting total holdings to well over 680,000 BTC.

Related: Bitcoin Quantum Testnet Launches With NIST-Approved Quantum-Resistant Security

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.